Briefly

- Bitcoin hovers close to $90,600 after failing to interrupt above $94,000, caught in loss of life cross territory regardless of a short ETF-fueled spike.

- Whole crypto market cap sits at $3.06 trillion, down 1.14% with bearish technical indicators suggesting additional draw back forward.

- Prediction markets stay resiliently bullish, with merchants giving a brand new “Crypto Winter” solely a 4.9% probability.

That temporary spike of hope within the crypto market? In all probability gone. Bitcoin’s buying and selling round $90,600 after a fast journey above $93,000 earlier this week, and the broader crypto market’s feeling the nippiness. The entire market cap sits at $3.06 trillion—down about $35 billion, or 1.14%—and a fast scan of the highest 100 cash exhibits 80% are underperforming immediately. A lot for that New Yr’s decision rally.

The macro image is not precisely screaming “purchase every part.” Conventional markets are exhibiting cracks. The S&P 500 simply wrapped up its third consecutive yr of beneficial properties above 14%, however analysts are warning that the AI-fueled social gathering could be working out of champagne. Gold, in the meantime, is flexing onerous—up over 60% in 2025 and pushing towards $4,500 per ounce as buyers hunt for protected havens amid geopolitical tensions and questions on AI spending sustainability.

Your entire crypto market can also be again in bearish territory at $3 trillion of whole capitalization. It could want to carry over the $3.2 trillion mark to get merchants speaking a couple of normal market restoration once more.

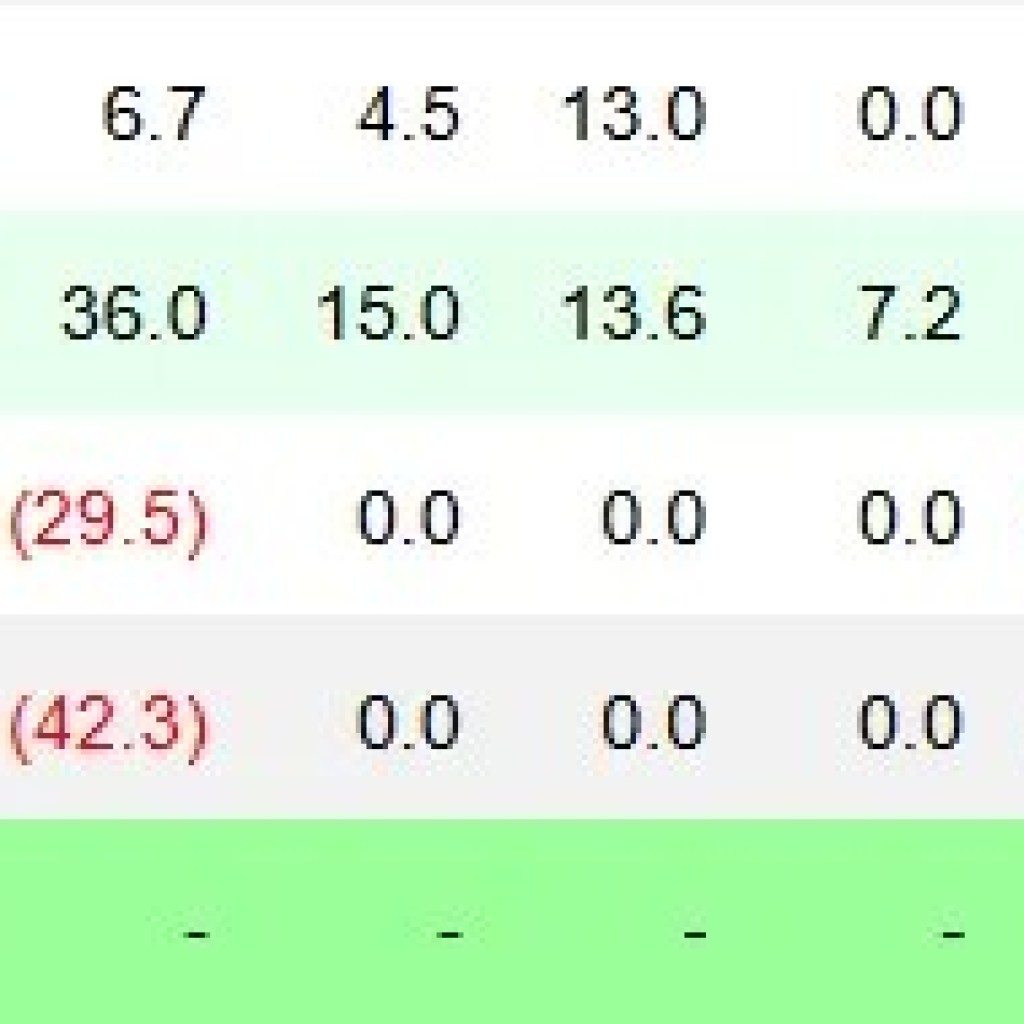

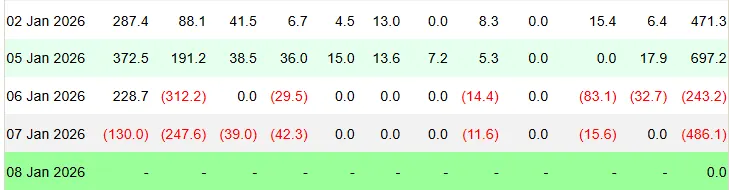

However for crypto the priority is not nearly weak worth motion. It’s what occurs when institutional cash will get skittish. Bitcoin ETFs, funding funds that observe the spot worth of BTC, noticed $1.2 billion circulate in throughout the first two buying and selling days of 2026—the biggest single-day influx since October at $697 million—however then instantly hit the brakes with $243 million in outflows on day three and $476 million flowing out yesterday.

That sort of whiplash suggests the institutional bid is again, nevertheless it’s fragile.

What Bitcoin offers, Bitcoin takes

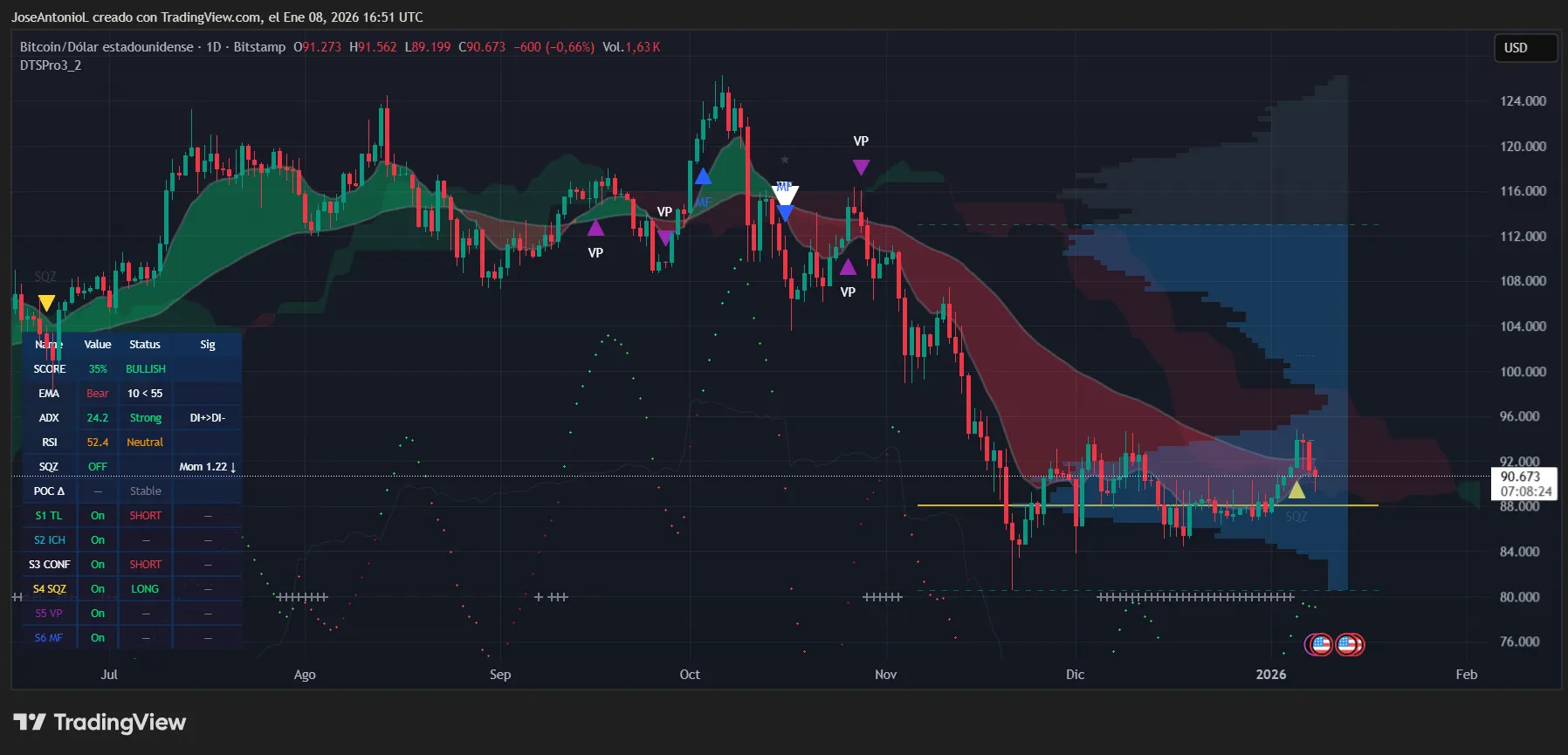

Bitcoin’s technical setup tells the identical story. The value is at the moment buying and selling at $90,673, down about 0.66% on the day, but nonetheless up 3% within the final seven days after a significant spike earlier this week that took costs out of the loss of life cross space for a day.

The loss of life cross—when the 50-day exponential shifting common, or EMA, crosses beneath the 200-day EMA—stays in place, a sample that sometimes alerts merchants to anticipate extra draw back or extended sideways motion. With costs now beneath each averages, the hole is about to widen once more, making that coveted golden cross—the alternative of a loss of life cross—more durable to look.

The hole may be very slim proper now, so there seems to be an excellent battle between bulls and bears making an attempt to set the course for the subsequent few months. With such a small hole, even when costs stay bearish, the tempo must be slower now than it was months in the past, again when Bitcoin started its slide from an all-time excessive above $126,000.

The Common Directional Index, or ADX, sits at 24.2, just under the 25 threshold that confirms a robust development. ADX measures development power on worth charts no matter course on a scale from 0 to 100, with readings above 25 usually telling merchants there’s a robust development in place. After the spike earlier this week, Bitcoin’s ADX tanked. However now, its ADX is creeping increased, which might imply the present bearish development is getting a little bit of steam once more.

The Relative Energy Index, or RSI, reads 52.4, inserting Bitcoin squarely in impartial territory. RSI tracks momentum on a scale from 0 to 100, with readings above 70 thought-about overbought and beneath 30 oversold. At 52, Bitcoin is not giving off any excessive alerts in both course. Merchants see this as a market caught in limbo—not sizzling sufficient to chase, not chilly sufficient to panic-sell.

Assist is holding across the $88,000-$90,000 zone, the place Bitcoin’s discovered patrons throughout latest dips. If that stage breaks, the subsequent main ground sits nearer to $80,000—a stage that Bernstein analysts known as the underside again in late November. On the upside, resistance clusters round $94,000-$97,000. The value briefly kissed $94,000 this week however could not maintain it, and that stage now acts as a psychological barrier that bulls have to reclaim earlier than anybody begins speaking about new highs.

That stated, sentiment on prediction markets stays comparatively bullish, and these merchants aren’t shopping for the doom narrative.

On Myriad, a prediction market developed by Decrypt’s mum or dad firm Dastan, merchants say there’s solely a 4.9% probability now of a brand new “Crypto Winter” in 2026.

Myriad merchants look like eyeing a market restoration, although not essentially a significant bullish run. The chances on Myriad for a brand new Bitcoin all-time excessive earlier than July sit at simply 20%.

The charts are bearish, the technicals are weak, and but the good cash on prediction markets is not screaming panic. So what offers?

The reply may lie in time horizons. Brief-term technicals recommend extra chop or draw back forward, however longer-term structural elements—like institutional adoption, spot ETF flows, and macroeconomic tailwinds from potential Federal Reserve charge cuts—maintain the bull case alive. Fundstrat’s Tom Lee expects a pullback within the first half of 2026 earlier than a rally within the second half, with a year-end goal of $115,000.

If that performs out, it will break the historic sample, since 2026 would usually line up as a crypto winter yr underneath the same old cycle of 1 main crash following three bullish years.

For now, although, bulls have to see Bitcoin reclaim $94,000 with conviction—ideally with rising ADX above 25 to verify momentum. Till that occurs, anticipate extra sideways grind with occasional dips that check the $88,000-$89,000 help. The loss of life cross does not assure catastrophe, nevertheless it does imply the straightforward cash’s been made. What comes subsequent relies on whether or not establishments maintain exhibiting up—or in the event that they determine to sit down this one out.

Disclaimer

The views and opinions expressed by the creator are for informational functions solely and don’t represent monetary, funding, or different recommendation.

Each day Debrief E-newsletter

Begin each day with the highest information tales proper now, plus unique options, a podcast, movies and extra.