Bitcoin (BTC) entered 2026 with a powerful begin, exhibiting greater than 7% achieve over the previous week. The asset is at round $93,600 at press time, rising 1% within the final 24 hours. Day by day buying and selling quantity stays excessive at $51.5 billion.

On Tuesday morning, Bitcoin climbed to its highest stage in practically two months, nearing the $95,000 mark. Not like earlier strikes, the weekend rally held by means of Monday, a change from latest patterns the place beneficial properties had been usually erased rapidly.

Worth Strikes Towards Key Resistance

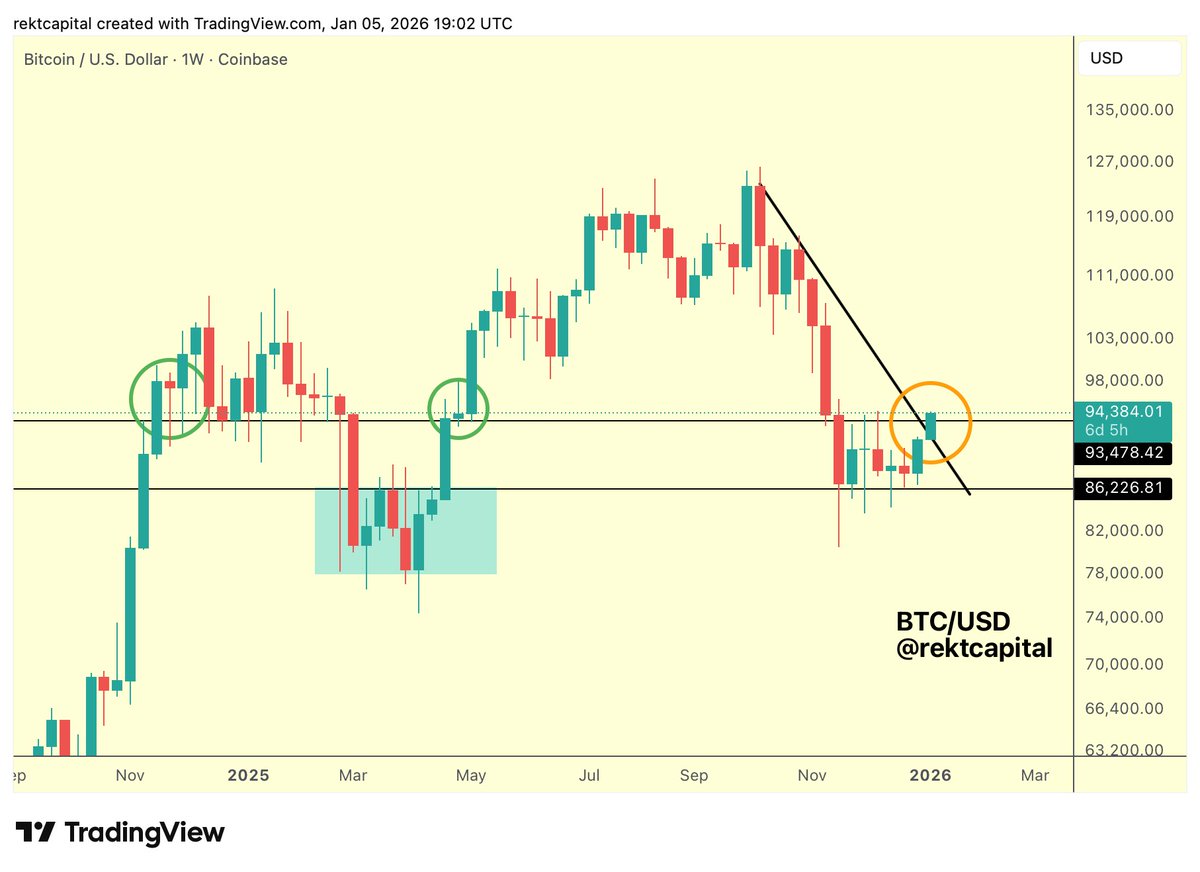

Bitcoin has rebounded from the decrease finish of its weekly vary close to $86,200. This stage has acted as a help space prior to now. The value has now climbed to check the highest of this vary close to $93,500. Analyst Rekt Capital identified {that a} shut above this stage would mark a possible breakout. The asset is at the moment buying and selling above the vary excessive, however the weekly shut will probably be essential.

Notably, the transfer additionally comes as BTC breaks above a downtrend line that has been in place since October 2025. This trendline, drawn from decrease highs, has now been breached. Holding above $93,500 is seen by many merchants as the extent that might shift the mid-term image.

“$93,500 wants to carry as help for mid-term bullish bias,” mentioned Rekt Capital.

Regardless of latest beneficial properties, market analysts stay cautious. Rekt Capital famous that Bitcoin closed its 12-month candle beneath $93,500. Primarily based on historic cycles, comparable ranges have remained unbroken for a number of years till the subsequent halving 12 months.

“If certainly Bitcoin has begun a bear market, worth may overextend past $93,500 over the approaching months… earlier than persevering with decrease.”

Sykodelic, one other market analyst, pointed to robust shopping for exercise driving latest beneficial properties. They famous a breakout within the On-Stability Quantity indicator and talked about that Coinbase is exhibiting indicators of a spot premium. Nonetheless, they added a warning:

“We have to get above and maintain $94.5K. If not, we might revisit $89K.”

Macro Developments Could Be Shifting

Analyst Lark Davis drew consideration to a technical crossover on the US Federal Reserve’s stability sheet. A month-to-month MACD golden cross has shaped, which final occurred in 2019. At the moment, Bitcoin started a serious rally within the months that adopted.

“Not official QE but… nevertheless it certain appears to be like like QE and smells like QE,” Davis mentioned.

The crossover suggests the Fed’s stability sheet could also be increasing once more after months of decline. This shift in liquidity might have an effect on markets in early 2026, particularly danger property like Bitcoin.

Assist Ranges and Market Outlook

Michaël van de Poppe recognized the $90,000–$91,000 vary as a short-term stage that should maintain. This zone additionally traces up with the 21-day transferring common. A failure to carry may result in a retest of decrease ranges.

“If that holds and a better low varieties, then we may very well be $100K,” he commented.

Knowledge from Glassnode reveals that Bitcoin is recovering from a correction. The present section is described as a consolidation, although market situations stay unsure. Whereas many metrics are turning constructive, some analysts consider this rally may very well be the ultimate leg earlier than a bigger transfer down.

The put up The Closing Barrier? Why This Key Stage Will Resolve Bitcoin’s Destiny appeared first on CryptoPotato.