New 12 months’s fireworks spark over Neo co-founders battle

Neo co-founders Erik Zhang and Da Hongfei clashed on New 12 months’s Eve in a heated public trade, accusing one another of mismanaging the blockchain’s treasury and misrepresenting years of inside governance choices.

Neo is a long-running sensible contract community based in 2014 that rose to prominence in the course of the 2017 bull market, when it was broadly dubbed “China’s Ethereum.” The nickname mirrored its early deal with sensible contracts and regulatory-friendly design, comparable in ambition to Ethereum however marketed as a home different for China’s tech ecosystem.

Zhang mentioned he initially stepped away from Neo management after Da argued that joint oversight of the inspiration was slowing the undertaking.

“Both you step away, or I do. I’m tremendous with both final result,” Zhang claimed Da advised him in a personal assembly. “Appearing in what I assumed was Neo’s greatest curiosity, I agreed on the spot that I’d step apart.”

Zhang mentioned the choice was not impartial. He claimed Da started growing a separate public blockchain undertaking and mentioned his elimination “eradicated inside checks, making it doable to leverage Neo’s sources whereas constructing a separate, personally managed undertaking that instantly competes with Neo.” He referred to as it “a elementary battle of curiosity” and mentioned he returned to demand “full, verifiable monetary disclosure of [Neo Foundation’s] belongings.”

Da rejected Zhang’s account outright. “False,” he wrote, saying the dispute stemmed from years of delayed efforts to safe the treasury.

“A blockchain undertaking’s treasury ought to be secured by multisig, not by one man after years of launching. It isn’t negotiable,” Da mentioned, accusing Zhang of deliberately stalling the handover.

Zhang claimed “the overwhelming majority of Neo’s belongings” past NEO and GAS had been beneath Da’s sole management for years. Da responded that “NEO [and] GAS have been at all times the tremendous majority of [Neo Foundation’s] belongings,” after which accused Zhang of “mendacity and fabricating information” and pointed to an upcoming monetary report.

Neo Basis distanced itself from the general public kerfuffle, stating that the disputes won’t have an effect on its operations. It added that monetary stories will likely be launched within the first quarter.

Asia’s main markets are warming as much as crypto ETFs

Japan despatched a transparent sign that cryptocurrency exchange-traded funds (ETFs) are shifting nearer to the regulatory mainstream.

Finance Minister Satsuki Katayama mentioned in her speech on the New 12 months opening ceremony on Monday — domestically generally known as the “daihakkai”— that 2026 marks a turning level for digital belongings, and the primary yr of “full-scale” digitalization.

“To make sure residents profit from digital and blockchain-based belongings, the function of exchanges and market infrastructure will likely be important,” she mentioned, in accordance with a machine translation. “Within the US, crypto belongings are more and more used by way of ETFs as inflation hedges, and Japan should additionally pursue superior fintech initiatives.”

Japan’s messaging and up to date developments in South Korea recommend that Asia’s largest economies are warming to crypto ETFs at the same time as formal approvals lag behind demand.

On Friday, Korea Change Chairman Jeong Eun-bo mentioned that the trade is operationally able to checklist crypto ETFs and derivatives, regardless of regulators nonetheless debating whether or not digital belongings qualify as eligible underlying securities.

Learn additionally

Options

12 minutes of nail-biting pressure when Ethereum’s Pectra fork goes stay

Options

Crypto Indexers Scramble to Win Over Hesitant Traders

Japan’s regulatory place is already shifting. Crypto belongings have been regulated beneath fee and custody frameworks moderately than securities regulation, limiting their eligibility as ETF underlyings. That’s set to alter as Japanese regulators are getting ready to reclassify crypto as a monetary product beneath securities laws.

Progress has been extra concrete elsewhere in Asia. Hong Kong accepted spot Bitcoin and Ether ETFs in 2024, permitting merchandise listed on the Hong Kong Exchanges and Clearing to start buying and selling, albeit with modest inflows in contrast with US counterparts.

Vietnam approves USDT conversion pilot

Vietnamese authorities in Da Nang metropolis have reportedly accepted a pilot permitting a neighborhood firm to transform USDT stablecoins into Vietnamese dong and again.

That is Vietnam’s first licensed check of a non-custodial digital asset–to-fiat conversion mannequin because the nation brings new crypto laws into pressure in 2026, in accordance with state-affiliated media Hà Nội Mới.

The Da Nang Metropolis Folks’s Committee licensed Dragon Lab JSC to deploy its resolution, which intermediates USDT and VND conversions with out taking custody of consumer funds. The trial will run by means of Dec. 17, 2028 and will likely be performed beneath regulatory supervision at three designated areas within the metropolis.

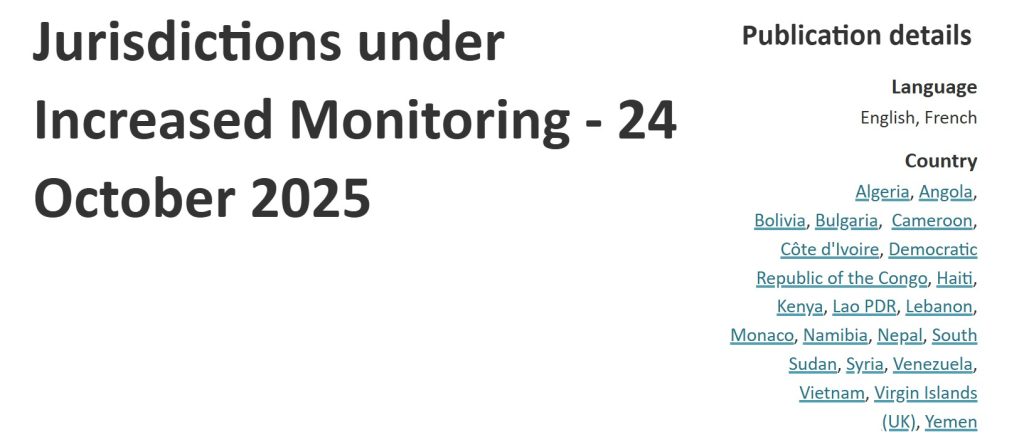

Vietnam’s “Legislation on the Digital Know-how Trade” got here into impact on New 12 months’s Day to determine a authorized framework for crypto belongings, licensing and regulatory sandboxes. The reforms kind a part of Vietnam’s broader effort to strengthen Anti-Cash Laundering and Combating the Financing of Terrorism controls after being positioned on the Monetary Motion Process Pressure (FATF) gray checklist in June 2023.

The FATF gray itemizing typically alerts deficiencies in a rustic’s monetary crime controls and may elevate compliance prices for banks, buyers and worldwide counterparties. International locations on the checklist face elevated scrutiny from world monetary establishments, which may limit entry to capital and deter overseas funding.

In a June 2025 advice, the FATF urged jurisdictions to speed up enforcement of its crypto requirements, warning that stablecoins now account for many illicit onchain exercise. The FATF mentioned jurisdictions proceed to battle with licensing, supervision and figuring out crypto service suppliers, at the same time as prison use of stablecoins, fraud and cross-border laundering rises.

Learn additionally

Options

Must you ‘orange capsule’ youngsters? The case for Bitcoin children books

Options

Cleansing up crypto: How a lot enforcement is an excessive amount of?

Indonesia kickstarts Asia’s crypto tax modifications

Indonesia is about to turn into one of many first Asian jurisdictions to implement the Crypto-Asset Reporting Framework (CARF), permitting the automated trade of cryptocurrency and e-wallet information with tax authorities from 2027, masking the 2026 tax yr.

New laws from the Ministry of Finance expands Indonesia’s monetary info reporting regime to incorporate fee service suppliers, e-wallet operators and crypto service suppliers.

Fee service suppliers — together with non-bank entities — are handled as deposit-taking establishments once they handle digital cash. Meaning e-wallet accounts and transaction information fall throughout the scope of knowledge reportable to the tax authorities.

Cryptocurrencies are additionally introduced throughout the reporting perimeter, with exchanges and different service suppliers required to reveal related monetary info. The regulation authorizes the taxman to entry information reported beneath CARF.

Indonesia is amongst a bunch of 48 jurisdictions dedicated to conducting their first CARF exchanges by 2027, in accordance with the OECD’s newest dedication checklist. In Southeast Asia, Indonesia is shifting forward of friends comparable to Singapore, Malaysia, Thailand and Hong Kong, which have indicated plans to start CARF exchanges from 2028.

CARF extends cross-border tax transparency by requiring jurisdictions to gather and trade info on crypto transactions. The framework was developed to handle gaps in reporting created by the speedy development of digital belongings and digital fee platforms.

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist masking blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has coated Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.