Crypto heads into the second week of January jam-packed with essential occasions. Right here’s what crypto holders have to know:

#1 BTC: Financial institution Of America Opens The Advisory Spigot

Beginning January 5, advisers throughout Financial institution of America Non-public Financial institution, Merrill, and Merrill Edge can advocate “a number of crypto exchange-traded merchandise (ETPs)” for consumer portfolios, eradicating prior asset thresholds and shifting advisers from execution-only to energetic allocation steerage.

In an early-December be aware tied to the rollout, Merrill’s Chris Hyzy framed the financial institution’s stance in portfolio-construction phrases: “For traders with a robust curiosity in thematic innovation and luxury with elevated volatility, a modest allocation of 1% to 4% in digital belongings could possibly be acceptable.”

Associated Studying

The market relevance is much less about someday of flows and extra about plumbing. Financial institution of America is among the largest US wealth distribution networks; even a modest allocation over the long-term might have vital value impression.

#2 Ethereum Blob Capability Steps Up Once more

Ethereum’s newest scaling cadence continues on January 7 through the second “Blob Parameter Solely” improve (BPO2), which will increase the per-block blob goal and most to 14 and 21, respectively, an incremental transfer designed to broaden rollup knowledge throughput with out bundling the grow to be a bigger named laborious fork. The Ethereum Basis has positioned the BPO observe as a intentionally minimal, config-only mechanism to “safely enhance blob throughput” after Fusaka.

For L2 customers, the direct linkage is knowledge availability pricing. Extra blob provide, all else equal, can stress blob charges decrease, which is the part many rollups go by way of into end-user transaction prices. The nuance is that these positive aspects are conditional: if demand for blobspace ramps as shortly as capability, payment reduction could be muted, and operators nonetheless need to validate stability as targets rise.

#3 Hyperliquid (HYPE) Token Unlock

Hyperliquid’s HYPE token has a scheduled provide occasion on January 6: Hyperliquid Labs workforce members are set to obtain an preliminary 1.2 million HYPE allocation, valued at roughly $31.2 million. Core contributors maintain rights to roughly 237 million tokens beneath a structured launch plan, practically one quarter of the overall provide.

The setup for merchants is easy: token unlocks are reflexively modeled as potential promote stress, however the realized impression is determined by recipient habits and any offsetting mechanics.

#4 Stellar’s Privateness Observe Strikes To Testnet

Stellar is scheduled to improve its testnet to Protocol 25, branded “Stellar X-Ray”, on January 7 at 21:00 UTC, with the mainnet vote slated for January 22. In its developer steerage, Stellar explicitly calls out the operational requirement: SDK and infrastructure operators ought to improve forward of the testnet date, with vacation timing cited as a motive for the unusually lengthy runway between secure releases and activation.

Associated Studying

On the product aspect, Stellar frames X-Ray as foundational privateness infrastructure: “laying the groundwork for builders to construct configurable, compliance-forward privateness functions utilizing zero-knowledge (ZK) cryptography,” whereas conserving the community’s transparency mannequin intact.

#5 Macro Outlook

Macro is doing crypto no favors when it comes to clear narratives. Over the weekend, US forces captured Venezuelan President Nicolás Maduro, a transfer that pushed Bitcoin and crypto costs greater. Oil initially jolted however then softened amid expectations that near-term provide disruption is proscribed.

Geopolitically, the spillover danger is in escalation moderately than the one occasion. US President Trump raised the opportunity of additional interventions within the area, together with language round Colombia. General, the weekly US market open can be essential for the week.

Charges politics are the opposite macro overhang. Trump has repeatedly mentioned he’ll identify his decide to succeed Fed Chair Jerome Powell “early subsequent yr,” with Powell’s management time period ending in Could 2026; the method has was a dwell market variable due to what it implies in regards to the White Home’s most well-liked fee path and perceived Fed independence. With prediction markets explicitly buying and selling on whether or not a nomination lands by January 9, some crypto desks will deal with the date as a volatility waypoint even when mainstream reporting stays looser on timing.

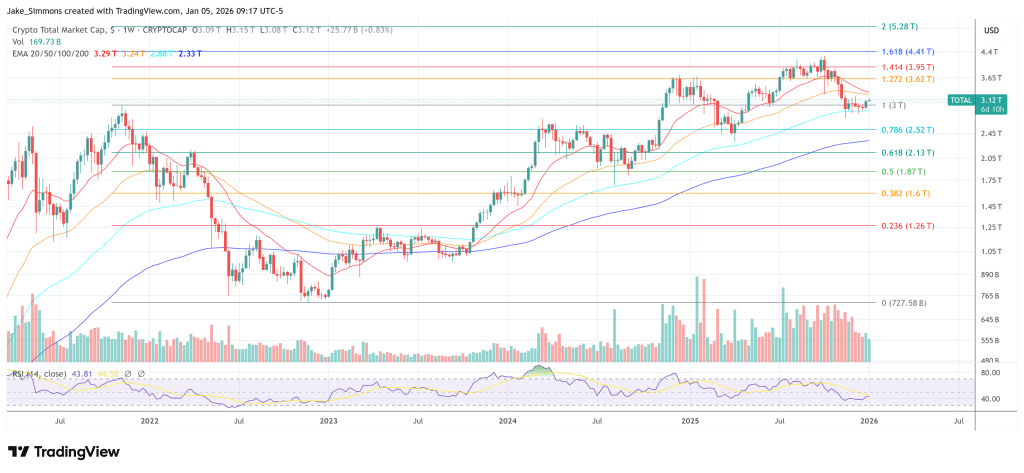

At press time, the overall crypto market cap stood at $3.12. trillion.

Featured picture created with DALL.E, chart from TradingView.com