- Whales are steadily accumulating LINK, signaling longer-term confidence

- Grayscale continues to carry its LINK place as alternate provide tightens

- The launch of a spot ETF may broaden institutional demand if market circumstances cooperate

Chainlink is quietly discovering its method again onto the radar of each crypto whales and institutional traders. Whereas the broader market nonetheless feels uncertain of itself, on-chain information suggests confidence round LINK is constructing, not fading. Accumulation, not hypothesis, appears to be the theme.

Current pockets exercise factors to bigger gamers stepping in with dimension. These aren’t quick flips both. The habits appears to be like affected person, deliberate, and really acquainted to anybody who has watched long-term positioning kind earlier than.

Whales Are Including, Not Chasing

Knowledge from Arkham exhibits a single whale just lately withdrew 171,000 LINK, value roughly $2.36 million, from Binance. That wasn’t a one-off transfer. Over the previous month, the identical pockets has collected near 790,000 LINK at a median worth round $12.72. That sort of consistency normally hints at conviction, not impulse.

The message right here is pretty clear. This investor seems keen to sit down by short-term noise in alternate for potential outperformance down the street. It’s the sort of accumulation that tends to occur earlier than narratives totally catch on, not after.

Leverage Merchants Are Leaning In Too

Derivatives markets are telling a barely completely different, however associated, story. OnChain Lens reported {that a} newly created pockets deposited $5 million in USDC on Hyperliquid and opened leveraged lengthy positions in each LINK and DOGE. The LINK place was taken at 5x leverage, whereas DOGE was pushed even more durable at 10x.

For the time being, the mixed commerce is exhibiting a floating lack of round $600,000 on a $28.2 million place. Nonetheless, the willingness to deploy leverage throughout uneven circumstances suggests merchants are positioning early, not ready for excellent affirmation. Dangerous, sure, however it highlights rising urge for food round LINK publicity.

Establishments Hold Holding Whereas Provide Tightens

On the institutional facet, Grayscale continues to play a gentle hand. Its LINK Belief just lately hit a brand new all-time excessive in complete internet belongings, approaching $90 million, with present holdings round $87.15 million. Extra notably, information from Coinglass exhibits Grayscale has held roughly 1.31 million LINK for almost two years with out promoting.

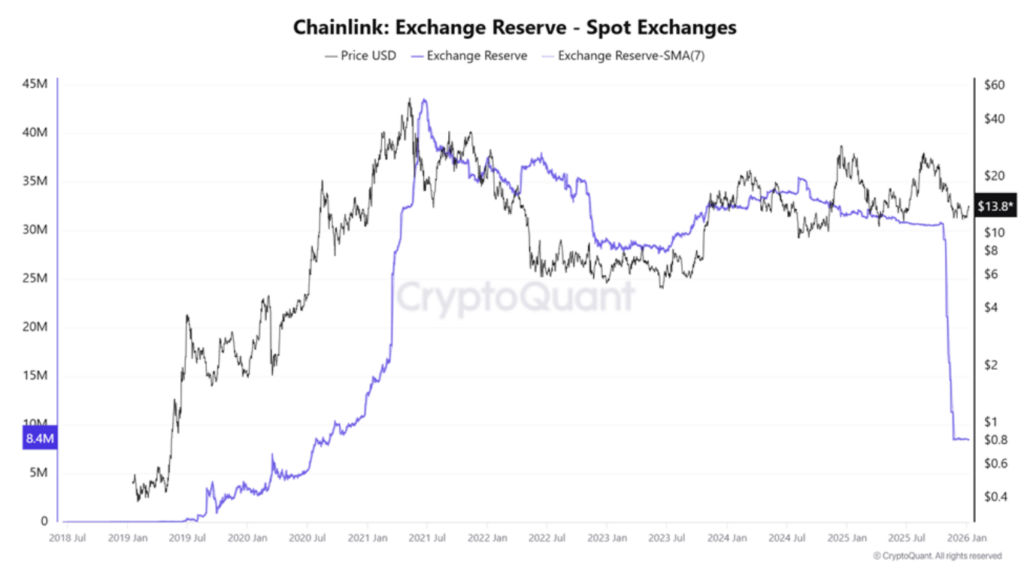

That sort of consistency issues. Mixed with ongoing whale accumulation, it’s contributing to a noticeable decline in LINK balances on exchanges. CryptoQuant information confirms alternate reserves are sitting close to historic lows, which regularly alerts decreased promote stress and tighter accessible provide.

A Spot ETF Provides One other Layer

Including gas to the story, Bitwise has secured approval from the SEC to launch a spot Chainlink ETF underneath the ticker CLNK on NYSE Arca. Buying and selling is predicted to start this week, marking Chainlink’s first direct publicity to US fairness markets. The ETF will custody belongings by Coinbase Custody and BNY Mellon, providing a well-known construction for conventional traders.

Regardless of all of this, LINK’s worth response has been pretty muted thus far, up just below 1% to round $13.84 on the time of writing. That disconnect between fundamentals and worth typically doesn’t final eternally, although timing stays unpredictable. Whether or not this setup interprets into sustained upside will nonetheless rely upon broader market circumstances and investor danger urge for food.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.