Spot Bitcoin ETFs within the US opened 2026 with a burst of money that shocked some market watchers and inspired others.

Associated Studying

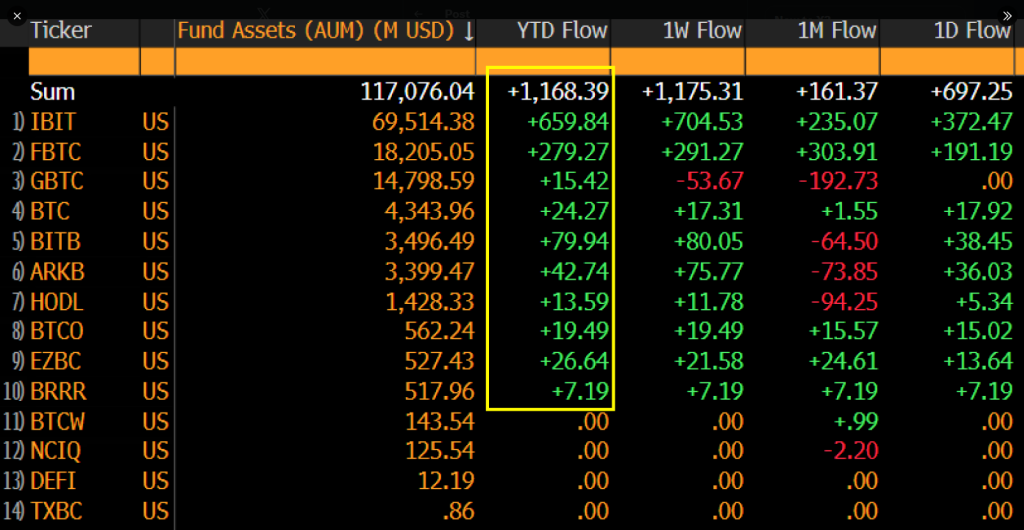

In response to Bloomberg’s senior ETF analyst Eric Balchunas, greater than $1.2 billion flowed into these funds throughout the first two buying and selling days of the 12 months.

He estimated that if that tempo held, annualized inflows might attain about $150 billion — roughly 600% greater than the full for 2025.

The spot Bitcoin ETFs are “coming into 2026 like a lion,” Balchunas mentioned.

ETF Flows Surge Early

In response to reviews, almost each main spot Bitcoin ETF noticed cash coming in throughout these opening periods. Balchunas calls this influx as broad-based.

The WisdomTree Bitcoin Fund (BTCW) was one of many few exceptions that didn’t register the identical demand. BlackRock’s iShares Bitcoin Belief (IBIT) was reported to have taken a big share of final 12 months’s shopping for.

The spot bitcoin ETFs are coming into 2026 like a lion, +$1.2 in flows in first two days of 12 months w/ everybody consuming. That’s a $150b/yr tempo. Informed ya’ll if they will absorb $22b when it’s raining, think about when the solar is shining. pic.twitter.com/YdRaLN0Op7

— Eric Balchunas (@EricBalchunas) January 6, 2026

Conventional Measures Fell Brief Final Yr

Final 12 months, spot Bitcoin ETFs recorded internet inflows of over $21 billion. That was down from $35 billion in 2024. But Monday’s single-day internet influx of $697 million was the largest every day consumption in three months, and it got here as Bitcoin traded again above the low $90,000s. Buying and selling quantity rose and a few positions that had guess on a worth drop have been closed, which added to the transfer.

Institutional Strikes And New Filings

Reviews present Morgan Stanley filed with the SEC to supply each Bitcoin and Solana ETFs, a step that places a serious wealth supervisor alongside established issuers.

Balchunas identified Morgan Stanley manages about $8 trillion in advisory property and has already cleared its advisors to allocate to such merchandise.

The agency’s proposed Bitcoin belief, based on the submitting, would observe the spot worth and keep away from leverage or derivatives.

How The Flows Have an effect on The Market

Analysts say ETF demand is probably going to take in circulating Bitcoin provide. If sustained, that dynamic might change how a lot liquidity is on the market to merchants and may cut back the quantity of BTC supplied on exchanges.

There was an early signal of unevenness: preliminary figures confirmed a big outflow from one Constancy fund on Tuesday, which raised the possibility of a internet outflow for the day as soon as all knowledge have been in.

Associated Studying

Bitcoin Worth Amid Geopolitical Noise

In the meantime, Bitcoin’s worth held its floor after geopolitical headlines involving Venezuela and the seize of its chief, Nicolas Maduro, by US particular forces. The highest crypto asset stored its composure across the low $90,000s and climbed previous $93,000 at moments.

Merchants and analysts pointed to quick place liquidations and a rebound in different threat property as causes for the elevate. Some on-chain observers flagged accumulation by bigger holders, whereas others mentioned markets have been treating the information as concluded quite than as a recent shock.

Featured picture from Unsplash, chart from TradingView