Bitcoin value is consolidating after a shallow 1% day-on-day pullback, whilst a daring macro prediction from Farzam Ehsani, CEO of VALR, attracts consideration.

His thesis factors to main upside as soon as capital rotation shifts from treasured metals. For now, Bitcoin should clear a couple of short-term strain zones earlier than that situation can unfold.

Why the VALR CEO Thinks Upside Is Delayed, Not Denied

Ehsani’s view facilities on capital rotation relatively than direct chart patterns. That is what he mentioned in an unique bit to BeInCrypto:

Sponsored

Sponsored

“Aggressive value development in Bitcoin and Ethereum is more likely to start after the rally in treasured metals fades,” he emphasised

He ties Bitcoin’s sideways motion on to the place world capital has gone:

“Over the previous yr, gold costs have risen by 69%, whereas silver has surged by 161%… In consequence, the upside momentum within the main crypto property has considerably stalled,” he highlighted

This relationship is seen within the knowledge. Bitcoin’s short-term correlation with gold at present sits close to −0.11, exhibiting the 2 property shifting barely in reverse instructions. Capital chasing metals throughout geopolitical stress and tight liquidity has presumably lowered urgency in crypto.

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto E-newsletter right here.

Crucially, Ehsani doesn’t see this as a structural weak point:

“Lengthy-term Bitcoin holders have stopped promoting for the primary time since July,” he talked about.

Sponsored

Sponsored

That removes a significant supply of provide. He describes the present section as:

“A relaxed earlier than the storm, usually adopted by a broader crypto market rally,” he mentioned

His base-case situation assumes a shift in steel dynamics:

“Within the first quarter of 2026, Bitcoin might rise to $130,000… however this situation is unlikely and not using a shift within the value dynamics of gold and silver,” he additional added

The macro thesis is obvious. Bitcoin’s upside is postponed by capital allocation, not undermined by fundamentals. But, there are a few on-chain hurdles as effectively.

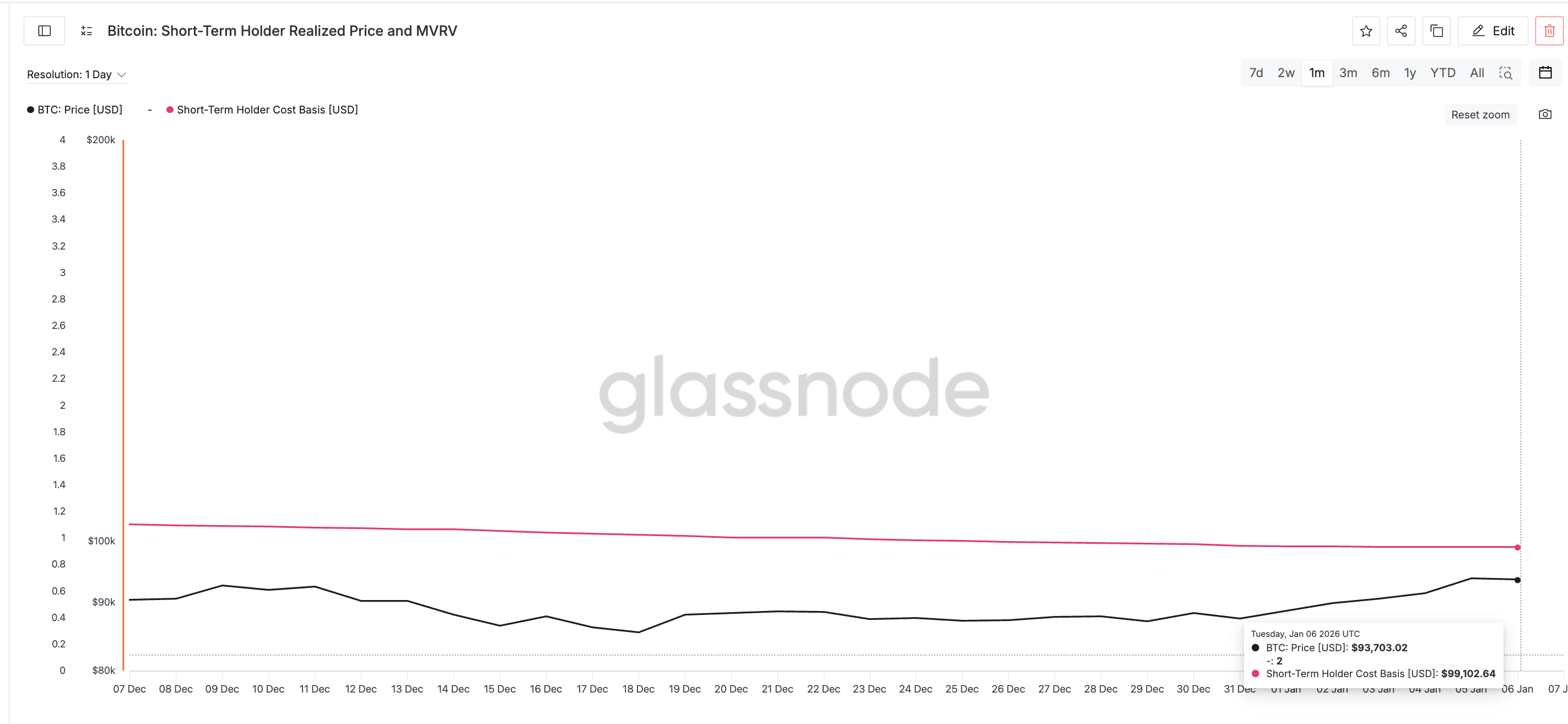

Quick-Time period Holders Are Creating the First Actual Check

Whereas long-term holders have stepped again from promoting, as Ehsani highlights, short-term holders now management near-term value conduct. Quick-term holders are wallets that acquired Bitcoin inside roughly the final 155 days and have a tendency to react strongly round break-even ranges.

Sponsored

Sponsored

That break-even degree is the short-term holder realized value, at present close to $99,100. That is the typical value of current consumers. Round this zone, conduct adjustments. Beneath it, the holders are underwater. Close to it, they search aid. And that might set off a promote wave, offered offsetting capital rotation doesn’t are available in.

This strain exhibits up in short-term holder NUPL (Internet Unrealized Revenue/Loss). On December 18, short-term NUPL dropped to round −0.18, signaling heavy losses. Since then, it has risen towards −0.05, that means losses are shrinking.

When NUPL approaches zero, promoting usually will increase, not as a result of markets flip bearish, however as a result of merchants wish to exit with out losses. This explains why Bitcoin may hesitate close to $99,100 whilst macro indicators enhance.

Sponsored

Sponsored

Bitcoin Value Ranges That Resolve Whether or not the Prediction Holds

Bitcoin’s value chart construction places these pressures into focus.

The BTC value is consolidating inside a cup-and-handle sample, a bullish continuation construction, after rebounding from resistance close to $95,180. For this sample to resolve greater, Bitcoin should clear two key hurdles, offered the neckline breakout above $95,180 occurs first.

The primary sits close to $99,400, intently aligned with the short-term holder realized value. A clear day by day shut above this zone would sign that break-even promoting strain has been absorbed.

The second hurdle is close to $101,600, which aligns with the 365-day shifting common. This shifting common tracks Bitcoin’s long-term pattern over a full yr. Reclaiming it usually marks the transition from consolidation to enlargement.

If value reclaims each ranges, with a day by day shut, Bitcoin’s construction helps continuation towards greater targets, aligning with Ehsani’s macro thesis. The primary key goal, then, can be $108,000 per the chart extension.

On the draw back, the bullish setup stays intact above $91,900, the decrease boundary of the deal with. A deeper break under $84,300, the bottom of the cup, would invalidate the construction and delay upside, although it could not negate the broader thesis.

Bitcoin’s long-term narrative stays constructive. The quick time period is just asking for proof past the short-term partitions. Clearing near-term holder strain is the ultimate step earlier than capital rotation can do the remainder.