Based on joint analysis cited in information reviews, about $110 billion — roughly ₩160 trillion — left South Korean crypto platforms throughout 2025. Buying and selling exercise didn’t cease. As a substitute, a lot of the cash moved to international exchanges the place extra merchandise and instruments can be found to odd buyers.

Market Limits Gasoline Outflows

Stories have disclosed that home guidelines largely confine native exchanges to identify buying and selling. Many advanced merchandise stay off limits for retail merchants in Korea, so merchants turned to abroad platforms reminiscent of Binance and Bybit. The joint examine by CoinGecko and Tiger Analysis is cited as the first foundation for the $110 billion determine.

Banking And Guidelines Form Decisions

Based on a joint report by CoinGecko and Tiger Analysis, South Korean buyers moved over KRW 160 trillion (~$110 billion) in crypto belongings from home exchanges to abroad platforms in 2025 attributable to native regulatory limits that limit CEXs largely to identify buying and selling. Korean… pic.twitter.com/KrYgFurdsm

— Wu Blockchain (@WuBlockchain) January 2, 2026

South Korea tightened compliance and person protections in recent times. Legal guidelines designed to guard prospects had been handed, such because the Digital Asset Consumer Safety Act in 2024, however corporations and customers say the legal guidelines didn’t create a full framework for wider market providers.

Lawmakers debated the Digital Asset Primary Act, however delays left gaps that some merchants discovered limiting. Consequently, a rising share of Korean-held crypto migrated to wallets and platforms overseas.

Charge Influence And Consumer Conduct

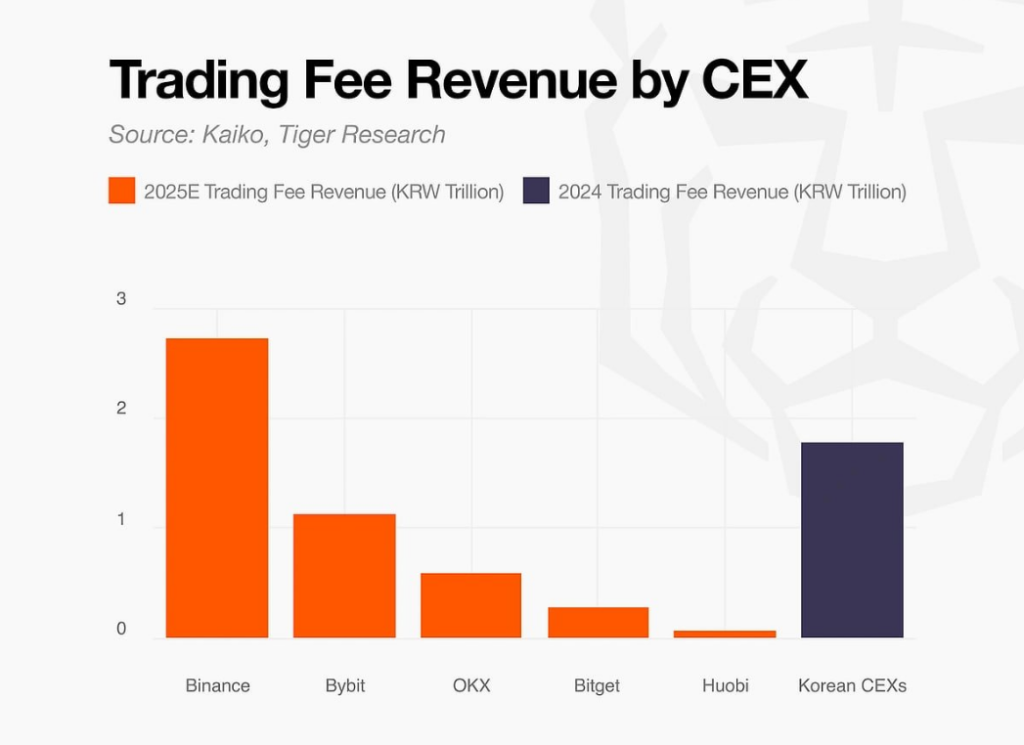

Primarily based on platform analyses, price income from korean customers on abroad exchanges turned vital. Estimates within the sector put user-based charges at about ₩2.73 trillion for Binance and roughly ₩1.12 trillion for Bybit in 2025.

Stories additionally indicated the variety of Korean accounts with massive abroad balances grew by greater than double year-on-year. Some capital was shifted into self-custody wallets too, exhibiting that customers cut up bets between exchanges and personal wallets.

Authorities level to dangers when cash crosses borders. Regulators have centered on anti-money-laundering checks and financial institution partnerships for crypto corporations. Merchants, then again, emphasize entry. They need margin buying and selling, derivatives, and different providers that they can not get at dwelling. This rigidity between entry and oversight is central to the motion of funds.

Buying and selling Demand Stays Excessive

Quantity tendencies counsel Korean curiosity hasn’t waned, however shifted location. Home platforms dealt with substantial spot buying and selling, however general demand seems to have flowed into abroad venues as a substitute of disappearing. The $110 billion determine tracks transfers and placements, not asset losses. In different phrases, worth was relocated reasonably than erased.

Lawmakers in Seoul are stated to be engaged on broader guidelines, together with stablecoin provisions that many trade gamers have pushed for. If new statutes arrive and markets reopen to a wider set of providers, some funds might return. However for now, many customers preserve buying and selling exterior Korea to entry a wider menu of selections and instruments.

Featured picture from Unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.