Be part of Our Telegram channel to remain updated on breaking information protection

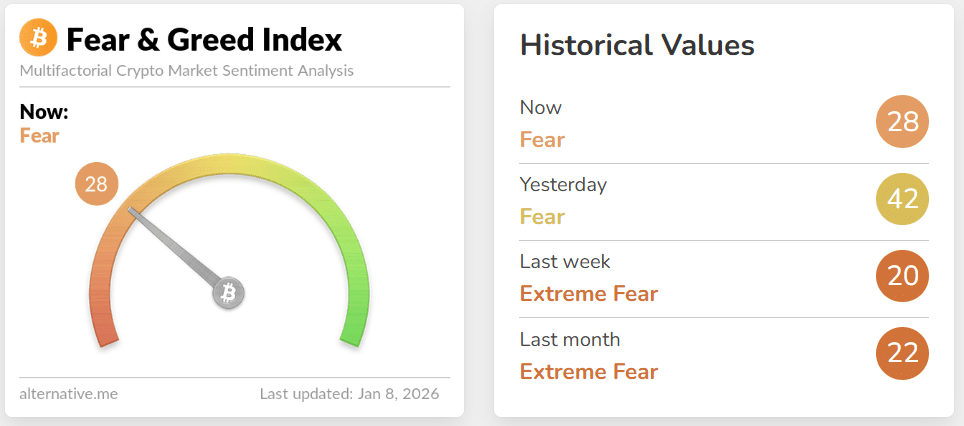

Bitcoin value pulled again during the last 24 hours to commerce at $90,430 as of 1:15 a.m. EST, because the crypto market took an enormous hit, dropping 2.5% to a market capitalization of $3.18 trillion, because the worry and greed index dropped again to worry.

Technical evaluation reveals Bitcoin’s value dropping again, albeit from a sustained surge initially of the 12 months that noticed the asset rise above $93,500.

Greed And Concern Index Drops To Concern As Bitcoin Sees Sturdy Promoting Stress

Based on CoinMarketCap information, the cryptocurrency market has dropped by 2.5% over the previous 24 hours, with Bitcoin nonetheless unable to maintain its surge above $93,000.

The Crypto Concern and Greed Index briefly moved towards impartial on Wednesday, however it has since slipped again into the “worry” zone, signaling weakening investor confidence and lowered danger urge for food.

On account of the drop, over 111k merchants had been liquidated, with complete liquidations totaling $364.56 million, based on CoinGlass information.

In the meantime, based on analyst Maartunn, Bitcoin’s Web Taker Quantity has hit -$19 million on the 25-hour MA, which signifies the strongest promoting strain since December 23.

Web Taker Quantity (25H MA) simply hit -$19M — the strongest promoting strain since Dec 23 🔻

Aggressive sellers are again in management. pic.twitter.com/4XWX1bTm5P

— Maartunn (@JA_Maartun) January 7, 2026

This indicators that sellers are again accountable for the short-term market. Web Take Quantity calculates the hole between market order purchase and promote volumes. Subsequently, a unfavorable studying displays aggressive promoting exercise.

In the meantime, information from Blockchain.com reveals that the 200-week shifting common stays under the BTC value, which helps a optimistic market narrative.

Bitcoin Worth Dangers Drop Beneath $89,000

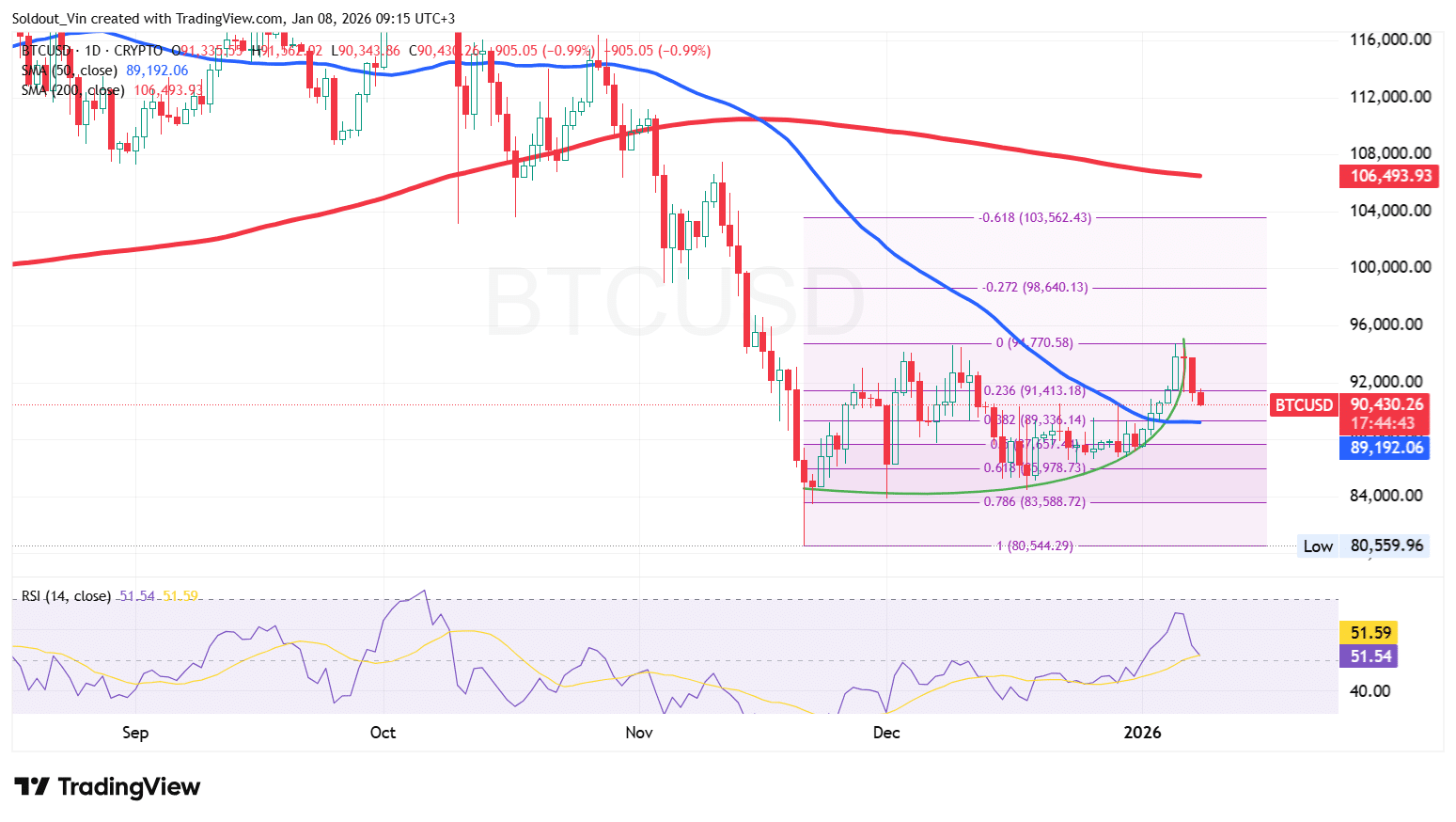

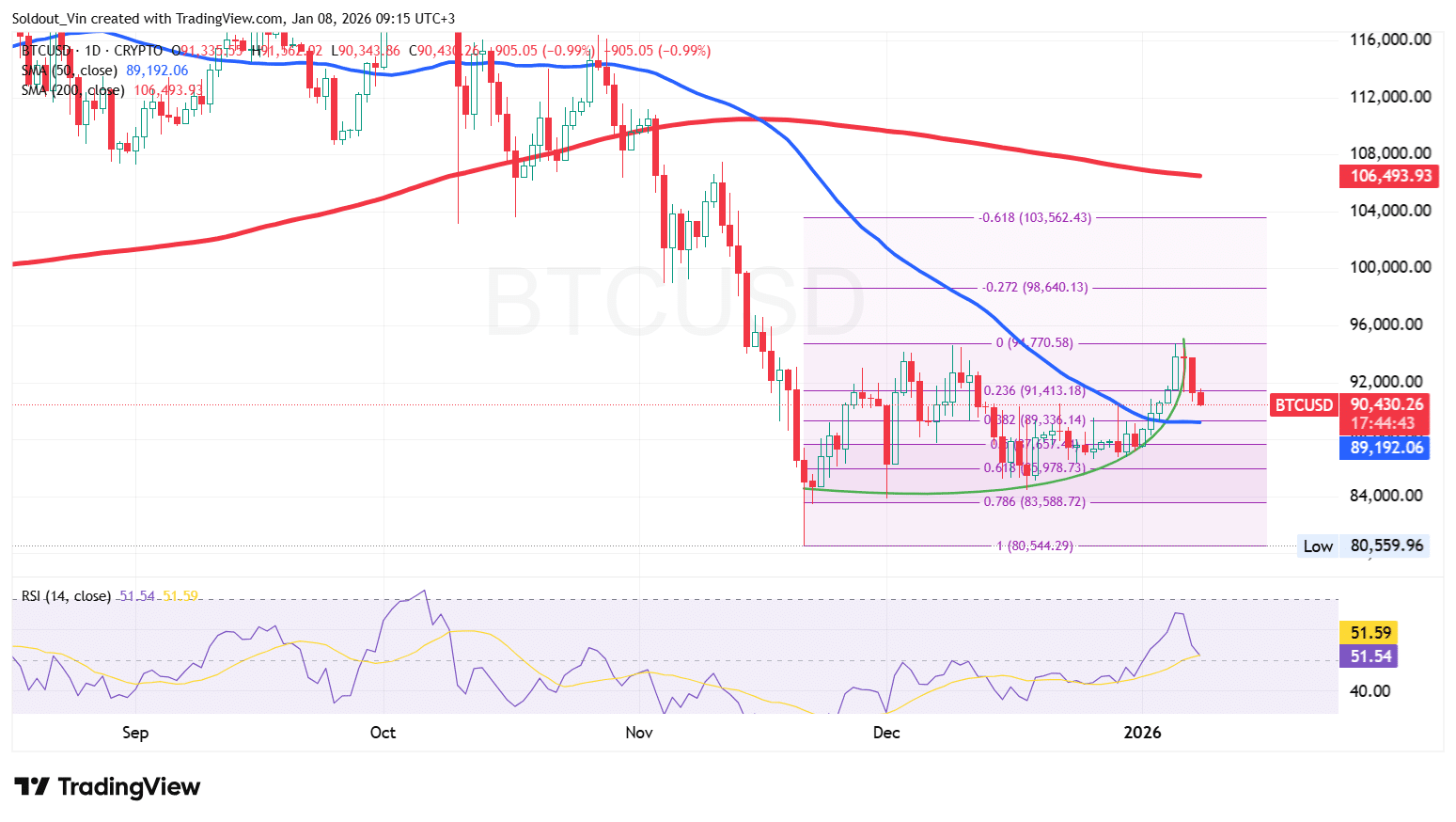

Bitcoin value is down 2% during the last 24 hours, because the crypto pulls again from the $93,500 space on the each day chart during the last 2 days.

As seen on the BTC/USD chart, the final two candles point out the BTC value is presently in a correction after a sustained surge.

Bitcoin nonetheless trades effectively above the 50-day Easy Transferring Common (SMA), indicating the value stays bullish within the quick time period.

In the meantime, the Bitcoin value is being supported by the important thing Fibonacci Retracement ranges at 0.382 ($89,336) and 0.5 ($87,657).

In the meantime, the Relative Power Index (RSI) is dropping from 66 to 51.54, indicating that sellers are stepping in or taking earnings after the new-year surge.

Primarily based on the BTC/USD chart evaluation on the each day timeframe, the BTC value may nonetheless drop again to the $89,192 (50-day SMA), however the stage is appearing as a robust help. This state of affairs reveals that buyers are being cautious with any slight transfer.

As merchants face indecision, Ali Martinez, a distinguished crypto analyst on X, says that any value route is dependent upon whether or not BTC closes under $88,000 or $94,000.

Bitcoin $BTC wants a each day shut exterior $88,000–$94,000 to verify pattern route. pic.twitter.com/T8ayEUCS8d

— Ali Charts (@alicharts) January 8, 2026

If the bearish strain continues, Bitcoin is prone to falling under the $89,000 stage, with the 0.5 and 0.618 Fib ranges appearing as rapid help at $87,657 and $85,978, respectively.

Nevertheless, if the 50-day SMA holds Bitcoin’s value, the asset may nonetheless surge in the long run, with $94,000 and $98,640 as the subsequent goal areas on the Fibonacci chart.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection