Often, the market tries to maintain it calm on Sundays, however early 2026 was not going to attend for Monday to start out throwing numbers round. One massive SHIB handle acquired fed straight from Coinbase Prime for 1.44 trillion cash, XRP derivatives market managed to liquidate nearly just one aspect within the final hour, and Bitcoin is sitting in that acquainted zone the place a single weekly push could make $100,000 cease sounding like a dream and begin sounding like a completed deal.

TL;DR

- A whopping 1.44 trillion SHIB was transferred from Coinbase Prime to a single new Shiba Inu whale handle.

- XRP skilled an 18,913% liquidation imbalance, with shorts going through the brunt of the influence.

- Bitcoin maintains its place at $100,000 because the January headline degree.

Unknown Shiba Inu whale empties Coinbase for 1.44 trillion SHIB

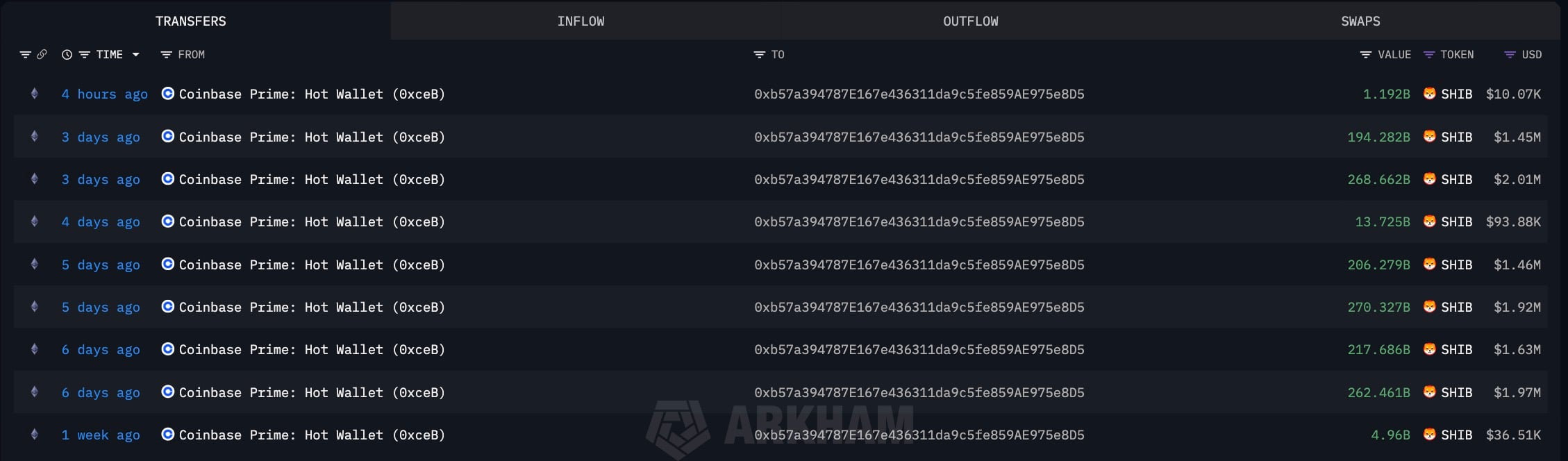

SHIB printed a clear exchange-drain setup on Sunday afternoon, not the standard obscure pockets shuffle. A Coinbase Prime sizzling pockets despatched 9 transfers in a row to the identical handle, 0xb57, for a complete of 1.439574 trillion SHIB in a single seen stream, as per Arkham.

Now this handle reveals a steadiness of 1.44 trillion SHIB, which is about $12.58 million, and SHIB was buying and selling round $0.0000087 when the transfer occurred.

When tokens exit an alternate, the market immediately costs the “much less cash on venues” angle, whatever the cause. It doesn’t assure long-term lockup. Custody reshuffles, chilly storage or staging wallets are nonetheless thought of short-term provide.

The value reacted prefer it at all times does when provide and demand are out of steadiness. On the each day SHIB/USDT chart, Shiba Inu opened close to $0.00000809, went as much as $0.00000880, dropped to $0.00000807 and is round $0.00000872 now, which is a 7.79% each day acquire.

The construction is straightforward to learn. Proper now, the market is testing the $0.00000900 line. And should you have a look at the numbers above that, you will notice $0.00001102 and $0.00001203, that are the subsequent upside checkpoints. If the value dips beneath $0.00000699, it may invalidate the bounce.

The near-term outlook is binary. Whether it is above $0.00000900 per SHIB, it would preserve going up. In the event you lose it, the transfer simply will get filed away as one other custody change, with no lasting influence. The subsequent periods will determine which model sticks for the Shiba Inu coin.

XRP stuns bears with 18,913% liquidation imbalance

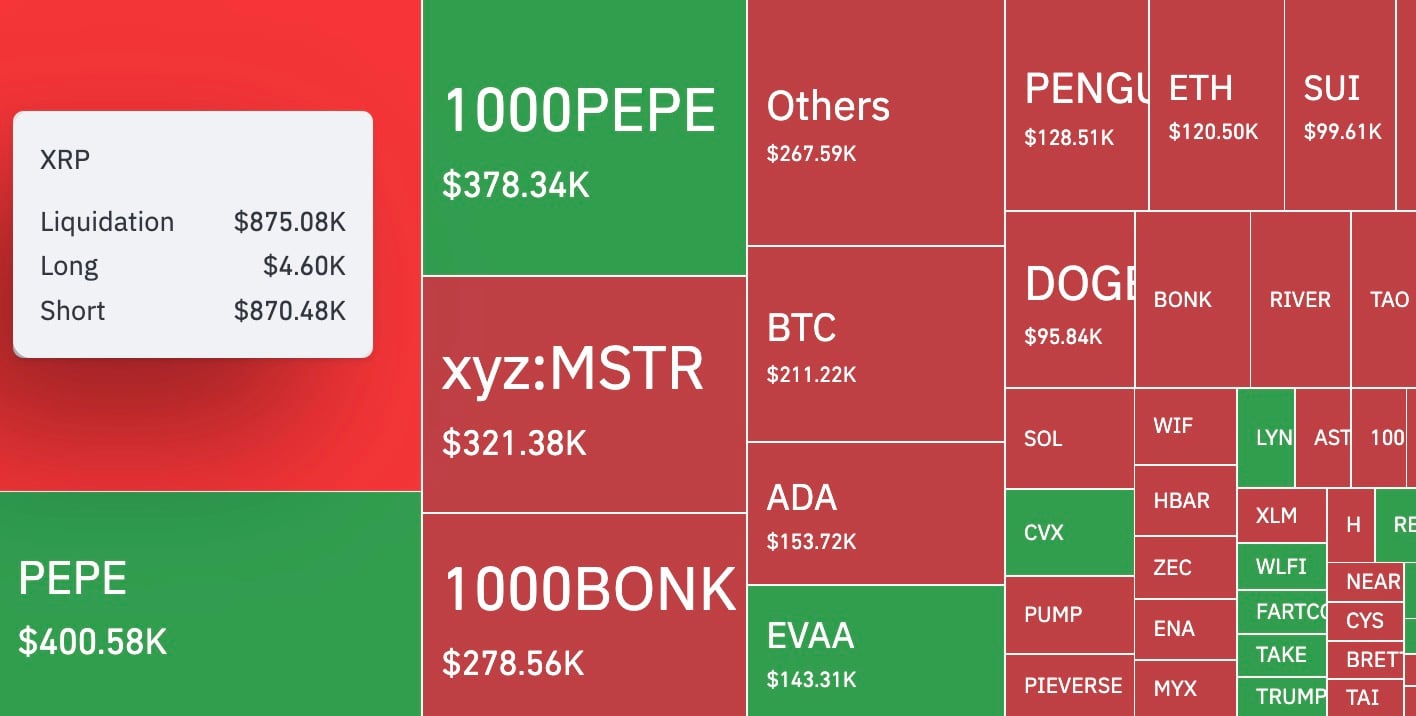

The XRP half is all about derivatives, however the numbers are so uneven that you do not want fancy language to promote it. The liquidation warmth map by CoinGlass reveals XRP liquidations at $875,080, with $4,600 in lengthy liquidations and $870,480 briefly liquidations. That break up is the entire story as a result of it means the final hour principally worn out folks leaning brief, which is the way you get a headline like “18,913% liquidation imbalance” without having any further context.

What makes it fascinating is that the XRP value itself isn’t behaving like a coin that simply went vertical. On the XRP/USDT chart, the most recent print is $2.0863 with the hourly low at 2.0833, and it’s mainly flat. The session additionally reveals that XRP spent the day grinding from the low $2.03 space into the $2.09 zone after which transferring sideways close to the highs.

The imbalance right here signifies issues. Shorts getting destroyed and the value trying managed recommend a two-way state of affairs: a crowded brief being pressured out on a small push or liquidations occurring in a single place whereas spot stays calm. Both approach, mistaken positioning continues.

If XRP stays at $2.08 and doesn’t bounce again, the subsequent liquidation print can go from “shorts acquired hit” to “late longs acquired baited,” which is normally when issues on the value chart get chaotic.

For now, it looks like the market learn that bears tried to fade the transfer and paid for it, whereas spot merchants watched it occur without having a fireworks candle.

Is $100,000 for Bitcoin in January inevitable?

Bitcoin is the piece that makes this complete Sunday pack into a much bigger story, as a result of the weekly chart is already doing the job for the bull case. The BTC/USDT weekly candle by TradingView printed at $87,952.71 on the open, hitting a excessive of $91,810.00 — up 3.90% for the week.

In the event you have a look at the Bollinger Bands on that very same weekly view, you will notice that the midline is at $103,522.98, the decrease band is at $79,800.54, and the higher band is up at $127,245.41.

Why is the $100,000 quantity popping up? It’s proper there within the candy spot between the present value and the mid-band. And let’s face it, markets love a superb chat about that mid-band — it’s like the apparent “subsequent check” line in trending phases.

May we count on a fee of $100,000 in January? That phrase is doing an excessive amount of, however the setup is clear. If Bitcoin’s value can preserve hitting new weekly highs across the $90,000s and begin pushing towards that $103,522.98 midline, hitting $100,000 would possibly make sense. If Bitcoin loses steam and dips towards the decrease finish of the vary, the January 2026 $100,000 prediction might be trying much more like a late 2025 state of affairs.

Crypto market outlook

The primary Sunday of 2026 delivered a really particular combo.

If follow-up SHIB transfers preserve coming from exchange-tagged sources, that half turns from headline into pattern, and if XRP retains sitting close to the highs after wiping shorts, the subsequent wave of leverage will determine whether or not the squeeze is completed or simply beginning.

- Shiba Inu (SHIB): value final proven round $0.00000872 after a 7.79% each day transfer, with $0.000009 as the road to reclaim, then $0.00001102 and $0.00001203 above and $0.00000699 as the extent that defines failure.

- XRP: final proven round $2.0863, with the day swinging from the low $2.03 space into the $2.09 zone.

- Bitcoin (BTC): weekly shut proven at $91,380.58, with $103,522.98 because the Bollinger midline goal, $79,800.54 because the decrease band reference and $127,245.41 because the higher band cap.