- Bitcoin is exhibiting early bullish alerts as institutional flows, sentiment, and derivatives positioning start to align

- The Coinbase Premium Hole rebound suggests U.S.-based consumers could also be returning after year-end promoting

- Regardless of enhancing indicators, macro uncertainty retains merchants cautious moderately than aggressively bullish

Bitcoin bulls are getting into the brand new 12 months with a bit extra confidence than that they had simply weeks in the past. A number of on-chain indicators are beginning to line up in a method that often grabs consideration. The Coinbase Premium Hole is rebounding as institutional flows seem to return, market sentiment is lifting out of worry, and derivatives merchants are nonetheless leaning lengthy regardless of a latest cooldown in leverage.

On the time of writing, Bitcoin is buying and selling round $91,700, comfortably above the late-December lows close to $87,000. That restoration has helped stabilize sentiment, although analysts stay cautious. The macro backdrop continues to be messy, and no one appears desirous to declare a full-blown bull run simply but.

Institutional Curiosity Begins to Reappear

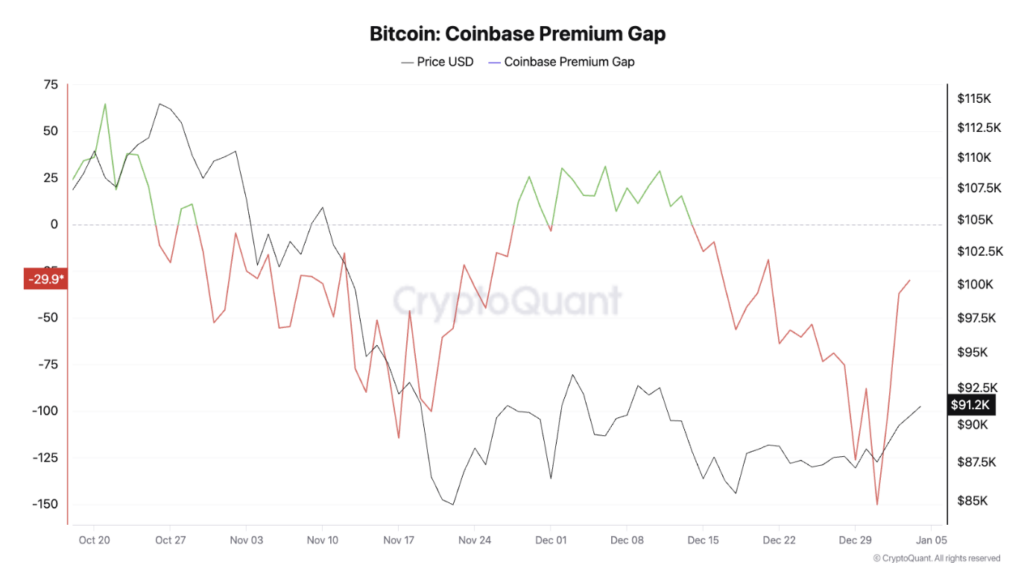

One of many extra encouraging indicators is the restoration within the Coinbase Premium Hole. After plunging to roughly -150 in late December, the metric has steadily climbed again towards the zero line. This issues as a result of Coinbase is broadly seen as the primary on-ramp for regulated U.S. capital, particularly institutional cash.

A narrowing or optimistic premium usually means that American consumers are stepping again in after durations of promoting or inactivity. Whereas the metric hasn’t totally flipped optimistic but, the path alone hints that dollar-denominated demand could also be rebuilding beneath the floor.

Sentiment Slowly Escapes Excessive Worry

Investor psychology can be shifting, albeit progressively. The Crypto Worry & Greed Index has climbed from round 29 final week to roughly 40 as we speak, shifting out of the acute worry zone that usually coincides with market capitulation. It’s not euphoric by any stretch, however it’s a clear enchancment.

Totally different platforms present barely totally different readings, some nearer to the mid-20s, others close to 40, however the development is pointing upward throughout the board. That consistency issues greater than the precise quantity, particularly after a unstable finish to the 12 months.

Merchants Nonetheless Lean Bullish, Fastidiously

Derivatives information provides one other layer to the image. The Bitcoin lengthy/quick ratio has eased off latest highs, however it stays above the important 1.0 degree. In easy phrases, extra merchants are nonetheless betting on upside than draw back.

What stands out is the way in which leverage has cooled. As an alternative of a pointy flush, positioning has unwound progressively, which tends to cut back the chance of sudden liquidation cascades. That sort of reset typically creates a more healthy base, even when worth doesn’t instantly explode larger.

Why Warning Nonetheless Makes Sense

Regardless of these optimistic alerts, the market isn’t out of the woods. The Worry & Greed Index could also be enhancing, however it’s nonetheless sitting in worry territory, reflecting lingering uncertainty round Federal Reserve coverage. December’s FOMC minutes reminded merchants that price cuts aren’t assured, and expectations proceed to shift.

There’s additionally the query of whether or not the latest bounce is partly technical. Yr-end tax-loss promoting might have exaggerated December’s draw back, that means a number of the present power may very well be repositioning moderately than recent conviction. Many analysts argue {that a} decisive, sustained transfer into optimistic Coinbase Premium territory can be wanted to substantiate a real development change.

A Cautious however Constructive Setup

Taken collectively, the alignment of recovering institutional demand, enhancing sentiment, and resilient lengthy positioning paints a cautiously optimistic image for Bitcoin as 2026 begins. Nonetheless, worry hasn’t disappeared, and macro dangers stay unresolved.

For now, merchants seem like accumulating rigorously moderately than chasing worth. Given the volatility of latest months, that restraint may really be essentially the most bullish signal of all.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.