Bitcoin value motion via 2025 mirrored a delicate however significant shift in institutional habits. Whereas BTC remained the market anchor, giant traders regularly lowered publicity and rotated capital into choose altcoins.

This redistribution advised establishments favored spreading danger throughout a number of property. Nevertheless, the important thing query now could be what pushed establishments away from Bitcoin, and whether or not that pattern can persist into 2026, given BTC’s historic four-year cycle dynamics.

Sponsored

Sponsored

Establishments Choose Altcoins Over Bitcoin

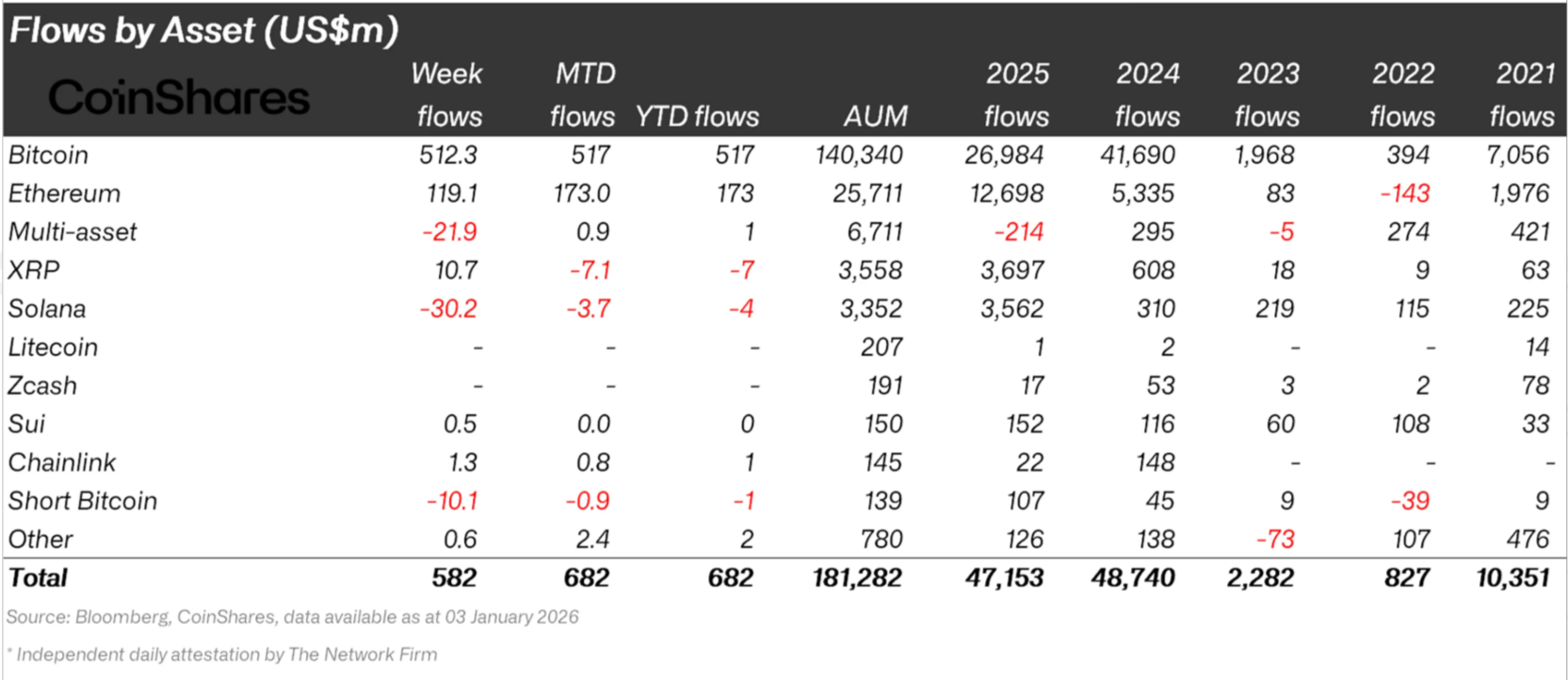

The establishments have closely divested from Bitcoin between January 2025 and December 2025 (yr 2025). CoinShares information reveals that in 2024, establishments poured about $41.69 billion into BTC (netflows). Apparently, in the identical period, altcoins suffered with Ethereum, XRP, and Solana, noting $5.3 billion, $608 million, and $310 million, respectively.

This modified within the yr 2025 when Bitcoin famous $26.98 billion inflows whereas ETH, XRP, and SOL recorded $12.69 billion, $3.69 billion, and $3.65 billion in inflows, respectively.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto Publication right here.

The shift from 2024 to 2025 marks a 31% drop in institutional curiosity for Bitcoin, whereas Ethereum famous a 137% enhance. Solana and XRP, then again, noticed a 500% and 1,066% rise in institutional curiosity.

This brings up the query of what precisely drove establishments to change to altcoins.

Sponsored

Sponsored

Was It DeFI? It Was Not DeFi

Decentralized finance ought to have been a core driver separating Bitcoin from main altcoin ecosystems. In observe, DeFi exercise stalled throughout 2025. Whole worth locked throughout DeFi protocols grew sharply in 2024, rising 121% from $52 billion to $115 billion. That enlargement created expectations for continued acceleration.

These expectations weren’t met. In 2025, DeFi TVL elevated by simply 1.73%, reaching $117 billion. Progress slowed dramatically regardless of new protocols and upgrades. This stagnation means that DeFi did not ship recent utility able to driving sustained institutional curiosity.

The information undermines the argument that DeFi fundamentals pushed establishments towards altcoins. If DeFi had been the catalyst, capital deployment would have adopted utilization development. As an alternative, exercise plateaued, indicating that one thing aside from on-chain utility influenced institutional allocation choices through the yr.

What Really Led To The Shift

Alternate-traded funds had been the first drive behind institutional rotation into altcoins. The shift, nonetheless, was pushed by narrative momentum relatively than measurable fundamentals. Altcoin ETFs gained approval amid claims that DeFi utility justified broader publicity, regardless of restricted development.

Sponsored

Sponsored

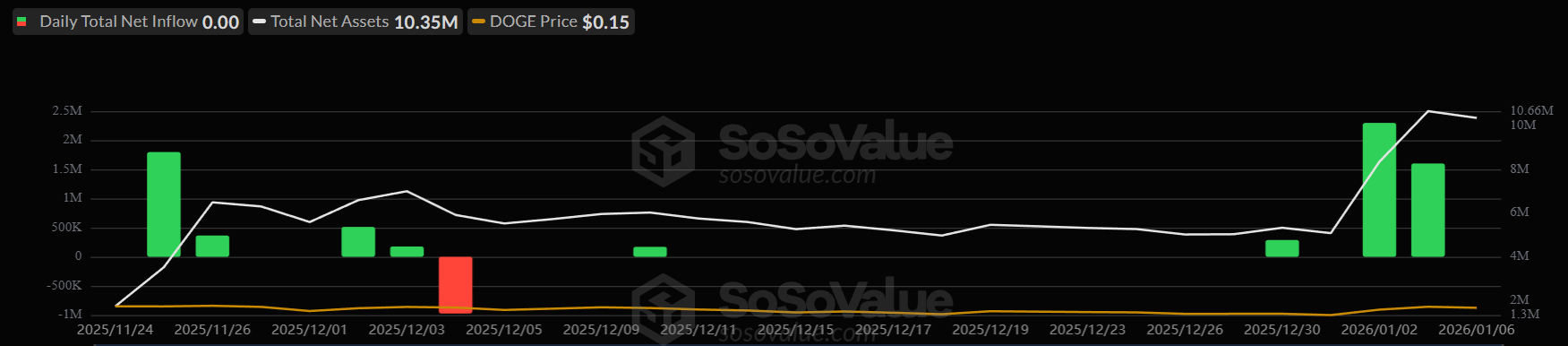

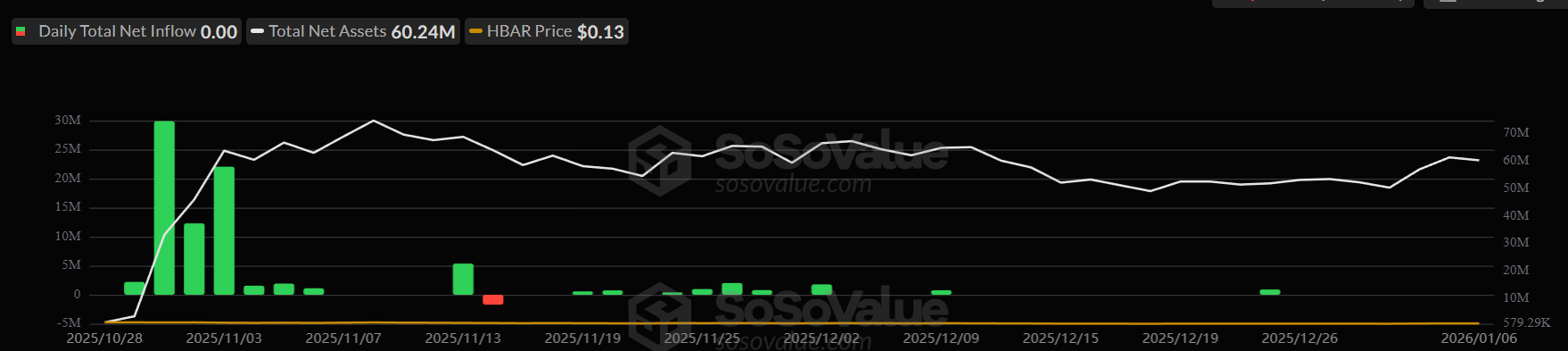

ETF launches for XRP, Solana, Dogecoin, and Hedera adopted rapidly. Preliminary enthusiasm fueled inflows, however demand pale for many merchandise. Outdoors of Solana and XRP, exercise remained muted. Dogecoin ETFs recorded near-zero internet inflows throughout most classes.

HBAR ETFs skilled related outcomes. Inflows had been minimal and sometimes nonexistent. These patterns recommend that institutional urge for food for altcoin ETFs lacked depth. The merchandise attracted consideration, however not sustained capital. This reinforces the view that hype, not utility, drove the shift away from Bitcoin.

Sponsored

Sponsored

What Does Bitcoin’s Previous Say About The Future?

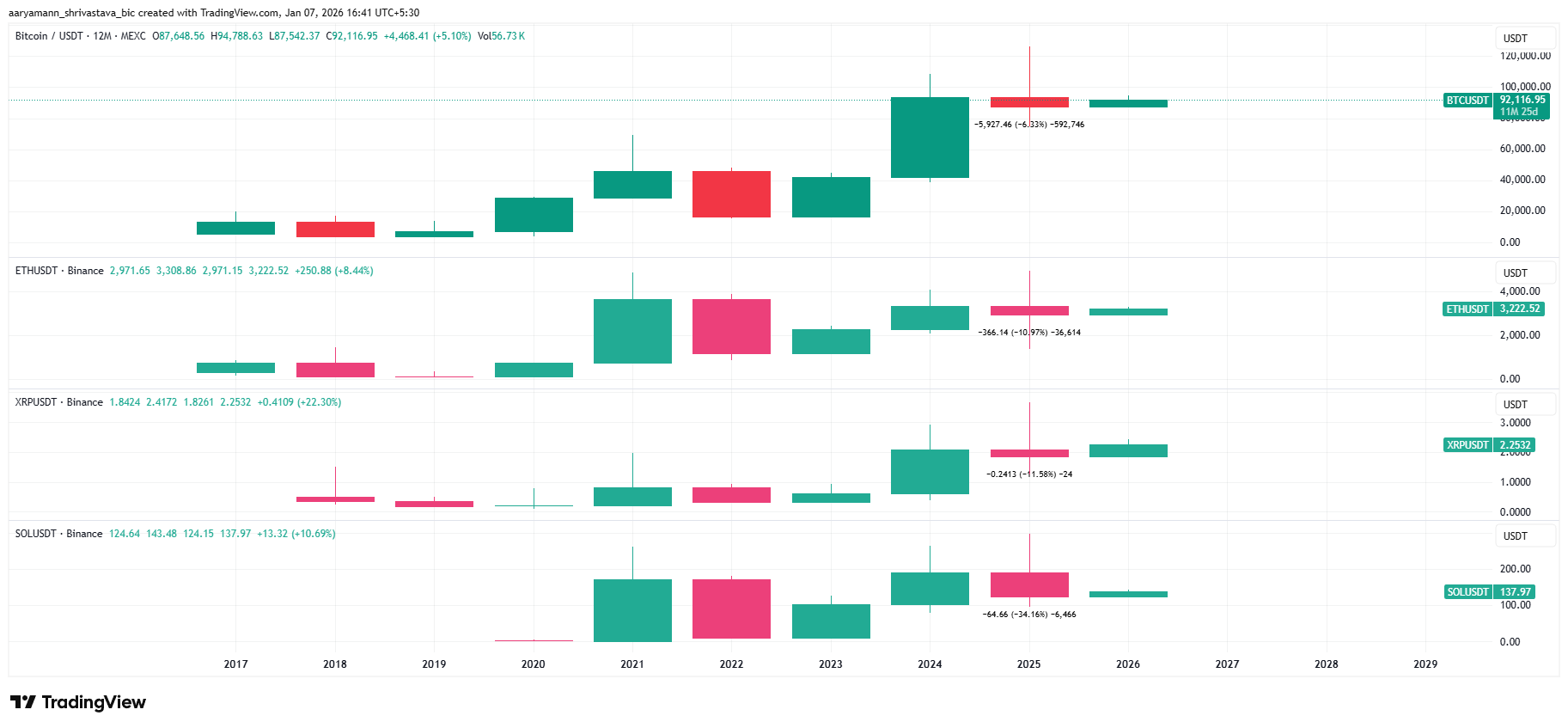

The optimism that outlined 2025 might face a pointy correction in 2026. Two structural components level towards a reassessment. The primary is an absence of utility/demand, and the second is Bitcoin’s four-year cycle. Traditionally, this cycle features a cooling part following peak enthusiasm.

Constancy’s director of worldwide macro, Jurrien Timmer, described 2026 as an “off yr” in December 2025. That evaluation aligns with prior cycles, the place consolidation or delicate bearishness adopted robust runs. Establishments typically cut back danger throughout such durations.

“…my concern is that Bitcoin might nicely have ended one other 4-year cycle halving part, each in value and time. If we visually line up all of the bull markets (inexperienced) we will see that the October excessive of $125k after 145 months of rallying suits fairly nicely with what one may anticipate. Bitcoin winters have lasted a couple of yr, so my sense is that 2026 may very well be a “yr off” (or “off yr”) for Bitcoin,” Timer acknowledged.

Value efficiency throughout property helps this view. Bitcoin value declined 6.3% in 2025. Ethereum fell 11%, XRP dropped 11.5%, and Solana slid 34%. The synchronized weak point reveals that altcoins didn’t outperform on fundamentals. Outdoors of ETF publicity, establishments had little incentive to favor altcoins over Bitcoin.

When Bitcoin enters consolidation, altcoins traditionally observe. The transition from 2021 to 2022 demonstrated this clearly. As BTC weakened, institutional capital retreated throughout the market (ref. Institutional Flows in 2025). An identical sample might emerge in 2026, decreasing urge for food for speculative diversification and refocusing consideration on liquidity and danger administration.

The institutional shift away from Bitcoin in 2025 seems much less structural than cyclical. ETF-driven narratives stuffed the hole left by slowing DeFi development, however demand proved shallow. As cycle dynamics reassert themselves, establishments might rethink whether or not altcoins really supply benefits over Bitcoin.