- XRP surged sharply on Jan. 6 earlier than pulling again close to $2.40 resistance.

- Regardless of the dip, XRP is up strongly throughout weekly and biweekly timeframes.

- ETF inflows and improved market construction maintain the medium-term outlook constructive.

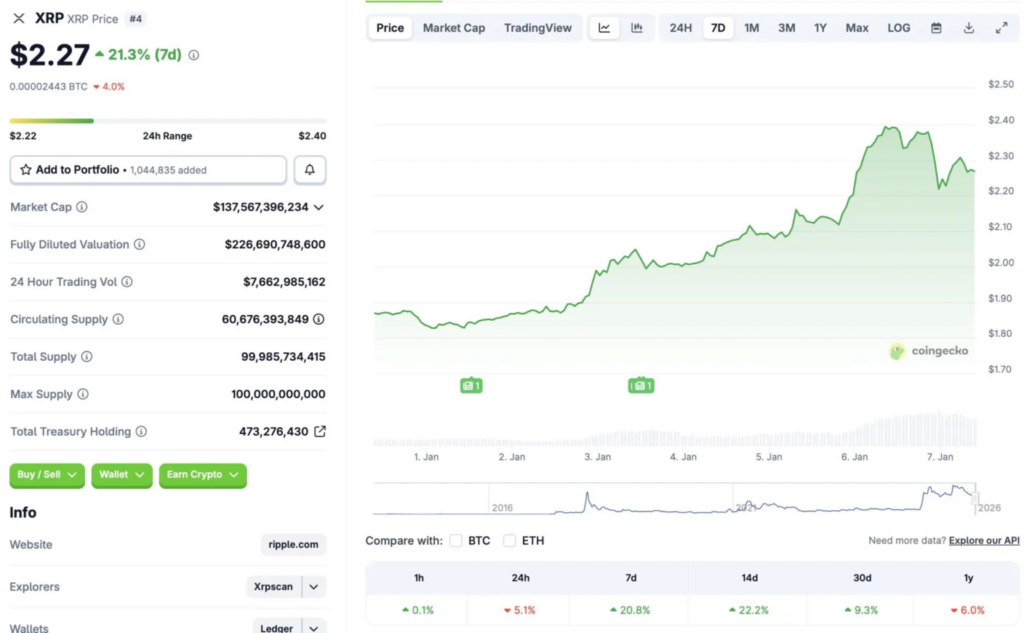

Ripple’s XRP delivered a strong breakout on January 6, 2026, earlier than cooling off with a pointy correction shortly after. In line with CoinGecko, the token is down 5.1% over the past 24 hours and about 6% for the reason that begin of the yr. Nonetheless, context issues. That single-day surge pushed XRP up greater than 20% on the weekly chart, over 22% throughout the previous 14 days, and roughly 9% on the month-to-month timeframe. After months of struggling beneath $2, XRP is now consolidating close to resistance round $2.40, a stage that will have felt out of attain not way back.

Momentum Has Shifted, Even If Value Is Pausing

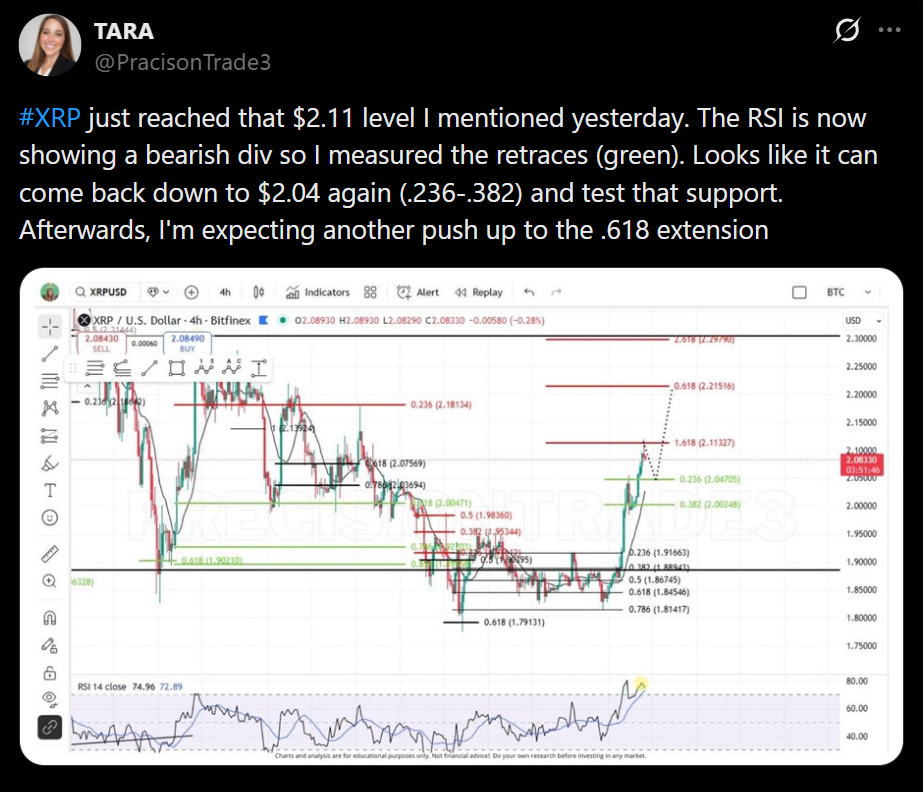

XRP’s broader setup appears to be like very totally different in comparison with late 2025. After spending months capped close to $1.90, the asset has lastly reclaimed increased floor, and pullbacks at these ranges look extra like digestion than rejection. Brief-term profit-taking following such a quick transfer is regular, particularly after a clear breakout. What issues extra is that XRP is not preventing to remain above $2 — it’s now testing increased zones as potential assist.

ETFs and Market Construction Are Doing the Heavy Lifting

The rally didn’t occur in isolation. XRP’s transfer got here alongside a broader crypto market resurgence, with Bitcoin pushing towards $93,000 earlier than easing barely. Extra importantly, ETF dynamics are again in focus. ETFs have been a serious driver of upside in 2025 for Bitcoin and Ethereum, and XRP’s rising presence in ETF merchandise might produce comparable results in 2026. Elevated inflows don’t at all times translate into straight-line worth motion, however they have an inclination to enhance the underlying construction over time.

Why the Pullback Doesn’t Invalidate the Bullish Case

The latest dip might replicate short-term profit-taking reasonably than fading conviction. Macroeconomic uncertainty remains to be pushing some capital towards conventional protected havens like gold and silver, however that doesn’t negate XRP’s enhancing setup. With the SEC lawsuit resolved, spot ETFs reside, and momentum returning to the broader market, XRP now appears to be like positioned for increased makes an attempt reasonably than one other extended vary. A interval of consolidation beneath $2.40 could possibly be the bottom wanted for the following leg increased, not an indication the transfer is over.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.