Bitcoin moved greater on renewed shopping for from massive holders whereas smaller wallets have been seen reserving beneficial properties, a sample that on-chain watchers view as supportive for additional upside.

Associated Studying

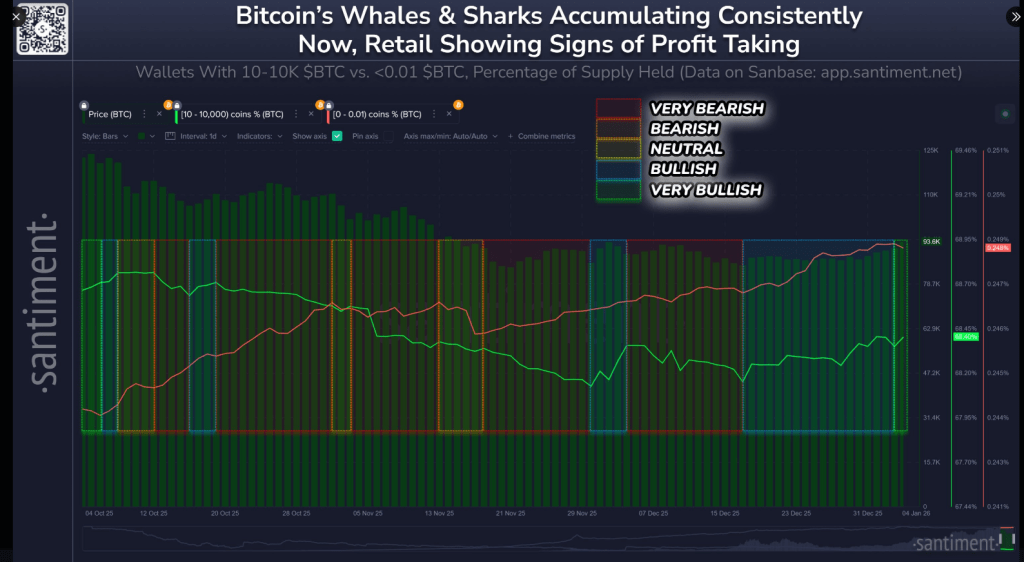

Whale Accumulation And Retail Revenue-Taking

In line with Santiment, wallets holding between 10 and 10,000 BTC — described as whales and sharks — have added 56,227 BTC since mid-December. On the similar time, wallets with lower than 0.01 BTC have been taking earnings, suggesting some retail merchants anticipate a bull entice or a idiot’s rally.

This break up — heavy accumulation by massive holders whereas small accounts promote — raises the percentages of market cap progress throughout crypto.

Provide Redistribution And Market Construction

Market observers say provide is shifting in a manner that helps worth motion. Analyst James Verify identified that the top-heavy provide share has fallen from 67% to 47%, a big transfer in a brief span.

📊 Crypto markets sometimes comply with the trail of key whale & shark stakeholders, and transfer the other way of small retail wallets. In our chart under:

🟥 Whales dumping, Retail accumulating (VERY BEARISH)

🟧 Whales dumping, Retail unpredictable (BEARISH)

🟨 Whales & Retail… pic.twitter.com/yoC0H1keBT— Santiment (@santimentfeed) January 5, 2026

That shift, paired with a drop in profit-taking and indicators of a short-squeeze in futures, has supported greater costs whilst general leverage stayed low.

Bitcoin has been principally rangebound between roughly $87,000 and $94,000 for about six weeks, but it surely briefly reached a seven-week excessive of $94,800 on Coinbase throughout late buying and selling on Monday.

Choices And Key Ranges

Merchants watching choice curiosity see heavy name exercise across the $100,000 strike for January expiry. Knowledge exhibits Bitcoin as being in a bullish consolidation part, with speedy resistance seen at $95,000 to $100,000 and help positioned close to $88,000 to $90,000.

A clear break above the higher zone might push costs greater, whereas a breach under the decrease zone would possibly invite deeper promoting stress.

Geopolitical Shock And Buying and selling Quantity

Following the seize of Venezuelan President Nicolás Maduro by US forces, Bitcoin moved to multi-week highs and traded above key ranges close to $93,000 on Monday, based mostly on reviews.

Analysts tied the transfer partly to geopolitical uncertainty pushing some traders towards different property. Hypothesis about Venezuela’s alleged massive BTC holdings — reportedly a whole bunch of hundreds of cash — additionally added to market chatter and commerce exercise.

Total, the occasion coincided with greater volatility and quantity, reflecting broad market reactions to world pressure fairly than serving as a direct driver of Bitcoin’s elementary worth.

Associated Studying

What This Means For Merchants

The present mixture of big-wallet shopping for and retail profit-taking provides the market a tilted bias. If accumulation by whales continues, the possibility of an upward breakout rises. But the retail sell-off warns that short-term reversals stay potential.

The $95,000 to $100,000 vary seems to be a key space for a possible breakout, whereas help round $88,000 to $90,000 might affect sentiment if costs fall under it.

Experiences and on-chain information counsel momentum leans towards additional beneficial properties, although the market might stay risky as merchants reply to each technical ranges and geopolitical developments.

Featured picture from Unsplash, chart from TradingView