- XRP has surged over 30% because the begin of 2026, outperforming each Bitcoin and Ethereum and briefly overtaking BNB by market cap.

- Trade reserves have dropped to an 8-year low whereas XRP spot ETFs recorded over $46 million in each day inflows, signaling rising spot demand.

- Technical indicators present a bullish construction with robust accumulation, suggesting XRP might keep momentum if broader market circumstances stay supportive.

Ripple’s XRP has come out swinging in early 2026. On the time of writing, the token was altering fingers round $2.39, up roughly 31% because the new yr kicked off. That rally hasn’t occurred in isolation both. As Bitcoin pushed up towards the $94.5k resistance zone, XRP quietly stole the highlight, outperforming each BTC and Ethereum over the previous a number of periods.

The momentum was robust sufficient to reshuffle the leaderboard. XRP briefly overtook Binance Coin by market capitalization, locking within the fourth spot among the many largest crypto property on CoinMarketCap. For long-time holders, it felt like a shift they’d been ready on for some time.

Trade Reserves Tighten as Volatility Breaks

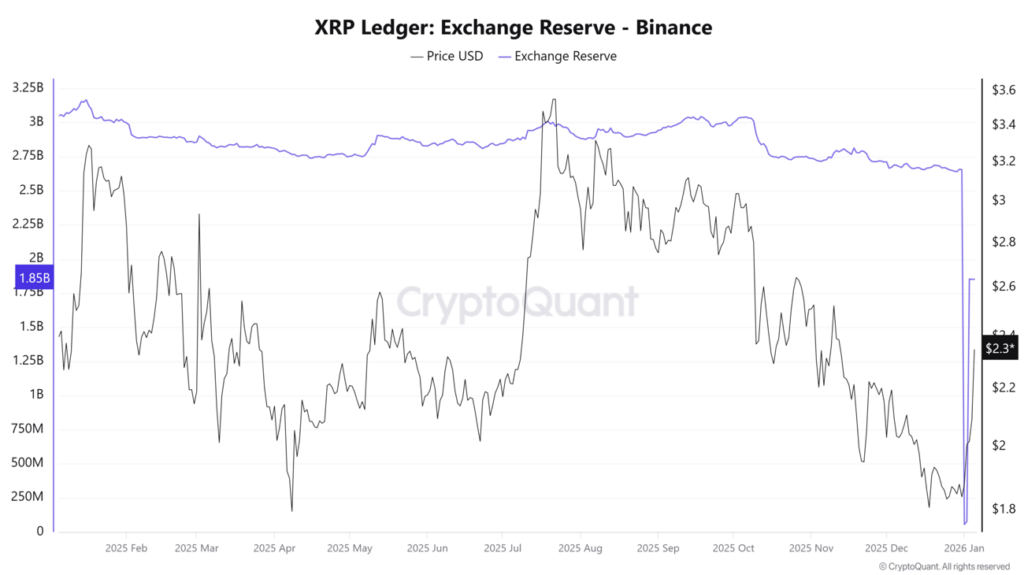

Behind the value transfer, provide dynamics have been performing some heavy lifting. Knowledge from CryptoQuant reveals XRP alternate reserves dropping to their lowest stage in eight years, down round 57% in comparison with October 2025. Towards the top of final yr, XRP traded in an unusually tight vary whereas tokens steadily flowed off exchanges, a mix that always precedes sharp strikes when demand returns.

That mentioned, shrinking alternate balances alone don’t assure an enduring rally. As AMBCrypto beforehand famous, spot demand and broader threat urge for food nonetheless matter rather a lot. If Bitcoin stumbles or total market sentiment flips risk-off, XRP’s momentum might cool sooner than many anticipate.

ETF Inflows Add Gas to the Transfer

Spot demand has proven up in one other place too, ETFs. On January 5, XRP spot ETFs recorded a complete internet influx of $46.1 million in a single day. Franklin’s XRPZ and Bitwise’s XRP product led the cost, pulling in $21.76 million and $17.27 million, respectively.

What’s notable is that inflows didn’t simply seem out of nowhere. December already noticed regular ETF demand, even whereas the broader market was weighed down by uncertainty and worry. That persistence suggests the latest sentiment shift could have deeper roots, with XRP positioned as one of many early beneficiaries.

Over the past 24 hours alone, XRP jumped greater than 11%, making it the second-best performer among the many high 20 cryptocurrencies. Its market cap hovered close to $144 billion at press time, reinforcing the size of the transfer.

Technical Construction Flips Bullish

On the each day chart, the technical image has improved meaningfully. XRP broke above its native swing excessive at $1.96, flipping the short-term construction bullish. Bulls additionally managed to reclaim the $2.28 resistance zone, a stage that had capped worth motion earlier than.

Momentum indicators replicate that power. The RSI has pushed into overbought territory, however to this point there’s been no aggressive rejection beneath $2.28. In the meantime, the Accumulation/Distribution indicator continues to climb, pointing to sustained shopping for strain fairly than a skinny, speculative spike.

Taken collectively, ETF inflows, falling alternate reserves, and bettering technicals paint a constructive image. So long as broader market circumstances stay supportive, XRP seems to be positioned to remain firmly bullish within the weeks forward, even when short-term pullbacks present up alongside the way in which.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.