- Dogecoin surged over 12%, breaking a long-standing descending trendline

- Trade-held DOGE provide has risen sharply, complicating the bullish setup

- Heavy lengthy positioning will increase upside potential but in addition liquidation threat

Momentum has crept again into Dogecoin simply as the information begins sending combined alerts. At press time, DOGE surged greater than 12% in a single session, lastly breaking above a long-standing descending trendline. The transfer got here after weeks of tight consolidation and fading volatility, the form of quiet stretch that always precedes one thing bigger.

Technically, the breakout appeared clear. DOGE pushed by means of short-term resistance ranges and momentum indicators flipped bullish. Nonetheless, the rally didn’t come with out issues, as on-chain information confirmed a noticeable rise in exchange-held provide, including a layer of uncertainty beneath the floor.

Trade Provide Ticks Increased, Elevating Questions

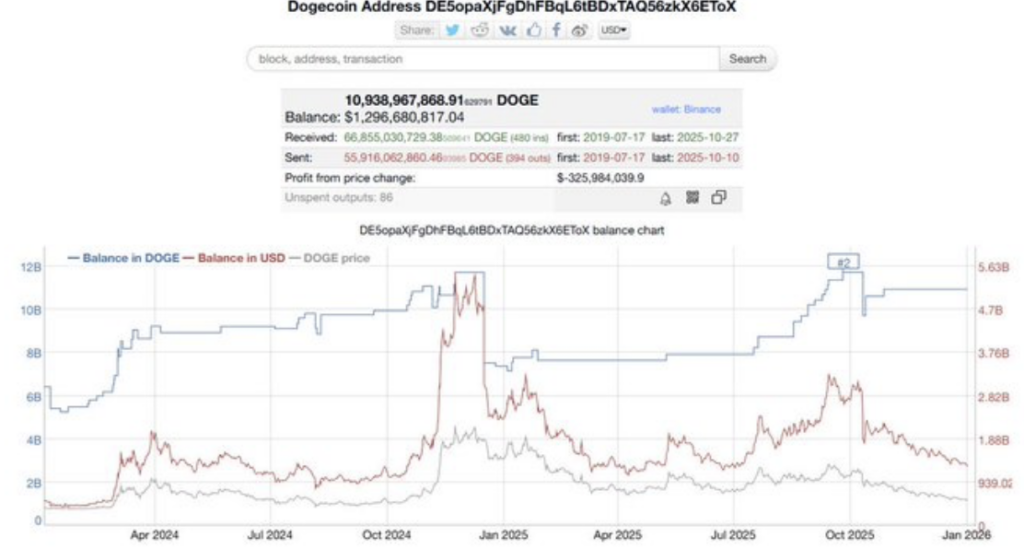

On-chain information exhibits Dogecoin balances on Binance grew from roughly 7.9 billion DOGE to about 10.9 billion DOGE all through 2025. Rising trade provide normally means extra tokens have gotten liquid, and traditionally that’s raised eyebrows throughout quick worth strikes. Extra cash on exchanges typically translate to extra potential promote stress, a minimum of in principle.

That mentioned, elevated trade balances don’t robotically sign an imminent dump. In some circumstances, they merely mirror merchants positioning for greater volatility or offering liquidity throughout lively market intervals. The actual check is whether or not incoming demand can proceed absorbing this added provide with out tipping the steadiness towards distribution.

Leverage Leans Closely Bullish

Derivatives information paints an much more aggressive image. Futures markets are at the moment stacked closely towards the lengthy aspect, with roughly $850 million in lengthy positions in comparison with simply $22 million in shorts. That imbalance suggests merchants are betting onerous on continued upside, possibly just a little too confidently.

Whereas robust bullish conviction can gas follow-through strikes, leverage cuts each methods. If worth momentum stalls or reverses, liquidation threat rises rapidly. In setups like this, sustained worth power turns into important to maintain the construction intact.

Technicals Help the Breakout, for Now

Regardless of the rise in trade provide, DOGE continued buying and selling greater, hovering round $0.132 on the 4-hour chart. The breakout above the descending trendline coincided with RSI climbing to round 72, signaling robust momentum but in addition brushing in opposition to overbought territory.

MACD remained constructive as properly, with the MACD line holding above the sign line, an indication consumers nonetheless management the short-term development. Nevertheless, elevated RSI ranges have a tendency to ask pullbacks, particularly when provide is rising within the background. A slowdown right here may rapidly change the tone.

Alternative Meets Elevated Threat

Proper now, Dogecoin sits at an fascinating crossroads. Value power suggests demand remains to be current, however rising trade balances and leverage-heavy positioning add threat beneath the rally. If DOGE can maintain above its breakout ranges with stable quantity, the transfer might prolong additional.

If it fails, although, the draw back may transfer quick. For the second, the setup provides alternative, however it’s the sort that calls for warning, not blind optimism.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.