- Bitmine’s whole crypto, money, and “moonshot” holdings now stand at $14.2 billion.

- The corporate controls over 4.14 million ETH, about 3.43% of whole provide, making it the most important ETH treasury on the earth.

- Bitmine is accelerating ETH staking and plans to launch its MAVAN validator community in early 2026.

Bitmine Immersion Applied sciences has disclosed that its mixed crypto, money, and “moonshot” holdings now whole roughly $14.2 billion, cementing its place because the world’s largest Ethereum treasury holder and one of many greatest crypto-focused stability sheets globally. The replace highlights simply how aggressively the corporate has been accumulating ETH, whilst broader market exercise slowed into year-end.

Inside Bitmine’s Increasing Ethereum Treasury

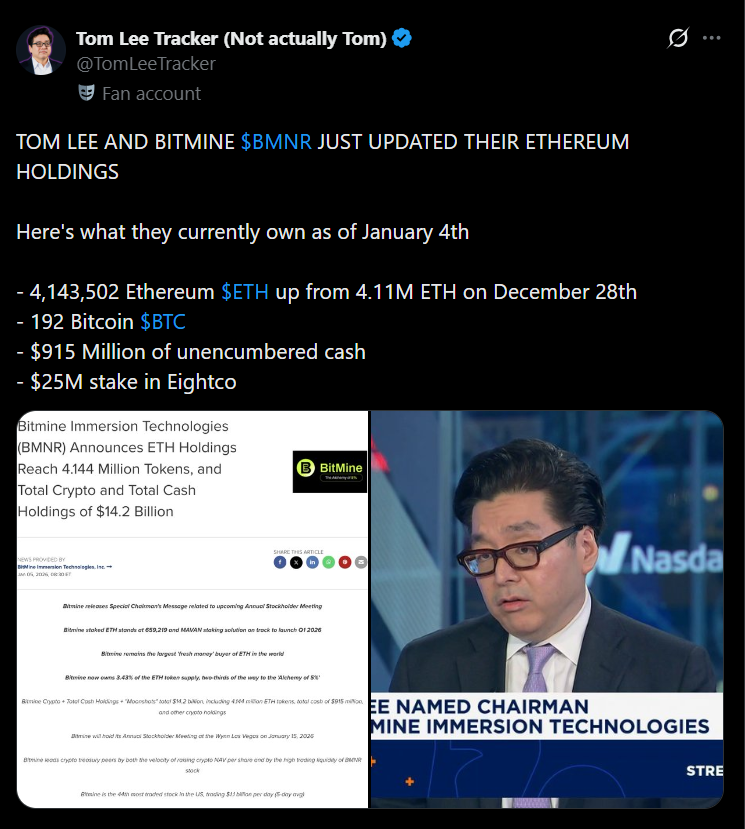

As of January 4, Bitmine holds 4,143,502 ETH, valued at round $3,196 per coin, alongside 192 Bitcoin, $915 million in money, and a $25 million stake in Eightco Holdings as a part of its higher-risk “moonshot” allocation. These Ethereum holdings alone symbolize roughly 3.43% of whole ETH provide, an unusually massive focus for a single company treasury.

Chairman Tom Lee famous that Bitmine added almost 33,000 ETH in simply the ultimate week of 2025, a interval when most market contributors have been stepping again. Based on the corporate, that tempo makes Bitmine the most important supply of “recent cash” ETH shopping for out there proper now.

Why Bitmine Is So Bullish on Ethereum in 2026

Lee outlined a number of tailwinds driving Bitmine’s conviction, together with rising U.S. authorities help for crypto, Wall Road’s growing concentrate on stablecoins and tokenization, and the rising want for authentication and provenance in an AI-driven economic system. He additionally pointed to sturdy parallels between the surge in commodities throughout 2025 and what may observe for crypto costs in 2026, traditionally.

Ethereum, particularly, sits on the middle of that thesis, given its position in tokenization, good contracts, and institutional-grade infrastructure.

Staking, MAVAN, and the Push for Yield

Bitmine’s technique goes past easy accumulation. The corporate now has 659,219 ETH staked, valued at about $2.1 billion, after growing staked balances by greater than 250,000 ETH in a single week. Whereas that is nonetheless solely a fraction of its whole holdings, it units the stage for a lot bigger yield era.

The agency is working with three staking suppliers because it prepares to launch its Made in America Validator Community (MAVAN) in early 2026. At full scale, Bitmine estimates staking may generate roughly $374 million in annual income, or greater than $1 million per day, assuming present staking charges.

Company Technique and What Shareholders Are Voting On

Forward of its January 15, 2026 annual assembly in Las Vegas, Bitmine is asking shareholders to approve a rise in licensed shares. Lee mentioned the transfer is designed to help capital market exercise, potential share splits if ETH reaches long-term targets, and selective acquisitions. Administration emphasised that every one of this ties again to a single aim: growing ETH per share whereas optimizing yield and strategic investments.

The Larger Image

With its crypto holdings now second solely to Technique’s Bitcoin treasury and its inventory rating among the many most actively traded within the U.S., Bitmine is positioning itself as a pure-play car for large-scale Ethereum publicity. Whether or not that technique delivers outsized returns will rely closely on how ETH performs in 2026, however the firm is clearly betting large that Ethereum’s second is approaching.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.