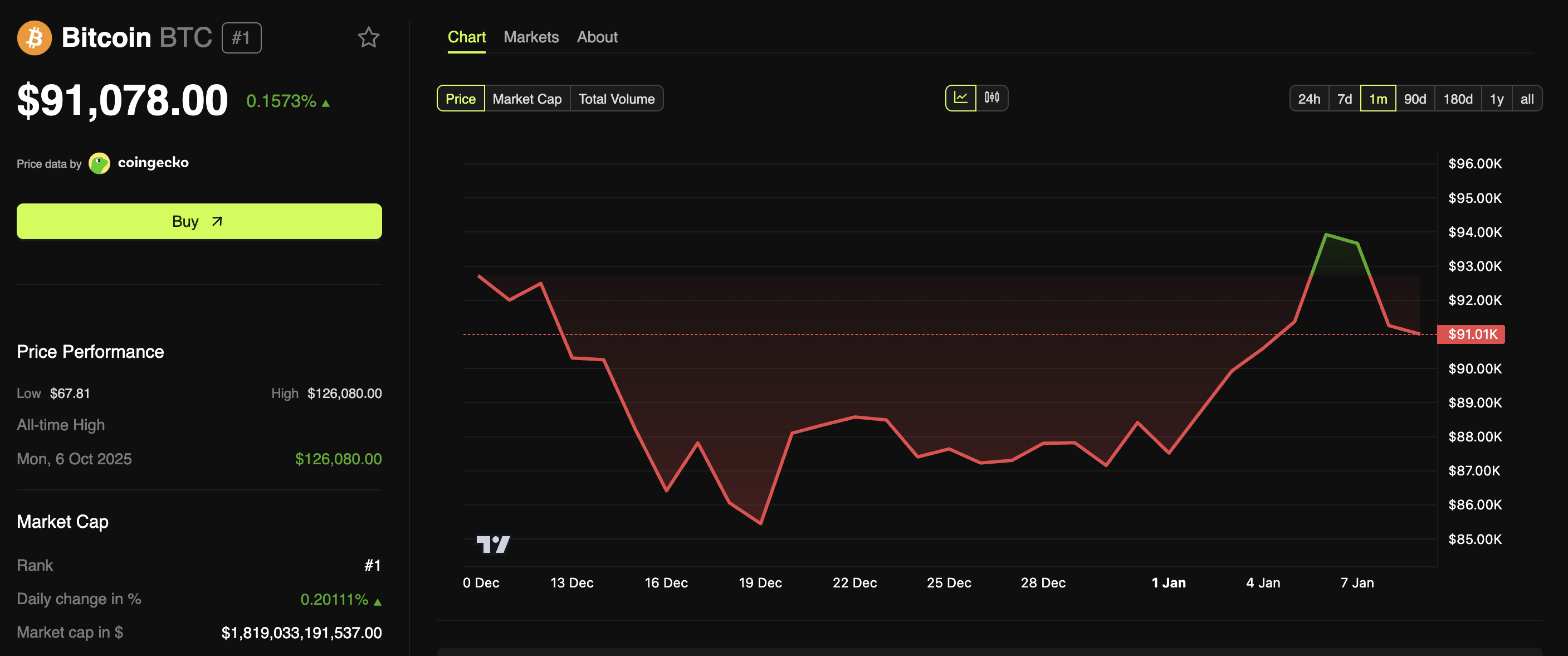

Bitcoin (BTC) is experiencing a risky January. The coin climbed to an almost four-week excessive earlier this week earlier than briefly slipping beneath $90,000 yesterday.

Amid these fluctuations, analysts are pointing to a number of key alerts that would point out the potential for an upcoming brief squeeze.

Sponsored

Bitcoin Derivatives Information Factors to Rising Brief Squeeze Threat

In response to BeInCrypto Markets information, the biggest cryptocurrency continued to publish inexperienced candles for the primary 5 days of January. The worth surged over $95,000 on Monday, a stage final seen in early December, earlier than reversing course.

On January 8, BTC briefly dropped beneath $90,000, reaching a low of $89,253 on Binance. On the time of writing, Bitcoin was buying and selling at $91,078, representing a 0.157% improve over the previous day.

Wanting forward, three key alerts are suggesting that market circumstances could also be aligning for a possible brief squeeze in Bitcoin’s value. For context, a brief squeeze happens when costs transfer increased towards bearish positions.

Leverage amplifies the stress, as merchants face compelled liquidations and have to purchase Bitcoin, which propels costs additional upward. This shopping for can shortly cascade throughout the market.

Sponsored

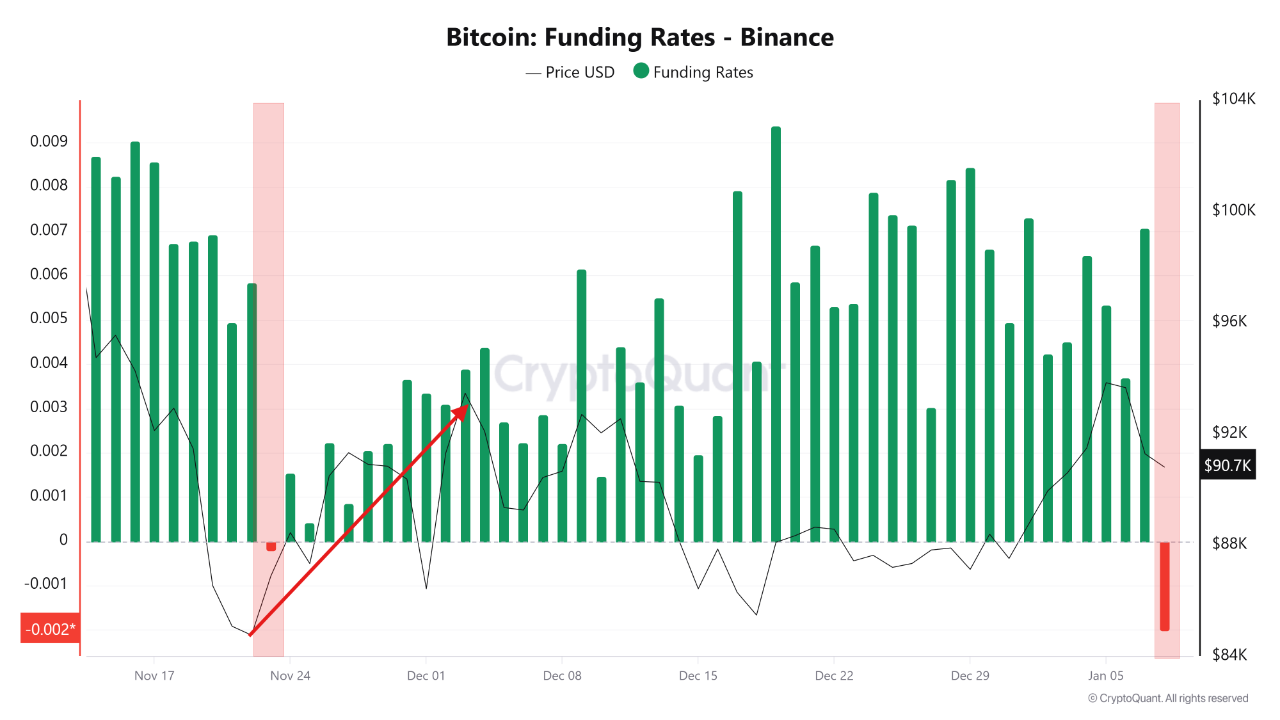

1. Detrimental Funding Price Displays Bearish Sentiment

The primary signal comes from Binance’s Bitcoin funding fee. In a current evaluation, Burak Kesmeci highlighted that the funding charges have flipped unfavourable on the day by day chart for the primary time since November 23, 2025.

This determine tracks the fee to take care of perpetual futures positions. When the funding fee is unfavourable, brief positions dominate, and brief sellers pay funding charges to lengthy place holders to take care of their positions.

The present funding fee stands at -0.002, which is considerably deeper than the -0.0002 recorded throughout the earlier unfavourable interval in November. That earlier shift got here earlier than a rally by which Bitcoin climbed from $86,000 to $93,000. January’s extra pronounced unfavourable fee alerts even stronger bearish sentiment amongst derivatives merchants.

“Funding is extra deeply unfavourable, whereas value stays beneath stress. This mixture will increase the chance of a a lot stronger brief squeeze. A pointy upside bounce in Bitcoin wouldn’t be stunning right here,” Kesmeci wrote.

Sponsored

2. Open Curiosity Climbs as Bitcoin Worth Drops

Secondly, one other analyst famous that Bitcoin’s value has been trending decrease. On the similar time, Open Curiosity continues to rise, a mix that the analyst interpreted as an indication of a possible brief squeeze.

“It is a textbook signal of an incoming Brief Squeeze!,” the publish learn.

Open curiosity displays the variety of excellent by-product contracts. When it will increase as costs fall, it usually suggests new positions are being opened within the path of the transfer, typically indicating rising brief publicity reasonably than longs closing.

This will create uneven danger, as a crowded brief positioning might depart the market weak to speedy liquidations if costs rebound.

Sponsored

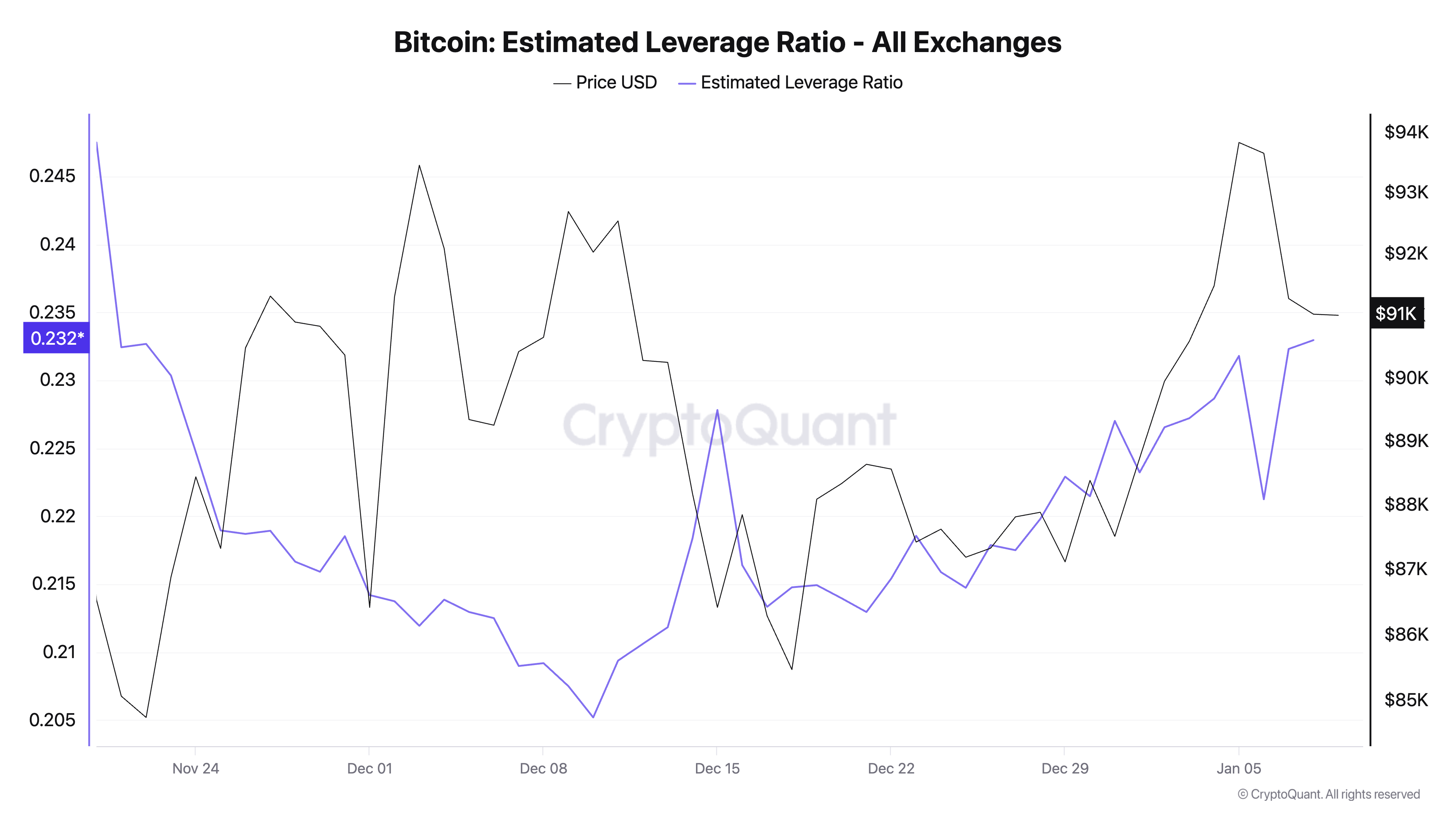

3. Excessive Leverage Provides to Liquidation Dangers

Lastly, Bitcoin’s Estimated Leverage Ratio has moved to a one-month excessive, in keeping with CryptoQuant metrics. This measure tracks the extent of borrowed capital in merchants’ positions. Excessive leverage magnifies each potential earnings and losses, so even small value strikes can set off broad liquidations.

Merchants utilizing 10x leverage, for instance, may be liquidated if Bitcoin strikes simply 10% the incorrect means. The present ratio signifies that many available in the market have elevated their danger, wagering on continued draw back momentum. Excessive leverage is dangerous if Bitcoin’s value abruptly bounces.

With these three indicators converging, Bitcoin could also be more and more weak to a pointy upside transfer if value rebounds set off cascading liquidations amongst overleveraged brief positions.

Nevertheless, whether or not a brief squeeze really materializes will rely upon broader market catalysts, together with macroeconomic developments, spot market demand, and general danger sentiment. And not using a decisive bullish set off, bearish positioning may persist, delaying or weakening any potential squeeze.