- Bitcoin fell beneath $92K, triggering practically $500M in liquidations.

- Lengthy positions made up the vast majority of losses, pointing to a leverage flush.

- The pullback seems corrective, not structural, with majors holding key ranges.

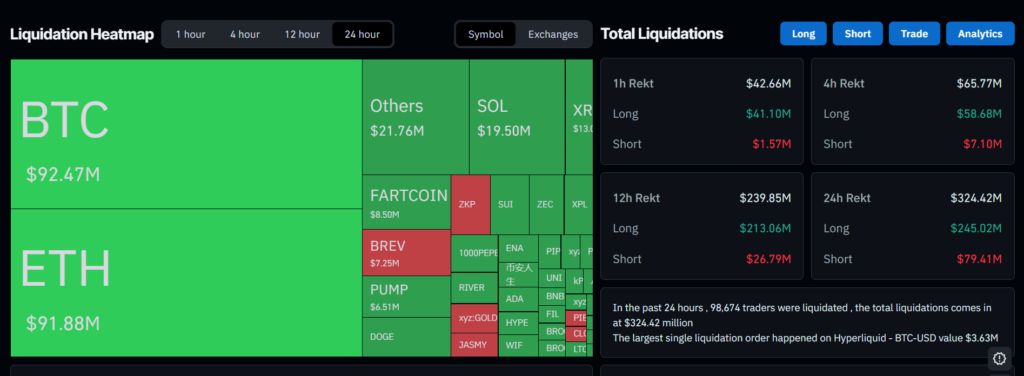

Bitcoin dipped beneath the $92,000 degree early Wednesday, triggering a wave of leveraged liquidations that cleared out overheated positioning. Based on CoinGlass knowledge, greater than $490 million in crypto positions have been worn out over the previous 24 hours, with the majority of losses coming from lengthy merchants caught on the incorrect facet of the transfer. The selloff adopted a short-lived rally earlier within the week that pushed BTC to a neighborhood excessive close to $95,000 earlier than momentum pale.

Leverage Unwind Drove the Transfer

Lengthy positions accounted for roughly $374 million of the overall liquidations, whereas shorts added one other $83 million. That imbalance suggests the transfer was much less about contemporary bearish conviction and extra about leverage getting flushed as worth failed to carry greater ranges. Bitcoin and Ethereum led liquidation charts, which is typical throughout broad danger resets, as large-cap property have a tendency to hold probably the most crowded positioning.

Altcoins Adopted Bitcoin Decrease

As Bitcoin pulled again, main altcoins adopted swimsuit. Ethereum slid from a weekly excessive close to $3,300 to round $3,140, whereas Solana retreated from $143 to $136. XRP noticed one of many sharper share drops amongst large-cap tokens, falling from $2.41 to roughly $2.20. Regardless of the declines, worth motion stays orderly, with no indicators of panic promoting or structural breakdown throughout majors.

Why This Doesn’t Change the Greater Image

The broader crypto market is down about 1.5% over the previous 24 hours, in keeping with CoinGecko, however the transfer seems to be extra like a leverage reset than a pattern reversal.

Liquidation-driven pullbacks usually relieve short-term strain and create cleaner circumstances for continuation, particularly once they happen after a failed breakout slightly than throughout sustained weak spot. If spot demand holds and promoting strain fades, this flush might find yourself strengthening the market’s basis slightly than damaging it.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.