- Transactions are plummeting

- Is XRP oversold?

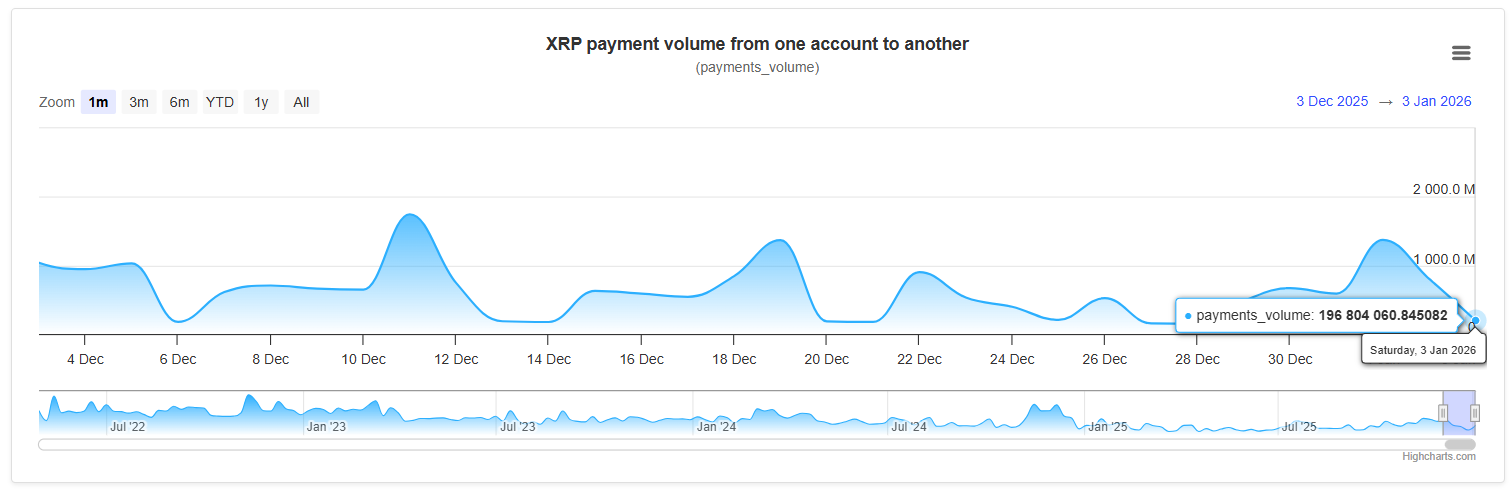

Though it sounds dramatic to debate a 90% collapse on XRP Ledger, knowledge signifies that this isn’t an impending disaster. Silently over time it has already occurred, and the market has largely absorbed it. On-chain metrics point out that ledger exercise has drastically declined. Each the quantity and quantity of funds have declined by about 90% from their highest factors.

Transactions are plummeting

There’s a structural decline within the amount and worth of transactions which can be really flowing via the community. Pretending in any other case is a coping mechanism. The factor that individuals steadily overlook is that notably in late-cycle cryptocurrency markets, the value and ledger exercise don’t at all times transfer in unison.

For months, XRP has been flushing out leverage, compressing ranges and bleeding volatility inside a protracted clearly outlined downtrend channel. The chart demonstrates exactly that, a protracted reset quite than new panic. The value didn’t collapse in response to the collapse of the ledger metrics. That’s important. If a community experiences an unanticipated 90% decline in exercise, it usually collapses.

For XRP, it has already been priced in. Speculative is left-handed. Utilization of low-quality merchandise ceased. A diminished baseline of precise transfers, treasury actions and infrastructure-level utilization is what’s left. That’s survivability quite than bullish hype. The context of the current bounce is extra vital than its magnitude.

Is XRP oversold?

Whereas the RSI slowly strikes out of oversold territory, the value is responding to the decrease fringe of the declining channel. Within the meantime, ledger funds are nonetheless low however regular quite than falling quicker. In sluggish movement bottoming seems like this: exercise ceases to worsen earlier than it improves.

What then ought to buyers actually stay up for? To begin with, don’t anticipate an abrupt enhance in on-chain quantity. If XRP takes off, it is going to in all probability be price-driven, usage-driven and pushed by positioning macro liquidity or regulatory catalysts quite than a sudden miraculous enhance in funds. Second, the growth of volatility is unavoidable.

After a brutal exercise drawdown, extended compression usually ends violently. Stasis is unlikely, however course just isn’t assured. Lastly, the 90% ledger drop is a filter quite than a loss of life sentence. Weak demand not exists. What’s left will resolve whether or not XRP turns right into a speculative relic or a platform able to reestablishing utilization on extra secure floor.