- The U.S. Marshals Service is suspected of promoting roughly $6.3 million in forfeited bitcoin from the Samourai Pockets case, a transfer that will battle with Government Order 14233 requiring such belongings to be held within the U.S. Strategic Bitcoin Reserve.

- Blockchain knowledge suggests the BTC was routed on to a Coinbase Prime handle and certain liquidated, bypassing long-term authorities custody and elevating questions on discretionary decision-making inside the DOJ and SDNY.

- The episode has renewed doubts about whether or not the federal “struggle on crypto” is actually ending, regardless of pro-Bitcoin indicators from the Trump administration and ongoing debate over developer prosecutions.

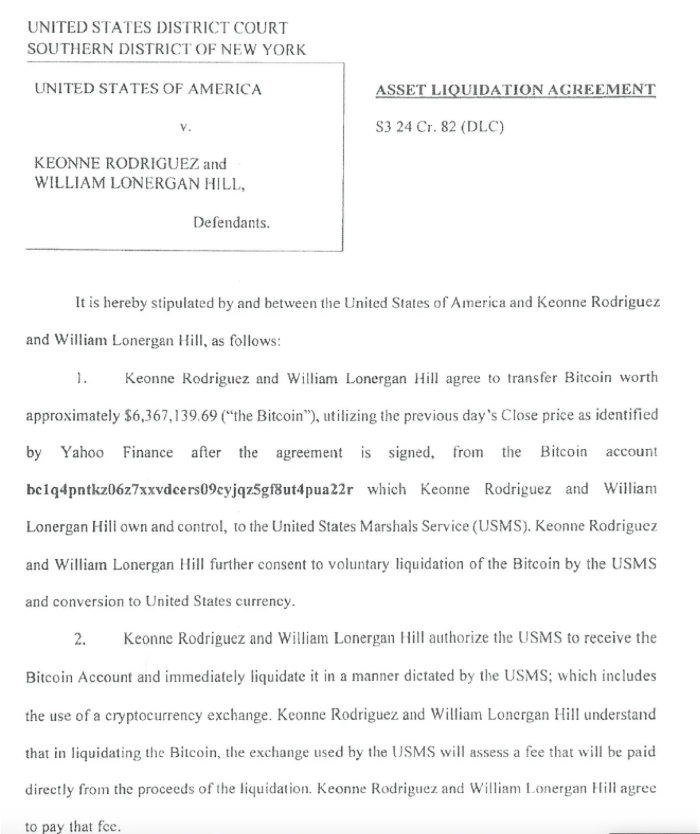

It seems the U.S. Marshals Service could have quietly bought the bitcoin forfeited by Samourai Pockets builders Keonne Rodriguez and William Lonergan Hill, a transfer that’s elevating eyebrows throughout the crypto and authorized communities. The quantity in query, roughly $6.3 million price of BTC, was paid to the Division of Justice as a part of the builders’ responsible plea.

If that sale did occur, it may place the company in direct battle with Government Order 14233. That order clearly states that bitcoin obtained by felony or civil asset forfeiture needs to be retained as a part of the US’ Strategic Bitcoin Reserve, not liquidated on the open market.

The scenario turns into extra delicate on condition that the case was dealt with within the Southern District of New York. That district has, prior to now, developed a popularity for appearing with a level of independence that typically runs towards broader federal course. If EO 14233 was ignored right here, it wouldn’t be with out precedent.

The place Did the Bitcoin Go?

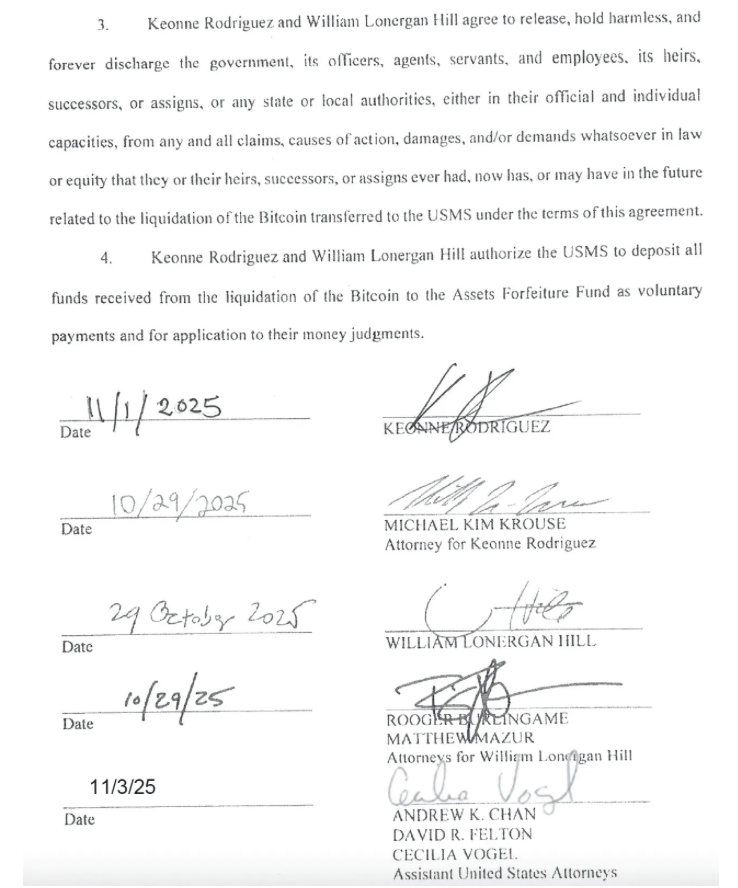

In accordance with an “Asset Liquidation Settlement” obtained by Bitcoin Journal, the bitcoin forfeited by Rodriguez and Hill was earmarked on the market, or could have already been bought. The settlement exhibits that 57.55353033 BTC, valued at $6,367,139.69 on the time, was transferred on November 3, 2025, after being signed by Assistant U.S. Lawyer Cecilia Vogel.

As a substitute of passing by a visual U.S. Marshals Service pockets, the funds seem to have been despatched on to a Coinbase Prime handle. Arkham Intelligence hyperlinks that handle to the brokerage. Notably, the pockets now exhibits a zero stability, which strongly suggests the BTC has already been liquidated.

That element issues. If the bitcoin by no means entered long-term authorities custody and was routed straight to an alternate, it factors towards an intentional resolution to promote quite than maintain.

A Potential Violation of Government Order 14233

Government Order 14233 leaves little room for interpretation. Bitcoin obtained by the federal government by forfeiture, referred to within the order as “Authorities BTC,” is explicitly to not be bought and should as an alternative be added to the Strategic Bitcoin Reserve.

If the Marshals Service proceeded with a sale anyway, it could not have been as a consequence of any authorized requirement. As a substitute, it could mirror discretionary motion by officers who should still view bitcoin as an asset to dump, quite than one thing to carry strategically, regardless of direct steering from the chief department.

That mindset would align carefully with the posture of the earlier administration, which was overtly hostile towards noncustodial crypto instruments and their builders. The Samourai case itself originated throughout that interval, and critics argue the dealing with of the forfeited BTC matches a broader sample.

What the Legislation Really Says About Forfeiture

A authorized supply conversant in the case says the forfeiture was carried out beneath 18 U.S. Code § 982(a)(1), tied to violations of unlicensed cash transmitter statutes. That regulation requires forfeiture of property concerned within the offense, nevertheless it doesn’t require liquidation.

Even when § 982 incorporates 21 U.S.C. § 853(c), the statute solely addresses possession switch to the US. It says nothing about changing forfeited belongings into money. The identical applies to different forfeiture-related statutes cited in EO 14233. They govern how proceeds are dealt with, not whether or not belongings should be bought.

The chief order goes even additional, classifying bitcoin as a “Authorities Digital Asset” and explicitly stating that company heads will not be permitted to promote such belongings besides beneath slim situations. None of these exceptions seem to use within the Samourai case, and most would require direct involvement from the U.S. legal professional common.

The Southern District of New York Issue

Seen by that lens, the SDNY’s position stands out. Typically referred to, half-jokingly, because the “Sovereign District of New York,” the workplace has lengthy been identified for working with uncommon autonomy inside the federal system.

Its resolution to pursue circumstances towards the Samourai builders, and towards Twister Money developer Roman Storm, got here even after Deputy Lawyer Basic Todd Blanche issued a memo in April 2025 instructing prosecutors to cease concentrating on builders of noncustodial crypto instruments for the actions of their customers.

Within the Samourai case, prosecutors moved ahead even after FinCEN officers reportedly prompt the pockets didn’t qualify as a cash transmitter as a consequence of its noncustodial design. That context makes the obvious sale of the forfeited bitcoin really feel much less like an oversight and extra like a part of a sample.

Is the Struggle on Crypto Actually Ending?

For a lot of within the crypto trade, this episode has reopened uncomfortable questions. President Trump campaigned on a pro-Bitcoin stance and issued EO 14233 as a transparent sign that the federal government ought to deal with bitcoin as a strategic asset, not contraband.

If that imaginative and prescient is to carry, businesses just like the DOJ and USMS would wish to totally align with these directives. That features honoring the order to retain forfeited bitcoin and following steering to cease prosecuting builders of noncustodial instruments.

Trump has just lately hinted he could think about pardoning Rodriguez. A pardon, mixed with a proper assessment of why the forfeited bitcoin was bought, would ship a a lot stronger sign that the administration’s pro-crypto posture is extra than simply rhetoric.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.