- The 300 million XRP switch seems to be an inside Ripple pockets transfer, not an exterior sale

- Historic patterns counsel routine escrow and treasury administration reasonably than market manipulation

- XRP value motion relies upon extra on broader market tendencies than single whale transfers

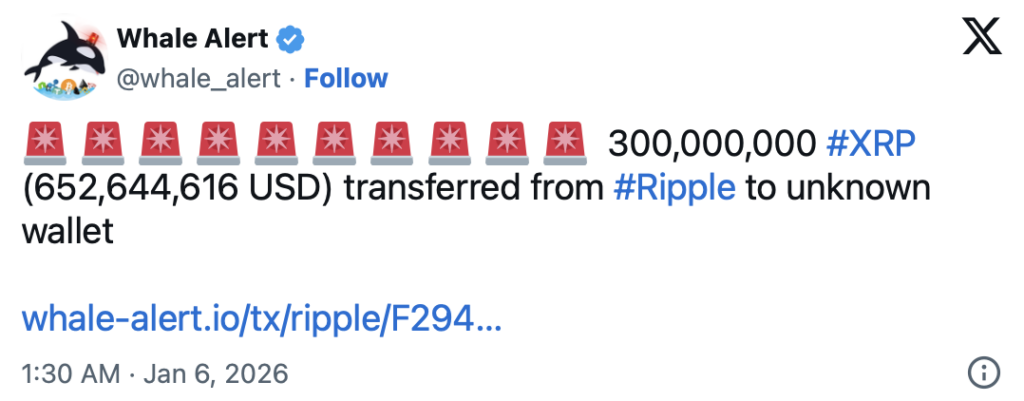

On January 5, 2026, on-chain trackers flagged an enormous XRP switch that instantly caught the market’s eye. Roughly 300 million XRP, valued at about $652 million on the time, moved from a identified Ripple-linked pockets to an deal with labeled as “unknown.” These sorts of whale-sized transactions at all times spark hypothesis, particularly after they contain Ripple itself.

Buyers shortly started asking acquainted questions. Is that this simply inside bookkeeping, or is Ripple making ready for one thing bigger behind the scenes. In crypto, measurement alone is sufficient to gasoline narratives, even earlier than the details are totally understood.

Breaking Down the 300 Million XRP Transaction

The switch came about at 17:29 UTC on January 5, with XRP buying and selling close to $2.18. The sending pockets was clearly tagged as Ripple-associated, pointing to company treasury or escrow-related management reasonably than a personal holder. The receiving deal with, in the meantime, lacked a public label in some monitoring methods, which led to the “unknown pockets” tag.

Regardless of the massive greenback worth, the mechanics have been very abnormal by XRPL requirements. The transaction settled in seconds, price a fraction of a cent in charges, and occurred throughout a broader crypto market upswing the place XRP itself was already up round 6% on the day. Context issues right here, and timing typically shapes notion greater than actuality.

The “Unknown Pockets” Isn’t as Mysterious as It Sounds

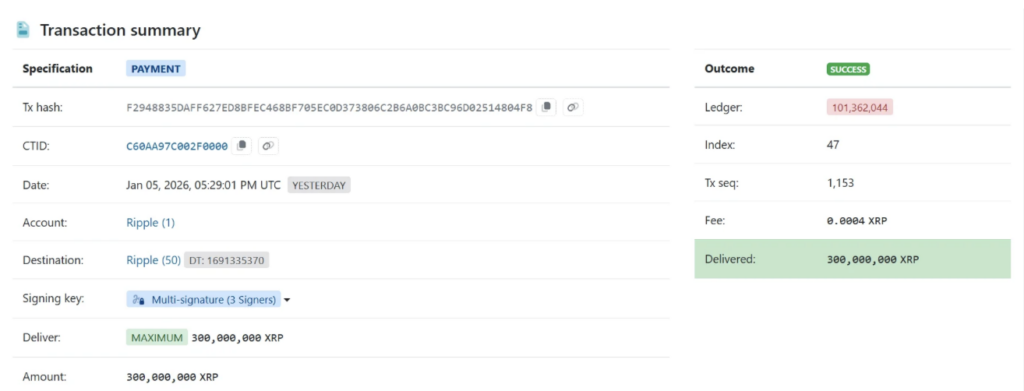

At first look, sending 300 million XRP to an unidentified deal with can really feel unsettling. In observe, “unknown” often simply means unlabeled, not exterior. XRP Ledger explorers equivalent to XRPScan later recognized the receiving pockets as “Ripple (50),” considered one of many inside addresses managed by the corporate.

This means the XRP by no means really left Ripple’s ecosystem. It was merely moved from one inside pockets to a different, probably for operational or accounting causes. Related conditions have performed out earlier than, together with a 200 million XRP switch in 2025 that originally raised eyebrows earlier than analysts confirmed it was an inside shuffle.

Can This Pockets Be Tracked Going Ahead

As a result of the XRP Ledger is totally public, the receiving deal with could be monitored over time. Analysts sometimes look ahead to indicators that funds are transferring towards identified change wallets, which might point out promoting or liquidity provisioning. As of the switch, no such change inflows have been noticed.

One other sign is fragmentation. If the 300 million XRP begins breaking into smaller transfers, it might level to distribution throughout companions or fee corridors. If it stays dormant, that often implies custody or treasury storage reasonably than energetic deployment.

Why Would Ripple Transfer 300 Million XRP

Ripple hasn’t commented immediately on this transaction, so any rationalization depends on historic patterns reasonably than affirmation. Probably the most easy rationalization is routine escrow and treasury administration. Ripple unlocks 1 billion XRP at the beginning of every month, then sometimes re-locks 70% to 80% again into escrow.

In January 2026, that very same sample performed out. Roughly 700 million XRP returned to escrow, leaving about 300 million obtainable for operational use. Shifting that quantity days later suits neatly with previous habits and doesn’t sign something uncommon by Ripple’s requirements.

Liquidity, Operations, or Easy Pockets Rotation

One other chance is operational liquidity. Ripple makes use of XRP for cross-border funds by means of its funds infrastructure, and funds are typically allotted to help liquidity in particular corridors. If that’s the case, parts of the XRP might later transfer towards change accounts tied to these companies.

There’s additionally a extra mundane rationalization. Giant holders periodically rotate funds between wallets for safety or administrative causes. Spreading property throughout a number of addresses reduces threat and simplifies inside administration. When this occurs, funds typically sit idle for prolonged intervals, which has been noticed in previous inside transfers.

Does a Whale Switch Like This Transfer XRP’s Worth

Regardless of the scale of the transaction, transfers like this don’t routinely push XRP’s value up or down. What issues is whether or not the XRP enters circulating provide by means of exchanges. On this case, no speedy promoting stress appeared, and XRP continued rising alongside the broader market.

Traditionally, Ripple has moved tons of of hundreds of thousands of XRP with out triggering sharp value reactions. Typically costs rise, typically they dip, and infrequently nothing occurs in any respect. The encompassing market surroundings often performs a a lot larger position than the switch itself.

What XRP Holders Might Need to Watch Subsequent

Going ahead, consideration will stay on the receiving pockets’s exercise. Trade inflows, fragmentation into smaller transfers, or disclosures in Ripple’s quarterly reviews might all present clues. Trade reserve knowledge and buying and selling quantity may even assist sign whether or not new provide is coming into the market.

As at all times, context is every little thing. In early 2026, crypto markets have been broadly trending increased, which tends to soak up provide extra simply. Understanding how Ripple manages escrow and treasury actions helps minimize by means of the noise when whale alerts hit social feeds.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.