Be part of Our Telegram channel to remain updated on breaking information protection

BlackRock, the world’s largest asset supervisor, transferred important quantities of Bitcoin and Ethereum to Coinbase, a transfer that has raised market issues.

On-chain knowledge reveals the agency transferred 1,134 BTC (about $101 million) and seven,255 ETH (round $22 million). These transfers seemingly imply BlackRock is getting ready to promote, particularly after heavy outflows from its crypto ETFs on the finish of final 12 months.

On December 31, Bitcoin ETFs recorded a internet outflow of $348.1 million, whereas Ethereum ETFs noticed $72.1 million depart the market. BlackRock’s personal funds had been among the many greatest losers, with its Bitcoin ETF seeing $99 million in outflows and its Ethereum ETF shedding about $21.5 million.

BlackRock moved 𝟏,𝟏𝟑𝟒 $BTC ($101.4M) & 𝟕,𝟐𝟓𝟓 $ETH ($22.1M) to Coinbase Prime 3 hours in the past. 😳😳

What’s the explanation?

Are they quietly 𝐥𝐨𝐚𝐝𝐢𝐧𝐠 or is the 𝐝𝐮𝐦𝐩 coming? pic.twitter.com/pdx7dEncyr

— Open4profit (@open4profit) January 2, 2026

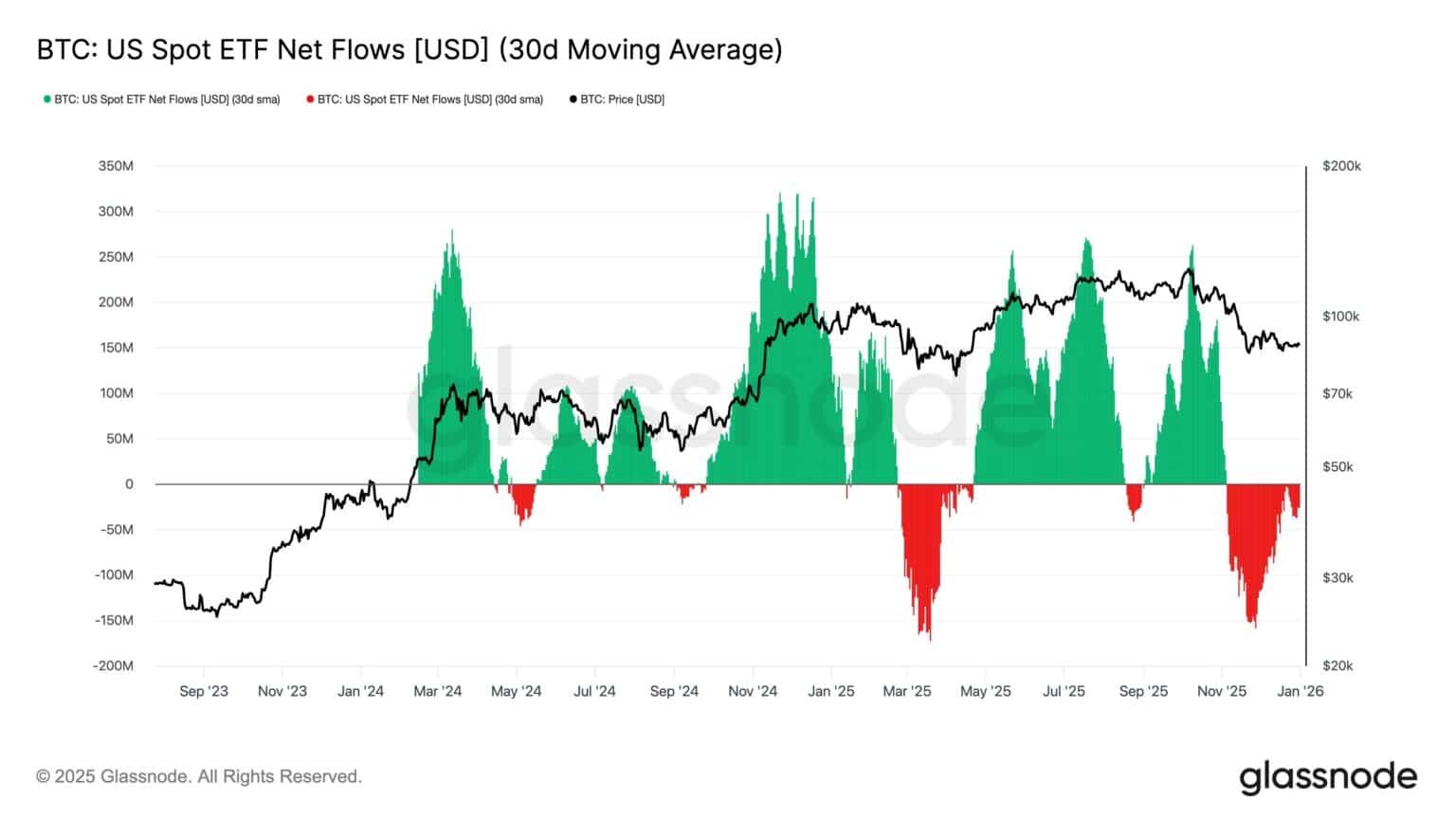

This reveals that institutional buyers are nonetheless pulling cash out of crypto-related funds. The promoting stress has been constructing for a while. Bitcoin ETFs have seen outflows in eight of the final 9 buying and selling days, whereas Ethereum ETFs recorded outflows in 5 of the final six days.

Analysts warn that if these outflows proceed, Bitcoin may fall under the necessary $90,000 degree. A break under that degree may open the door for a a lot deeper correction. Market nerves are additionally excessive as a result of $2.2 billion value of crypto choices are expiring at this time.

Bitcoin Stabilizes Close to $88K as Choices Expiry Assessments the Market

These choices cowl Bitcoin, Ethereum, XRP, and Solana. For Bitcoin, the important thing “max ache” degree is round $88,000, which merchants are watching intently. Regardless of these negatives, there are a couple of optimistic indicators. Glassnode says there may be nonetheless no robust new institutional demand, as ETF flows stay damaging.

Nonetheless, long-term Bitcoin holders have stopped promoting. This has helped BTC bounce from round $88,300 to above $89,600. The entire crypto market worth has additionally climbed again above $3 trillion, with some altcoins posting strong positive factors.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection