- SUI surged over 10% in 24 hours as quantity and momentum returned throughout the market

- A recent TD Sequential purchase sign echoes setups that preceded main rallies prior to now

- Robust on-chain metrics and clean token unlocks are supporting confidence, although dangers stay

The most recent bounce throughout crypto markets didn’t go away Sui Community behind. SUI jumped greater than 10% in simply 24 hours, with buying and selling quantity rising proper alongside value. It was a type of strikes that felt coordinated, not random, and merchants undoubtedly observed.

Sui is usually labeled a “Solana killer,” a daring tag, however not fully baseless if the community can hold scaling at tempo. On-chain exercise and up to date value habits have began to resemble early Solana phases, although SUI remains to be removed from matching SOL’s historic highs. Even so, the construction forming on the charts has sparked speak that Sui is perhaps organising for one thing acquainted.

A Technical Sign That’s Exhausting to Ignore

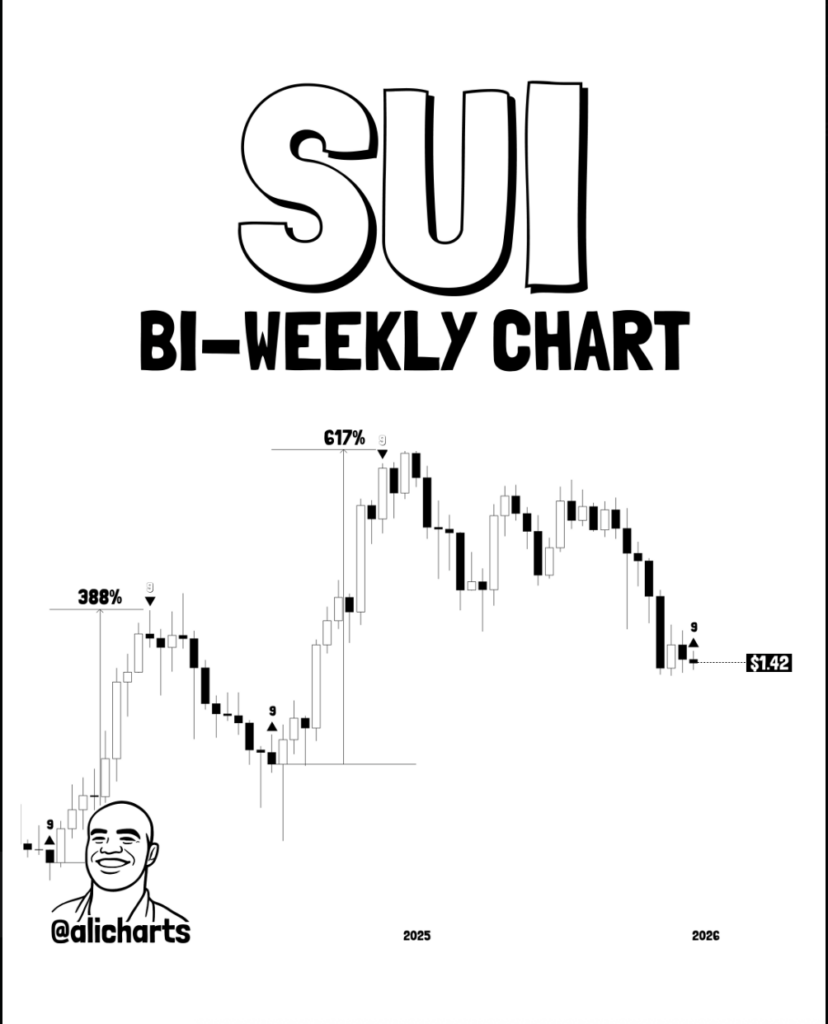

SUI grabbed additional consideration after its bi-weekly chart flashed a recent TD Sequential purchase sign. Traditionally, that sample has preceded some very aggressive rallies for the token. In early 2024, an analogous sign was adopted by a 388% transfer from native lows. One other occasion led to a 617% surge that pushed value to new peaks.

The most recent sign appeared close to the $1.42 stage, after a protracted slide from 2025 highs into early 2026 lows. That downtrend regarded much less like panic promoting and extra like a sector-wide correction. After the sign triggered, SUI responded shortly, climbing to round $1.70 by January 4, a achieve of over 20% in a brief window.

Ali Charts prompt that, in concept, SUI might repeat its historic sample and push towards the $7 space. That stated, not everyone seems to be satisfied the previous will repeat so cleanly. Market circumstances have shifted, liquidity is totally different, and macro elements matter extra now than they did in earlier runs. The setup appears promising, but it surely’s not a assure.

Brief-Time period Value Motion Heats Up

Zooming into the 4-hour chart, SUI rebounded sharply from help round $1.32 and started urgent towards the $1.73 resistance zone. This transfer adopted an prolonged interval of consolidation, usually an indication that consumers have been quietly constructing positions earlier than making a push.

Momentum indicators present power, perhaps a bit an excessive amount of. The RSI climbed near 78, which places SUI firmly in overbought territory. That doesn’t kill a rally, but it surely does increase the percentages of a pause or short-term pullback.

Quantity is backing the transfer, although. On-balance quantity rose towards $900 million, suggesting actual participation moderately than skinny liquidity spikes. If SUI can maintain above $1.60, a clear break previous $1.73 turns into extra probably. Failure there might ship value again towards $1.50, or in a deeper reset, again to the $1.32 vary.

On-Chain Progress Retains the Story Alive

Away from the charts, Sui’s on-chain knowledge continues to look strong. The community just lately absorbed a $60 million token unlock with none noticeable disruption, an indication that provide strain was dealt with easily. That alone boosted confidence amongst holders.

The Mysticeti v2 improve additionally made a distinction, considerably decreasing latency whereas preserving transactions per second close to 866. Complete worth locked sits above $1 billion, helped by a 30% soar in DEX buying and selling quantity and rising BTCfi integrations. Every day transactions have climbed previous 13 million, exhibiting regular utilization.

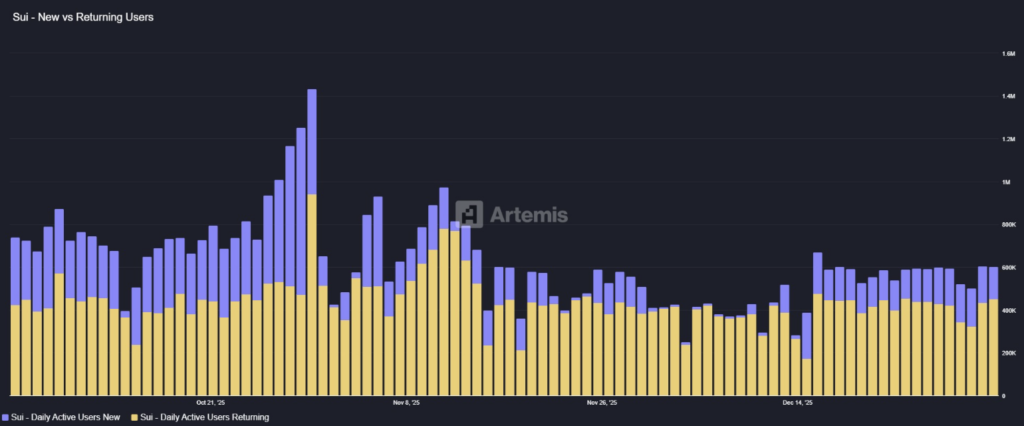

New lively customers reached round 1.3 million, roughly half the variety of returning customers. That blend suggests each retention and recent curiosity, a wholesome combo for a rising community.

What Comes Subsequent for SUI?

Hypothesis round potential spot SUI ETFs from corporations like Bitwise and Canary provides one other layer of intrigue. Approval isn’t assured, however even the likelihood has helped help sentiment. The truth that SUI remained comparatively secure after the token unlock suggests holders aren’t dashing for exits.

Sui is more and more seen as a scalable execution layer, however its long-term success will nonetheless rely upon adoption and regulatory readability. Broader market pullbacks or macro delays might simply gradual momentum. For now although, SUI appears like a community merchants are watching carefully, with historical past whispering one factor and actuality reminding everybody to remain cautious.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.