- Lengthy-term XRP holders consider sustained adoption may dramatically reshape portfolio worth over time

- Many analysts see 1,000 to 10,000 XRP as significant publicity for future progress

- Institutional curiosity and ETF inflows proceed to help XRP’s long-term funding narrative

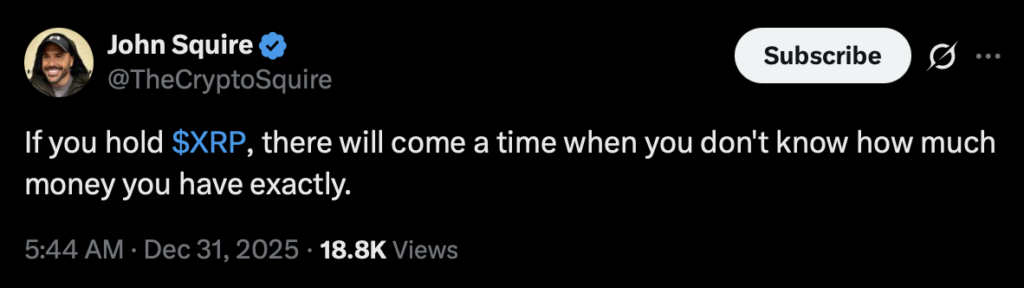

Finance commentator and long-time XRP advocate John Squire lately stirred dialogue by pointing to the long-term affect of merely holding XRP. In accordance with him, buyers who keep positioned for years might finally attain a degree the place monitoring the precise worth of their holdings turns into surprisingly tough. The thought sounds daring, but it surely displays a wider optimism contained in the XRP group about the place the asset may land if adoption retains unfolding as anticipated.

His feedback aren’t framed as a exact prediction, however extra as a mirrored image of scale. If XRP turns into deeply embedded in international monetary infrastructure, even early assumptions about worth may really feel outdated. For supporters, that chance alone retains long-term conviction alive, even throughout slower market intervals.

Rising Expectations Round XRP Wealth Potential

Throughout the XRP ecosystem, many buyers consider time is an important variable. Institutional adoption, ongoing ETF developments, and gradual integration into real-world cost rails are sometimes cited as the primary drivers behind this optimism. The considering is straightforward, if XRP retains discovering utility, value appreciation tends to comply with, even when it’s uneven alongside the way in which.

Bark, founding father of an XRP-focused NFT mission, has echoed this sentiment, suggesting that XRP may finally help retirement-level monetary safety for disciplined long-term holders. It’s not about in a single day features, he argues, however about letting the asset mature whereas remaining affected person, even when markets cool or sentiment drifts.

How A lot XRP Is Thought-about Significant Publicity

The query of what number of tokens are “sufficient” stays a daily subject of debate. Whereas opinions range, many analysts level to holdings between 1,000 and 10,000 XRP as providing significant long-term publicity with out requiring excessive capital. Edoardo Farina, for instance, has beforehand urged that 1,000 XRP represents an inexpensive minimal for buyers who’re severe about future upside.

At present costs close to $1.85, 1,000 XRP prices roughly $1,850, whereas 5,000 XRP is available in round $9,250. A ten,000 XRP place sits nearer to $18,500, a determine many group members view as manageable in comparison with the potential long-term outcomes they envision.

Lengthy-Time period Value Forecasts Gas the Narrative

Forecasts for XRP stretch throughout a variety, relying on who you ask. Telegaon tasks XRP may commerce between $80 and $120 by the 2035–2040 window, which might place 1,000 XRP close to $100,000 and 10,000 XRP round $1 million. Extra aggressive outlooks, like these from Changelly, recommend costs between $150 and $200 in the identical timeframe, pushing a ten,000 XRP holding towards $2 million.

Some analysts, together with Jake Claver, have floated even larger situations, proposing four-digit XRP costs if the asset turns into a foundational layer in international finance. These projections are clearly speculative, and would require huge adoption and market growth, however they proceed to form long-term holder psychology.

Institutional Curiosity Provides Weight to the Thesis

Current institutional exercise has added contemporary gas to XRP’s long-term story. Spot ETF launches tied to corporations corresponding to Franklin Templeton, Grayscale, Bitwise, and Canary Capital reportedly absorbed round $1.25 billion value of XRP in a brief interval. Whereas ETF flows can fluctuate, analysts observe that sustained inflows are inclined to tighten provide over time.

Past ETFs, XRP’s use in company treasury administration and cross-border settlement continues to develop quietly. Squire’s remarks finally level again to endurance moderately than value targets. If adoption retains increasing, at present’s valuations might look small in hindsight, even when the trail there isn’t easy or predictable.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.