- Bitcoin fell under $90K, triggering over $100M in lengthy liquidations.

- U.S. spot Bitcoin ETFs recorded their largest day by day outflows since late November.

- On-chain demand stays muted, holding upside momentum in test.

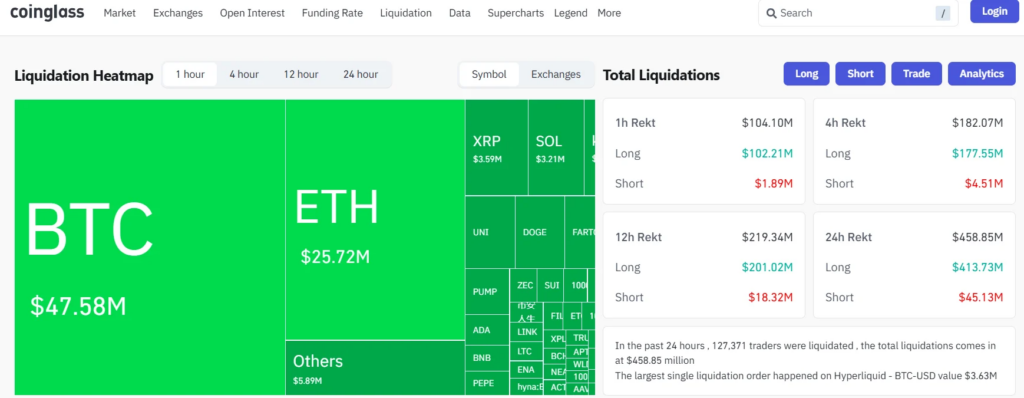

Bitcoin dropped under the $90,000 stage within the early hours of Thursday, triggering greater than $100 million in lengthy liquidations as leverage was flushed from the system. On the time of writing, BTC was hovering proper round $90,000, down roughly 3% over the previous 24 hours, in response to CoinGecko knowledge. The transfer caught many merchants offside, particularly after Bitcoin had briefly pushed towards $94,000 earlier within the week.

ETF Outflows Are Driving Brief-Time period Weak point

The pullback traces up carefully with a pointy reversal in ETF flows. Information from Farside Buyers reveals U.S. spot Bitcoin ETFs recorded $486 million in web redemptions on Wednesday, marking the biggest single-day outflow since November 20. Flows had already turned adverse on Tuesday, with $243 million exiting throughout that session, erasing a lot of the robust shopping for seen in the beginning of January. Bitcoin’s latest value motion has been shifting virtually lockstep with these move shifts.

Liquidations Accelerated the Transfer

As Bitcoin slipped beneath key ranges, leveraged lengthy positions absorbed the majority of the harm. Greater than $100 million in longs have been liquidated as value momentum flipped, amplifying the draw back transfer. Such a promoting strain tends to be mechanical somewhat than conviction-driven, however it could possibly nonetheless push value decrease within the quick time period whereas positioning resets.

On-Chain Demand Has But to Rebound

Regardless of ongoing debate about what initially fueled Bitcoin’s rally towards $94,000, some analysts stay cautious. CryptoQuant analyst Cauê Oliveira famous that on-chain demand has not but recovered in a significant approach. Present exercise ranges, whereas bettering barely, are nonetheless seen as inadequate to maintain a sustained push towards the $100,000 mark with out renewed spot demand.

The Larger Image Stays Unresolved

Some market contributors level to geopolitical developments, notably round Venezuela and potential impacts on oil costs, as a potential longer-term tailwind. Decrease vitality prices might ease inflation strain and cut back mining bills, making a extra supportive backdrop for Bitcoin over time. For now, nonetheless, ETF flows and leverage dynamics seem like setting the near-term tone.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.