- Solana is buying and selling above $137 after gaining greater than 7% over the previous week, supported by regular worth motion fairly than sharp spikes.

- Spot Solana ETFs recorded over $16 million in day by day inflows, pushing complete property above $1 billion and signaling rising institutional curiosity.

- Bullish on-chain information and enhancing technical indicators recommend SOL may goal $150, although assist close to $126 stays key if momentum fades.

Solana is entering into the brand new 12 months with noticeable energy. On the time of writing on Tuesday, SOL was buying and selling above the $137 stage, holding onto features after rising greater than 7% over the previous week. The transfer has come alongside enhancing sentiment throughout the broader market, however Solana seems to be benefiting from its personal set of tailwinds as nicely.

Value motion has remained comparatively regular fairly than euphoric, which many merchants see as a more healthy setup. As an alternative of sharp spikes, SOL has been grinding increased, suggesting demand is constructing fairly than fading rapidly.

Institutional Demand Quietly Accelerates

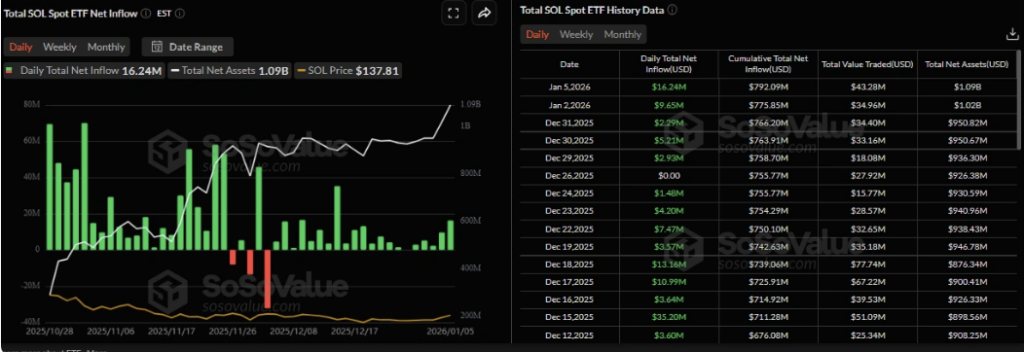

One of many largest drivers behind Solana’s latest energy is renewed institutional curiosity. Information from SoSoValue reveals that spot Solana ETFs recorded roughly $16.24 million in internet inflows on Monday, marking the strongest single-day influx since mid-December.

That push lifted complete internet property in Solana ETFs above the $1 billion mark this week. Whereas someday doesn’t outline a development, continued inflows at this tempo would sign that establishments are more and more snug allocating capital to SOL, not simply buying and selling it brief time period.

On-Chain Metrics Assist a Bullish Bias

On-chain information can also be leaning constructive. CryptoQuant’s abstract metrics level to buy-side dominance throughout each spot and futures markets, with giant whale orders showing alongside cooler market circumstances. In easy phrases, accumulation appears extra intentional than reactive.

In the meantime, DefiLlama information reveals Solana’s stablecoin provide recovering steadily since early January, now sitting round $15.32 billion. Rising stablecoin balances typically trace at rising on-chain exercise, as capital waits to be deployed into DeFi, buying and selling, or different purposes throughout the ecosystem.

Technical Construction Units Sights on $150

From a chart perspective, SOL has already cleared an necessary hurdle. Value broke above the higher trendline of a falling wedge sample on December 26 and rallied greater than 12% via Monday. That transfer additionally pushed Solana above its 50-day EMA, a stage that had beforehand acted as resistance.

If momentum holds, the subsequent technical goal sits close to $150, near the 100-day EMA. The RSI at present reads round 63, above impartial however not overheated, whereas the MACD continues to print rising inexperienced histogram bars. Collectively, these indicators recommend bullish momentum is constructing, although not but stretched.

Draw back Dangers Nonetheless Linger

Regardless of the enhancing setup, draw back eventualities can’t be ignored. A broader market pullback or a lack of momentum may ship SOL again towards its weekly assist close to $126.65. How worth behaves in that zone would possible decide whether or not this transfer is a pause or one thing extra significant.

For now, Solana’s mix of ETF inflows, supportive on-chain information, and enhancing technicals retains the short-term outlook tilted bullish, even when volatility makes a short return.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.