- Why Bitcoin is robust

- Market is but to catch up

Inside a five-minute interval, spot inflows elevated by about 1,671%, a big sufficient shift to trigger worth reactions and warp short-term order move. Though these figures are present and topic to sudden change, the sign itself is extra necessary than the quantity reported by CoinGlass.

Why Bitcoin is robust

Spot flows versus leveraged bets are precise capital purchases and gross sales of the underlying asset. Spot influx spikes of this magnitude usually point out giant transfers into spot venues which might be executed straight away or aggressive market purchases. In comparison with futures-driven pumps, which incessantly fail as soon as leverage unwinds, that’s fairly completely different.

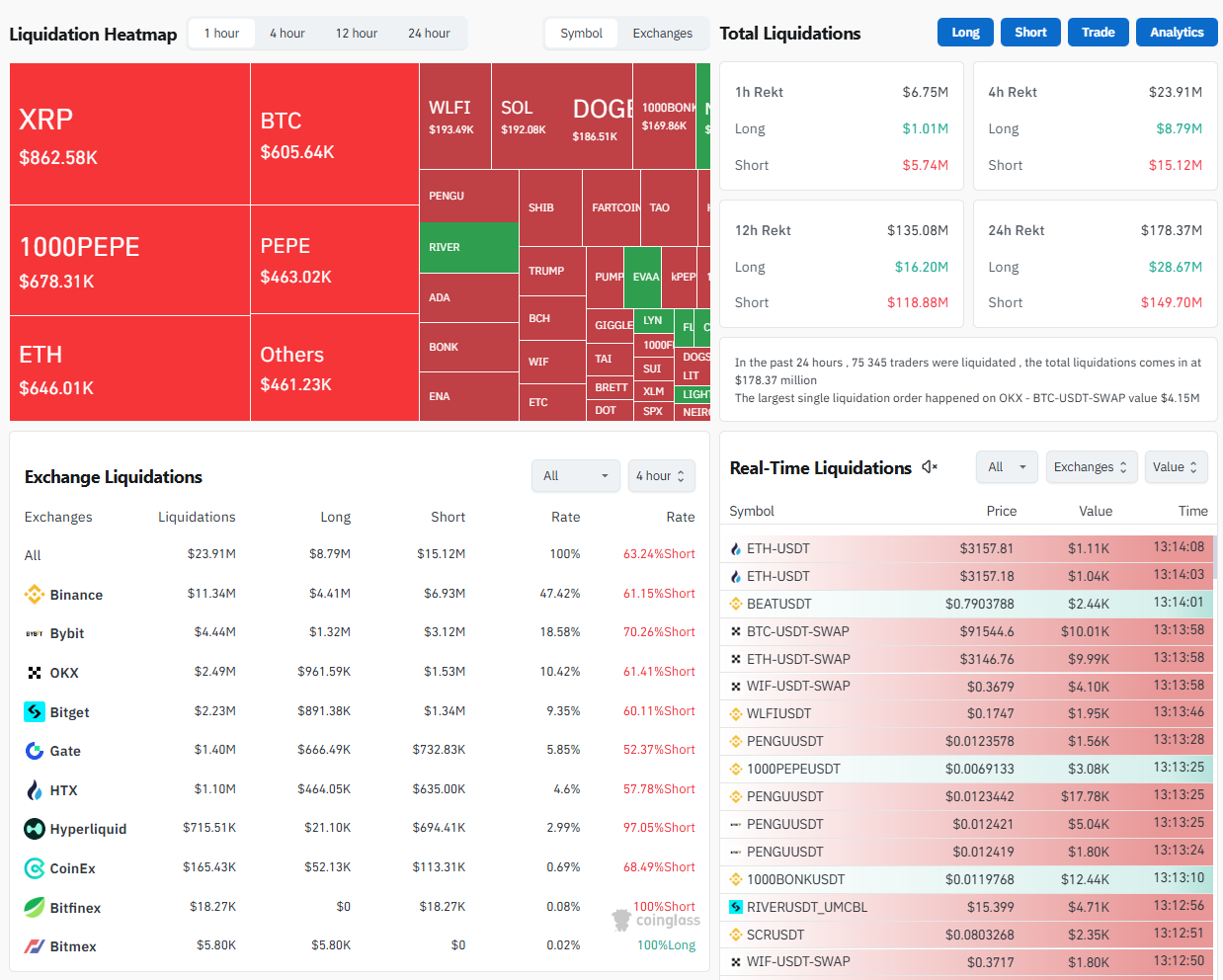

Following a harsh correction from the highs, there’s now a surge. Leverage was shaken out as Bitcoin dropped from above six figures into the low-$90,000 vary. The vast majority of the injury was already finished, in line with liquidation information, with longs being worn out and open curiosity cooling.

The reset is necessary. By way of structural well being, spot demand coming into the market after leverage has been eliminated is preferable to chasing the worth throughout euphoric instances.

Market is but to catch up

On a lot of intraday time frames, futures flows proceed to be combined to damaging. It’s essential that they diverge. Whereas derivatives merchants stay cautious, hedge spot consumers are filling the void. Prior to now, that configuration has favored upside grinding over explosive vertical strikes. FOMO shouldn’t be the problem, accumulation strain is. Technically, after basing the worth is attempting to recuperate its short- and mid-term shifting averages.

The momentum indicators will not be rising from overheated ranges however relatively from impartial territory. That suggests that if spot demand continues, there’s potential for continuation. Between the mid-$90,000 zone and the psychological $100,000 stage, there’s nonetheless important overhead resistance. There may be numerous trapped provide and former distribution in that space. Is $100,000 subsequent?

It’s a chance, however it isn’t a given. Macro resistance can’t be overcome by a single spot-flow spike. Comply with-through — repeated spot inflows, falling trade balances and managed futures — is what counts. Bitcoin might grind increased and power shorts to cowl into energy if spot continues to soak up provide whereas leverage stays muted.

The worth will stall and return to vary if this spike is a one-time switch or short-term arbitrage. For this reason it’s essential to view this as affirmation relatively than a sign to pursue.