- BlackRock moved roughly $360M in Bitcoin and Ethereum to Coinbase Prime.

- ETF flows flipped from robust inflows to sharp outflows in early January.

- The transfers possible mirror liquidity administration slightly than outright promoting.

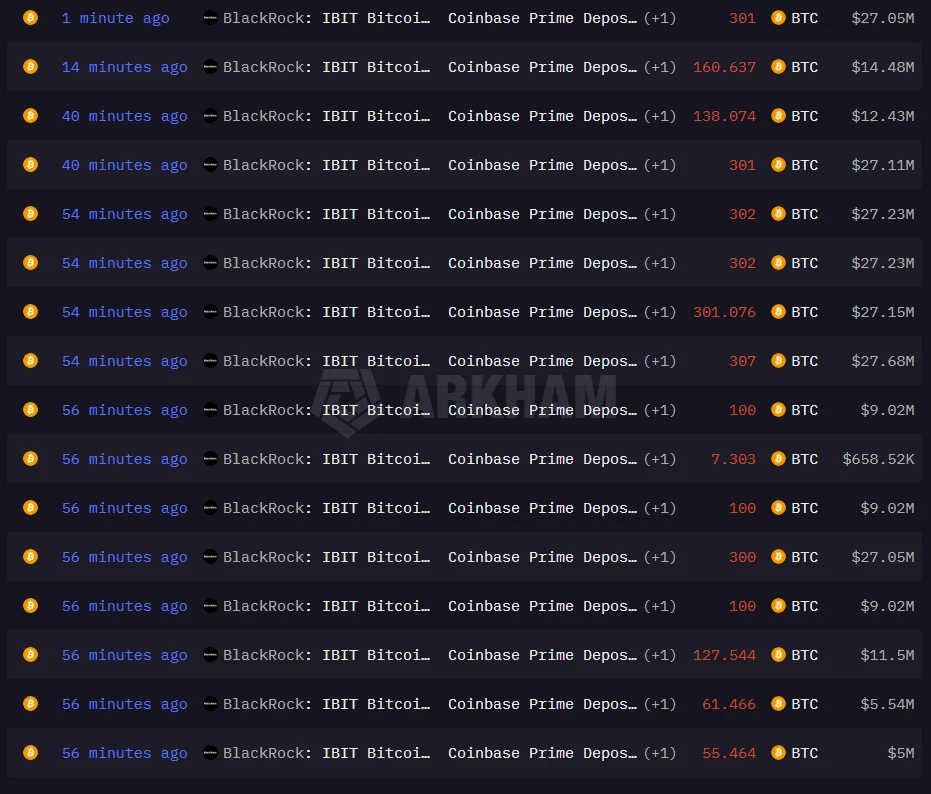

BlackRock shifted a large quantity of crypto to Coinbase Prime as we speak, transferring roughly 3,064 Bitcoin price about $276 million alongside 26,723 Ethereum valued at greater than $83 million, in accordance with Arkham Intelligence. Giant transfers like this have a tendency to seize consideration rapidly, particularly after they coincide with altering ETF circulate dynamics. The timing issues, not as a result of it ensures promoting, however as a result of it displays how establishments handle liquidity when sentiment begins to wobble.

ETF Momentum Flipped Quick in Early 2026

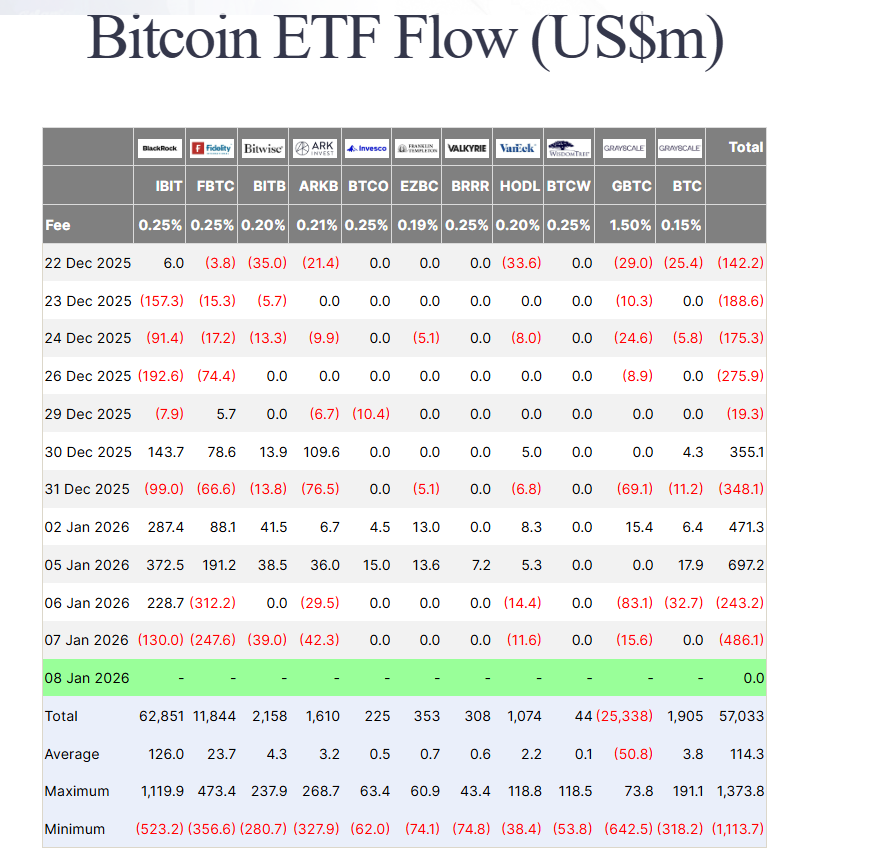

The transfers arrive after a pointy reversal in ETF flows in the course of the first week of the 12 months. Sturdy inflows on January 2 and January 5 gave solution to heavy redemptions on January 6 and January 7, in accordance with information from Farside Buyers. That swing pushed the general image into web outflow territory, reminding the market how rapidly institutional positioning can change as soon as momentum cools.

IBIT Redemptions Lead the Pullback

BlackRock’s personal Bitcoin ETF, IBIT, recorded $130 million in redemptions yesterday as U.S. spot Bitcoin ETFs collectively noticed $486 million in web outflows. That marked the biggest single-day drawdown since late November. Bitcoin funds bore the brunt of the stress, however the Ethereum switch suggests portfolio-level rebalancing slightly than a single-asset choice.

What These Transfers Doubtless Characterize

Sending belongings to Coinbase Prime doesn’t routinely imply liquidation. For establishments, it’s usually about flexibility — getting ready for redemptions, facilitating settlement, or managing short-term liquidity throughout risky circulate durations. With ETF sentiment flipping rapidly, these strikes look extra like danger administration than a directional wager towards crypto.

Why This Doesn’t Break the Greater Pattern

Quick-term ETF volatility can create noise, nevertheless it doesn’t erase the structural function these merchandise now play. Establishments rebalance continuously, particularly in the course of the early weeks of the 12 months. What issues extra is whether or not sustained promoting follows or if flows stabilize as soon as the preliminary repositioning passes. For now, this seems to be like adjustment, not an abandonment.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.