Prime Tales of The Week

‘Tons of’ of EVM wallets drained in mysterious assault: ZachXBT

An attacker has drained “lots of” of crypto wallets on Ethereum Digital Machine (EVM) chains, siphoning small sums from every sufferer in what onchain investigator ZachXBT described as a broad however low-value exploit.

The losses seem restricted on a per-wallet foundation, with every sufferer shedding lower than $2,000, in response to ZachXBT. The exercise has affected wallets on a number of EVM-compatible networks, indicating a widespread incident slightly than it being remoted to a single blockchain.

A fraudulent e-mail disguised as reputable communication from Web3 pockets MetaMask may have been the car for the assault, mentioned cybersecurity researcher Vladimir S., who cited a clue left by one other pseudonymous X person.

“This seems to be like automated, wide-net exploitation,” cybersecurity supplier Hackless mentioned, warning customers to revoke sensible contract approvals and proceed monitoring their wallets.

Coinbase bets on stablecoins, Base and ‘all the pieces alternate’ for 2026

Coinbase intends to prioritize stablecoins, its Ethereum layer-2 Base and constructing out its alternate merchandise previous cryptocurrencies all through 2026, in response to CEO Brian Armstrong.

In a New 12 months’s social media put up, Armstrong reaffirmed Coinbase’s “all the pieces alternate” technique, which incorporates merchandise like prediction markets, equities and commodities.

At its year-end convention in December, Coinbase launched inventory buying and selling and prediction markets as a part of its push. The corporate has additionally rebranded its pockets app as an “all the pieces app,” including social networking and onchain options.

Coinbase isn’t alone in broadening its product suite. Rival crypto exchanges are more and more bundling providers in a bid to grow to be “tremendous apps.”

No, whales usually are not accumulating huge quantities of Bitcoin: CryptoQuant

Hypothesis that Bitcoin whales are engaged in a large reaccumulation section has been considerably overstated, suggesting the digital asset market construction has not materially modified, in response to onchain knowledge from CryptoQuant.

The favored narrative that giant holders are aggressively shopping for Bitcoin is deceptive, mentioned Julio Moreno, head of analysis at CryptoQuant. A lot of the publicly shared “whale accumulation” knowledge is distorted by exchange-related exercise slightly than real investor habits.

Cryptocurrency exchanges routinely consolidate funds from many smaller wallets into fewer giant ones for operational and regulatory causes. This course of artificially will increase the variety of wallets holding very giant balances, main onchain trackers to misclassify the exercise as whale accumulation.

BitMine chairman proposes 1,000x improve in firm’s licensed shares, to 50B

Tom Lee, chairman of publicly listed Ether treasury firm BitMine, urged shareholders to again a proposal to dramatically improve the corporate’s licensed share rely to 50 billion from 50 million, citing the potential want for future inventory splits as Ether’s value drives the corporate’s valuation.

Lee mentioned BitMine’s share value intently tracks the worth of Ether, and that he modeled potential future valuations utilizing the ETH/Bitcoin ratio. In accordance with Lee, ETH may attain $250,000 if Bitcoin climbs to $1 million, a situation that might push BitMine’s share value to ranges he mentioned can be inaccessible for many retail traders.

BitMine shifted from working as a Bitcoin mining and holding firm to an ETH treasury technique in 2025, but it surely nonetheless retains a few of its Bitcoin operations.

SEC’s Crenshaw set to depart, leaving US monetary watchdog all Republican

Caroline Crenshaw, the only Democratic member main the US Securities and Alternate Fee (SEC) as commissioner, shall be departing the company this week after serving greater than 5 years.

Crenshaw is predicted to depart the SEC by Saturday, marking 18 months after her time period resulted in June 2024. Commissioners are permitted to proceed work on the company, supplied the Senate has not confirmed a alternative.

Learn additionally

Options

South Korea’s distinctive and wonderful crypto universe

Options

E For Estonia: How Digital Natives are Creating the Blueprint for a Blockchain Nation

Crenshaw, who was sworn into workplace in August 2020, has usually been crucial of the company’s strategy to digital property. She spoke out in opposition to the SEC settling its enforcement case with Ripple Labs and warned that weakening laws on digital property may result in “vital market contagion.”

Trump Media plans 1:1 blockchain token rewards for shareholders

Trump Media and Expertise Group, operator of US President Donald Trump’s Fact Social platform, mentioned Wednesday it plans to roll out a blockchain token for shareholders that entitles them to perks and rewards.

The DJT token shall be launched in collaboration with crypto alternate Crypto.com, and the distribution to present shareholders set at a 1:1 ratio, or one token per share owned, in response to the announcement from the corporate.

The token “might” embrace rewards and perks for DJT shareholders, together with reductions on the Fact Social media platform, the Fact+ media streaming platform, and prediction market Fact Predict.

Nevertheless, the token will not be a tokenized inventory and doesn’t entitle holders to shareholder rights or a declare on the corporate’s future earnings, Trump Media confirmed to Cointelegraph.

Winners and Losers

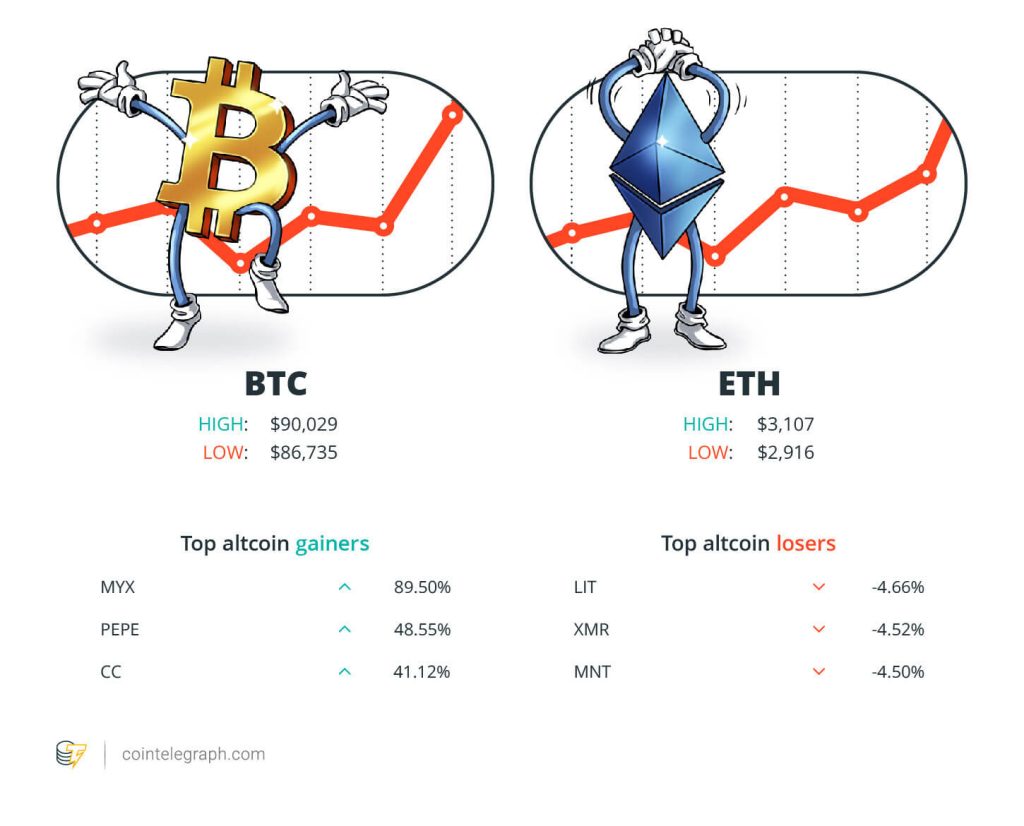

On the finish of the week, Bitcoin (BTC) is at $90,029, Ether (ETH) at $3,107 and XRP at $2.00. The entire market cap is at $3.07 trillion, in response to CoinMarketCap.

Among the many largest 100 cryptocurrencies, the highest three altcoin gainers of the week are MYX Finance (MYX) at 89.50%, Pepe (PEPE) at 48.55% and Canton (CC) at 41.12%.

The highest three altcoin losers of the week are Lighter (LIT) at 4.66%, Monero (XMR) at 4.52% and Mantle (MNT) at 4.50%. For more information on crypto costs, be certain that to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“If you wish to see it in a constructive approach, from the all-time excessive, the drawdown is absolutely not as excessive as now we have had in earlier bear markets when now we have had drawdowns of 70%, 80%. This shall be identical to a 55% from the all-time excessive.”

Julio Moreno, head of analysis at CryptoQuant

“Decentralization erodes not by way of seize, however by way of comfort.”

Vitalik Buterin, co-founder of Ethereum

“We’re seeing quantitative easing mild proper now. The Fed is beginning to purchase its personal bonds. I feel demand for presidency debt goes to fall considerably subsequent yr, together with decrease charges. All of this bodes nicely for all property, together with Bitcoin.”

Invoice Barhydt, CEO of Abra

“The Market Has New Gamers, crypto isn’t 2016 or 2020 anymore. ETFs, establishments, and company steadiness sheets don’t commerce like hype-driven retail.”

Armando Pantoja, unbiased investor

“If we hold transferring at this velocity in 5 years, Pakistan would be the crypto chief, one of many crypto leaders on this planet.”

Changpeng “CZ” Zhao, founder and former CEO of Binance

“The market reveals indicators of restoration as holders specific satisfaction in income and continued dedication. Occasions and giveaways enhance engagement, reflecting optimism regardless of latest challenges.”

Santiment, crypto sentiment platform

Prime FUD of The Week

Crypto phishing losses fell 83% in 2025, however drainer ecosystem ‘stays energetic’

Crypto phishing assaults tied to pockets drainers dropped sharply in 2025, with complete losses falling to $83.85 million, down 83% yr over yr from practically $494 million in 2024.

The variety of victims additionally declined considerably to 106,000, a 68% drop from the earlier yr, Web3 safety platform Rip-off Sniffer mentioned in its new report analyzing signature-based phishing throughout Ethereum Digital Machine chains.

Learn additionally

Options

Blockchain is as revolutionary as electrical energy: Large Concepts with Jason Potts

Options

What it’s really like to make use of Bitcoin in El Salvador

Regardless of the steep fall, the report warned that phishing exercise has not disappeared. As a substitute, losses intently adopted market cycles, rising during times of upper onchain exercise and easing as markets cooled.

The third quarter of 2025, which coincided with Ether’s strongest rally of the yr, recorded the best phishing losses at $31 million, with August-September accounting for practically 29% of annual losses.

DeFi pioneer coughs up $50K after making unhealthy wager on Ether

Crypto govt Kain Warwick, the founding father of Synthetix and Infinex, is about to pay up $50,000 after betting that Ether would hit $25,000 in 2025, becoming a member of considered one of many market contributors who overestimated the velocity of Ether’s restoration after its dip in October.

Ether ended Dec. 31 buying and selling at roughly $2,980, round 13.7% decrease than the place it began firstly of the yr, in response to CoinMarketCap.

A part of it was as a result of a $19 billion crypto market liquidation on Oct. 10 that triggered a downtrend, pushing Ether as little as $2,767 earlier than it slowly crept upward once more.

The wager got here from an alternate between Warwick and Multicoin managing companion Kyle Samani in November. Samani doubted the probabilities that Ether may recuperate and hit $25,000 by the top of the yr.

Warwick disagreed, betting at 10:1 odds that it had an opportunity.

Crypto sentiment shifts off excessive worry, however ‘combined feelings’ persist

A broadly used crypto market sentiment indicator has shaken off its “excessive worry” score as of Friday, returning to its highest ranges in 21 days regardless of nonetheless buying and selling beneath $90,000.

The index, which measures general crypto market sentiment, recorded a “worry” rating of 29 in its Friday replace, climbing out of the “excessive worry” zone to its highest degree since Dec. 12.

The value of Bitcoin is $88,995 on the time of publication.

The rise in sentiment is a constructive sign for the crypto neighborhood, and a few analysts say the lengthy stretch in “worry” or “excessive worry” territory may point out the market is primed for potential positive aspects. “Threat/Reward is the most effective it has ever been,” crypto entrepreneur Brian Rose mentioned in an X put up on Dec. 28, mentioning that the index has been in fearful territory for eight weeks.

Prime Journal Tales of The Week

How crypto legal guidelines modified in 2025 — and the way they’ll change in 2026

The US handed stablecoin laws and EU noticed the primary yr of MICA. What’s subsequent for crypto legal guidelines in 2026?

9 weirdest AI tales from 2025: AI Eye

The AI revolution is popping out to be so much weirder than anybody anticipated. Right here’s 9 high-quality examples.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Ciaran Lyons

Ciaran Lyons is an Australian crypto journalist. He is additionally a standup comic and has been a radio and TV presenter on Triple J, SBS and The Venture.