XRP opened 2026 with robust bullish momentum, pushed by a $48 million surge in spot ETF inflows on January 5 and 6.

Institutional shopping for powered a day by day rally of greater than 21%, permitting XRP to reclaim the essential $2 psychological stage and set its sights on a breakout towards the $2.40 to $2.60 vary.

As ETFs take in greater than 1% of the circulating provide, merchants and analysts more and more query whether or not XRP can maintain a push towards $3 or attain the long-anticipated $5 milestone throughout the first quarter.

Broader macro forces proceed to bolster this rally. After U.S. forces captured Venezuelan President Nicolás Maduro on January 3, Bitcoin surged again above $94,000 as buyers sought decentralized property to hedge towards rising geopolitical danger.

On the identical time, President Trump’s indicators of a sweeping overhaul of Venezuela’s oil business accelerated capital flows into digital property. This shift towards a risk-on surroundings strengthened total market confidence and amplified XRP’s ongoing technical breakout.

As establishments pour cash into main cryptocurrencies, buyers are turning to new crypto cash with real-world makes use of. Bitcoin Hyper (HYPER) stands out by combining Bitcoin’s safety with fashionable scalability.

Many analysts now name Bitcoin Hyper the most effective crypto to purchase now for robust returns within the subsequent section of the 2026 bull market.

Supply – 99Bitcoins YouTube Channel

XRP Worth Prediction

XRP has remained one of the vital watched crypto property within the first week of 2026. After years of sideways worth motion, charts reveal a transparent multi-year sample now approaching a essential turning level. Merchants see the present bullish development constructing on a big accumulation base.

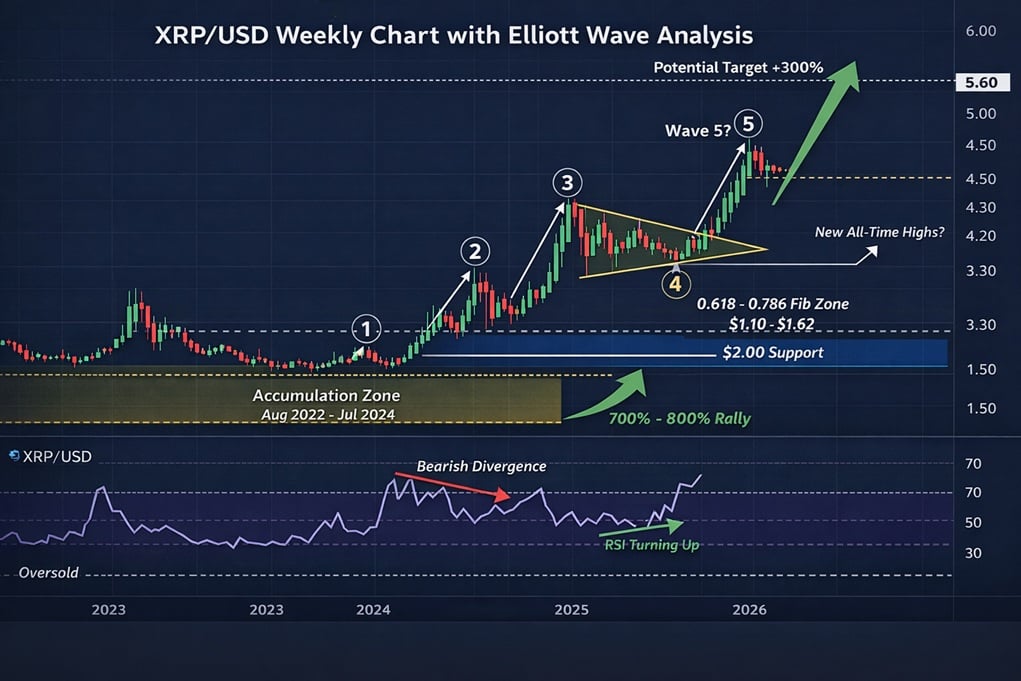

On larger time frames, XRP first accomplished a posh ABC corrective drop after which stayed in a two-year accumulation section from August 2022 to July 2024. This lengthy consolidation created the momentum and liquidity wanted for the 700% to 800% rally that reshaped XRP’s market in 2025.

Analyzing the Elliott Wave construction, the preliminary rally pulled again earlier than resuming its upward trajectory. Analysts determine the cycle as a basic impulsive sample.

Waves 1 and a couple of fashioned the primary breakout and confirmed it with a retest, whereas Wave 3 pushed worth strongly above earlier resistance. Wave 4, the present correction, emerged as bearish divergence appeared on the weekly chart, with worth making larger highs whereas the RSI lagged.

XRP then fashioned a triangle consolidation and located robust assist close to the 0.618 to 0.786 Fibonacci zone ($1.10 to $1.62), permitting momentum to reset from overbought to impartial or oversold circumstances.

As of early January, the market setup helps the following leg larger. XRP stays above the $2 psychological stage and has rebounded sharply from December lows, holding beneficial properties of 70% to 80%.

With the weekly RSI clearing its bearish divergence, technicals level upward. Historic oversold circumstances, reminiscent of in July 2024, typically preceded triple-digit rallies.

Based mostly on the present wave construction, analysts anticipate XRP may rise about 300% from its current low. This transfer would full the “Grand Cycle” Wave 5 and doubtlessly push XRP to new all-time highs because the broader crypto market enters its subsequent progress section in 2026.

ETF Demand and Institutional Curiosity Place XRP for Market Management

The broader monetary world is noticing XRP’s resurgence. CNBC lately reported that “the most popular crypto commerce of 2026 is $XRP,” emphasizing that “there’s massive cash behind this commerce.”

Institutional buyers are actively accumulating XRP, absorbing change provide, and positioning the token to guide the following leg of the market cycle.

Regulated funding merchandise drive these current beneficial properties. ETF purchasers bought $19.12 million in XRP within the first week of January, in response to Whale Insider, pushing whole web property in XRP ETFs to roughly $1.62 billion.

Traders present related exercise throughout the crypto sector, with current inflows totaling $697 million into Bitcoin ETFs and $168 million into Ethereum ETFs. Analysts interpret this sustained progress as a powerful bullish sign, reflecting clearer laws and a shift towards long-term institutional participation.

Macroeconomic and coverage developments are additionally shaping XRP’s worth. Discussions round U.S. coverage and tokenization initiatives recommend that digital property may play a central position in future monetary methods.

Speculators are more and more exploring the tokenization of real-world property, together with vitality commodities reminiscent of oil, on blockchain platforms.

XRP stands out due to its native give attention to cross-border settlements. Whereas claims that XRP will energy world oil transactions stay unverified, its design positions the token as a frontrunner for institutional use in large-scale monetary functions.

Merchants anticipate XRP to keep up momentum so long as it holds key assist throughout any short-term pullbacks.

Whereas XRP dominates the cost narrative, the rising demand for Bitcoin-backed utility is positioning Bitcoin Hyper (HYPER) as the most effective crypto to purchase now for these searching for next-generation infrastructure publicity.

XRP Traders Eye the Finest New Crypto Coin for 2026 Positive factors

Bitcoin Hyper is an rising Layer 2 (L2) blockchain designed to scale Bitcoin by delivering high-speed transactions and low charges whereas preserving the bottom layer’s safety. By integrating the Solana Digital Machine (SVM), Bitcoin Hyper brings full sensible contract performance to the Bitcoin ecosystem.

This permits a vibrant vary of decentralized functions (dApps), together with high-speed DeFi token swaps and lending markets, native staking and yield-bearing property, and low-latency environments for gaming and NFTs.

The community ensures asset mobility by way of a decentralized canonical bridge, permitting customers to lock BTC on the Bitcoin blockchain and mint an equal asset on the L2, giving them the liberty to make use of Bitcoin for DeFi whereas retaining the choice to withdraw to the native chain.

Bitcoin Hyper’s native token, $HYPER, has a hard and fast whole provide of 21 billion, mirroring Bitcoin’s shortage mannequin, and powers all on-chain transactions, secures the community by way of staking with a present 38% APY, and permits governance votes to information the protocol’s future.

Standard crypto influencers, together with Borch Crypto, consider $HYPER is the most effective crypto to purchase now.

As of as we speak, the undertaking has raised round $30.2 million in its ongoing presale at a present token worth of $0.013545, reflecting robust institutional and retail demand and signaling that main exchanges will doubtless prioritize $HYPER listings following its Token Era Occasion (TGE).

Early adopters should purchase $HYPER straight on the Bitcoin Hyper web site utilizing ETH, USDT, BNB, or bank cards, and handle their tokens utilizing Finest Pockets, the place $HYPER already seems within the “Upcoming Tokens” part for seamless monitoring and post-launch claiming.

Go to Bitcoin Hyper

This text has been offered by one in all our business companions and doesn’t mirror Cryptonomist’s opinion. Please remember our business companions could use affiliate applications to generate revenues by way of the hyperlinks on this text.