- Chainlink’s reserve pockets continues absorbing provide, quietly decreasing circulating LINK

- Spot inflows have dropped sharply, signaling endurance however weaker natural participation

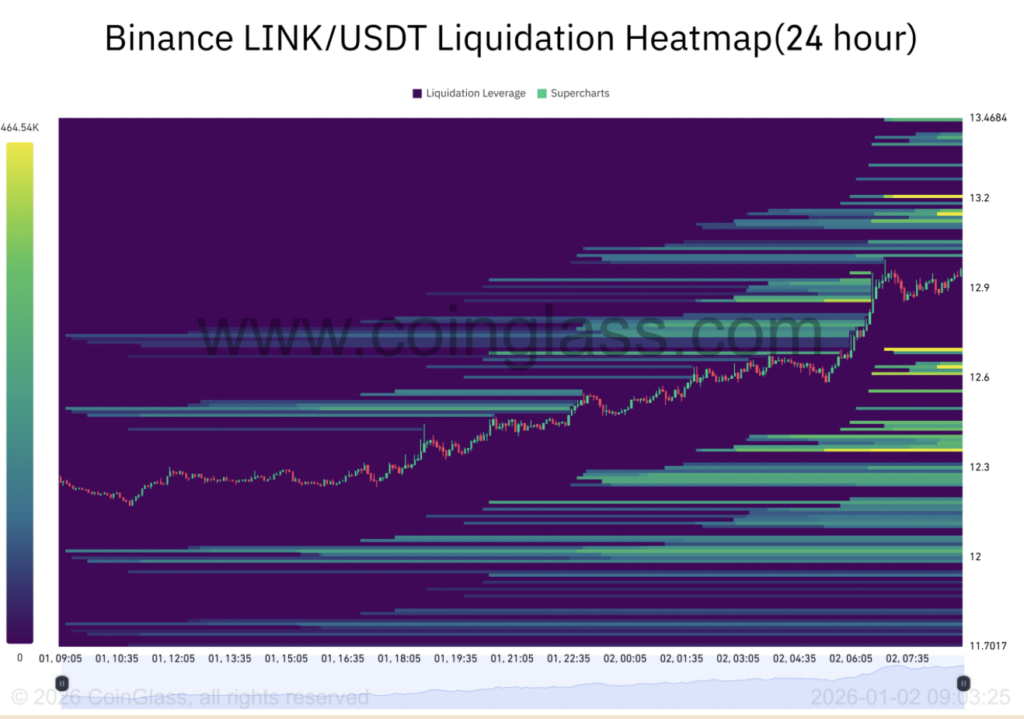

- Rising leverage and draw back liquidity clusters counsel volatility might come earlier than continuation

Chainlink’s reserve pockets has quietly added one other 94,267 LINK, bringing complete holdings to roughly 1.41 million tokens. The transfer appears intentional, much less about passive accumulation and extra about lively stability administration behind the scenes. By shifting tokens into reserves, Chainlink successfully reduces circulating provide with no need recent market demand to do the work.

This sort of provide absorption doesn’t normally spark fireworks within the brief time period. As a substitute, it slowly reshapes liquidity situations, easing sell-side strain over time. The reserve additionally performs an extended sport, appearing as a stabilizer for ecosystem incentives and total community sustainability, even when the worth doesn’t react immediately.

Spot Exercise Slows as Merchants Step Again

On the spot aspect, exercise has cooled noticeably. LINK spot inflows dropped from round $3.22 million to roughly $480,000, signaling fewer tokens shifting onto centralized exchanges. That sometimes reduces fast promote strain, which sounds constructive, nevertheless it additionally factors to weaker spot participation total.

Merchants appear much less curious about rotating LINK actively proper now. Many seem content material holding positions, whereas others shift their consideration towards derivatives as a substitute. This dynamic makes worth motion much less depending on natural spot demand, usually leading to thinner order books and better sensitivity to sudden strikes. Nonetheless, the dearth of inflows suggests endurance greater than worry, a market ready, not fleeing.

Leverage Builds as Open Curiosity Climbs

Derivatives knowledge provides one other layer to the image. Open Curiosity jumped by about 8.61%, reaching roughly $607.9 million, confirming renewed engagement in LINK futures. Slightly than shopping for spot, merchants are expressing directional views by leverage, which might speed up momentum but in addition improve fragility.

Leverage magnifies reactions to comparatively small worth adjustments. When spot demand stays muted alongside rising Open Curiosity, it may well sign a speculative section the place merchants place early, anticipating enlargement. That conviction, nonetheless, wants affirmation. With out spot follow-through, leverage-driven strikes can unwind quick, and generally with out a lot warning.

Draw back Liquidity Defines the Threat Path

Liquidation heatmap knowledge reveals dense liquidity clusters stacked under present worth ranges. These zones usually act like magnets throughout volatility spikes, making draw back sweeps an actual threat. Upside liquidity, against this, seems thinner, providing fewer fast targets if worth pushes increased.

This construction usually results in short-term pullbacks earlier than any continuation performs out. Leveraged longs sitting under these zones stay uncovered, and if worth dips, liquidations might cascade rapidly. As soon as these ranges are cleared, strain tends to ease, however the path there could be uneven and uncomfortable.

Can LINK Maintain Its Construction?

From a structural standpoint, Chainlink’s reserve accumulation strengthens the long-term setup, whereas declining spot inflows level to restraint moderately than distribution. On the similar time, leverage is clearly driving short-term worth dynamics, bringing each alternative and threat into focus.

In the end, sustainability hinges on whether or not spot demand returns to assist the leverage constructing beneath. If it does, decreased circulating provide might amplify upside strikes. If not, LINK might must shake out extra leverage first earlier than any significant enlargement takes maintain.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.