As 2026 begins, the cryptocurrency market presents an uncommon distinction. Public curiosity and retail participation seem muted, but behind the scenes, massive traders are steadily positioning themselves.

This quiet divergence between sentiment and capital motion is shaping the early narrative of the 12 months.

On the heart of this shift is Bitcoin, the place on-chain information reveals rising accumulation by massive holders at a time when smaller merchants are largely disengaged.

Bitcoin has proven reasonable value stability close to the $90,000 vary in early January. Whereas value motion itself stays subdued, pockets information tells a extra revealing story.

A publish shared by Merlijn The Dealer reveals that addresses holding 1,000 BTC or extra have shifted from promoting to constant accumulation, whereas retail demand has dropped to its lowest level in roughly a 12 months.

Traditionally, retail individuals are likely to re-enter markets as soon as momentum turns into apparent. Massive holders function otherwise. They accumulate in periods of uncertainty, low conviction, or restricted consideration.

Rising whale accumulation throughout weak sentiment typically alerts preparation for future market enlargement moderately than response to present value actions.

From Accumulation to Infrastructure Focus

Durations of Bitcoin accumulation have typically coincided with elevated curiosity in constructing on high of the community itself. As confidence quietly returns amongst massive holders, consideration steadily expands past easy value publicity towards scalability, effectivity, and utility.

In early 2026, this shift is turning into more and more seen by renewed curiosity in Bitcoin-focused infrastructure tasks, significantly these aiming to reinforce transaction velocity and community usability.

Inside this context, Bitcoin layer 2 options are drawing rising consideration. One challenge that has emerged prominently on this setting is Bitcoin Hyper.

Supply – Cryptonews YouTube Channel

Bitcoin Hyper Reaches a Main Presale Milestone

Bitcoin Hyper has surpassed $30 million raised throughout its ICO, marking one of many largest early funding milestones for a Bitcoin-native scaling initiative to this point in 2026.

This degree of early participation displays sustained demand moderately than short-term hypothesis, as tokens stay non-tradable till launch.

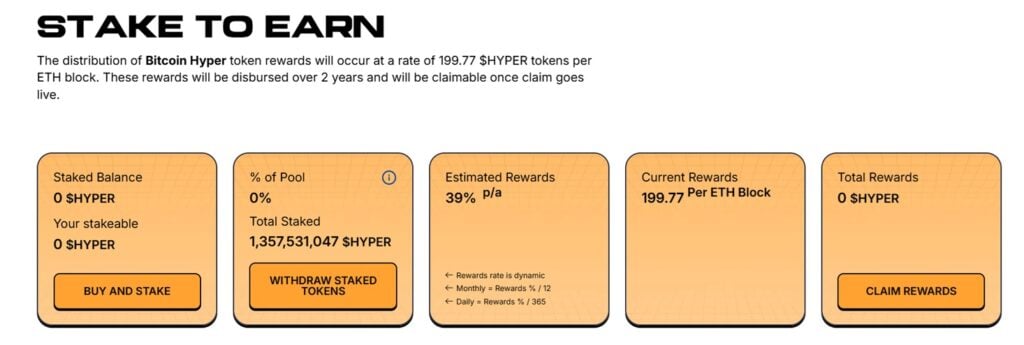

Early individuals have already seen unrealized positive aspects as later presale phases unlock at larger valuations, whereas a staking mannequin providing estimated yields of round 40% yearly through the preliminary interval has inspired lively engagement.

Multiple billion tokens have already been staked, highlighting robust involvement and dedication from early backers.

Collectively, these components underscore each confidence within the challenge’s imaginative and prescient and execution roadmap, positioning Bitcoin Hyper among the many finest crypto presale tasks to this point in 2026.

What Bitcoin Hyper Is Making an attempt to Resolve

Bitcoin Hyper positions itself as a layer 2 resolution designed to increase Bitcoin’s capabilities with out altering its base layer safety. The challenge goals to mix Bitcoin’s settlement layer with execution expertise derived from the Solana ecosystem.

By integrating the Solana Digital Machine, Bitcoin Hyper seeks to allow sooner transactions, decrease charges, and assist for decentralized purposes.

This method targets long-standing limitations of Bitcoin’s base layer, the place good contracts, lending, staking, and software improvement stay constrained.

Supply – Bitcoin Hyper through X

Importantly, the design emphasizes consumer custody. Bitcoin is briefly locked for community use moderately than faraway from the underlying chain, preserving core safety rules whereas increasing performance.

Token Allocation and 2026 Launch Roadmap

Bitcoin Hyper’s token construction emphasizes long-term ecosystem improvement moderately than short-term liquidity extraction.

A portion of the availability is allotted to the treasury to assist ongoing operations and community sustainability, whereas advertising receives a major share to make sure visibility and consumer acquisition in a aggressive setting.

Extra allocations cowl change listings, improvement, and rewards, reflecting a method designed to assist launch readiness, adoption, and ecosystem enlargement.

The challenge’s roadmap targets early 2026 for mainnet deployment, which is able to embrace activation of the Bitcoin bridge, integration of good contract assist through the Solana Digital Machine, and the primary decentralized software launches on the layer 2 community.

After mainnet launch, Bitcoin Hyper plans to increase its ecosystem by onboarding extra purposes and builders, strengthening its place throughout the broader Bitcoin scaling panorama.

Why Bitcoin Hyper Matches the Present Market Cycle

Bitcoin Hyper’s timing aligns carefully with broader market habits. As whales accumulate Bitcoin and macro situations steadily shift, infrastructure tasks that stretch Bitcoin’s utility typically appeal to consideration forward of retail participation.

Bitcoin Hyper enters 2026 aligned with a broader pattern of accumulation, endurance, and long-term community improvement moderately than short-term hype.

In a market outlined by quiet positioning moderately than loud hypothesis, tasks constructed round Bitcoin infrastructure are more and more turning into a part of this narrative.

For the most recent updates on improvement and community progress, official bulletins can be found on Bitcoin Hyper’s X and Telegram channels.

Go to Bitcoin Hyper

This text has been supplied by certainly one of our industrial companions and doesn’t mirror Cryptonomist’s opinion. Please bear in mind our industrial companions could use affiliate applications to generate revenues by the hyperlinks on this text.