The bitcoin value was buying and selling close to the $90,000 mark on Friday as crypto markets steadied following a delay from the U.S. Supreme Courtroom on a intently watched ruling tied to President Donald Trump’s tariff coverage, quickly easing near-term macro uncertainty.

The worth of bitcoin stood at $90,443 on the time of writing, down about 1% over the previous 24 hours, in response to market knowledge. Each day buying and selling quantity totaled roughly $45 billion, whereas bitcoin’s whole market capitalization slipped to roughly $1.80 trillion, additionally down 1% on the day.

Regardless of the modest pullback, the bitcoin value stays tightly rangebound close to latest highs. The asset is at present about 2% under its seven-day excessive of $91,839 and roughly 1% above its seven-day low of $89,671, per Bitcoin Journal Professional knowledge.

Bitcoin’s circulating provide now stands at 19,973,659 BTC, inching nearer to its mounted cap of 21 million cash — a structural characteristic that continues to underpin long-term bullish narratives.

Tariff uncertainty weighs, then lifts the bitcoin value

Crypto costs initially wavered this week as merchants positioned forward of a possible Supreme Courtroom resolution on the legality of Trump-era international tariffs, extensively considered as a serious macro catalyst.

Nonetheless, markets moved greater on Friday after the court docket delayed its ruling till subsequent week, decreasing instant draw back threat throughout equities, bonds, and digital property.

The bitcoin value hovered round $90,000 close to the U.S. fairness market open as buyers reassessed threat publicity.

Analysts stated the delay eased issues about abrupt fiscal disruptions, together with the chance that the U.S. Treasury could possibly be compelled to refund greater than $130 billion to importers if the tariffs have been struck down.

Bitcoin has more and more traded as a macro-sensitive asset, reacting to shifts in coverage expectations, liquidity circumstances, and geopolitical uncertainty.

Consequently, main authorized or political developments proceed to affect short-term value motion, whilst long-term adoption tendencies stay intact.

Bitcoin value in consolidation following early-year rally

The present value displays a cooling interval after the bitcoin value surged within the opening days of the yr, briefly pushing towards new short-term highs.

That early-January rally reignited bullish sentiment but additionally triggered profit-taking as momentum light close to resistance.

Technically, merchants are watching the $90,000–$91,000 zone as a key help space. A sustained break decrease might expose draw back towards the high-$80,000 vary, whereas a transfer again above $92,000 would seemingly reopen the trail towards greater resistance ranges.

For now, bitcoin stays locked in consolidation, with volatility compressed and merchants awaiting a clearer catalyst.

Will the USA purchase Bitcoin?

Cathie Wooden of ARK Make investments stated in a podcast just lately that politics might drive the U.S. to actively purchase bitcoin in 2026. Wooden argues that crypto has develop into a sturdy political concern for President Trump, probably shaping coverage forward of the midterm elections.

Whereas the U.S. at present holds a bitcoin reserve made up of seized property, Trump has pledged to not promote any of the bitcoin, and the unique purpose was to amass a million BTC.

Wooden urged in her dialog that the administration might transfer from holding solely confiscated bitcoin to buying BTC outright for a nationwide strategic reserve.

Crypto has additionally emerged as a extra organized political constituency, supporting Trump and fascinating with the White Home by occasions and donations. On the coverage facet, govt orders have established the reserve and stockpile, with suggestions for Treasury-led growth.

Wooden sees authorities purchases as a possible market inflection level, reinforcing bitcoin’s shortage as practically 20 million of its 21 million cap have already been mined. If the USA would begin shopping for bitcoin, its secure to imagine that the bitcoin value would react positively.

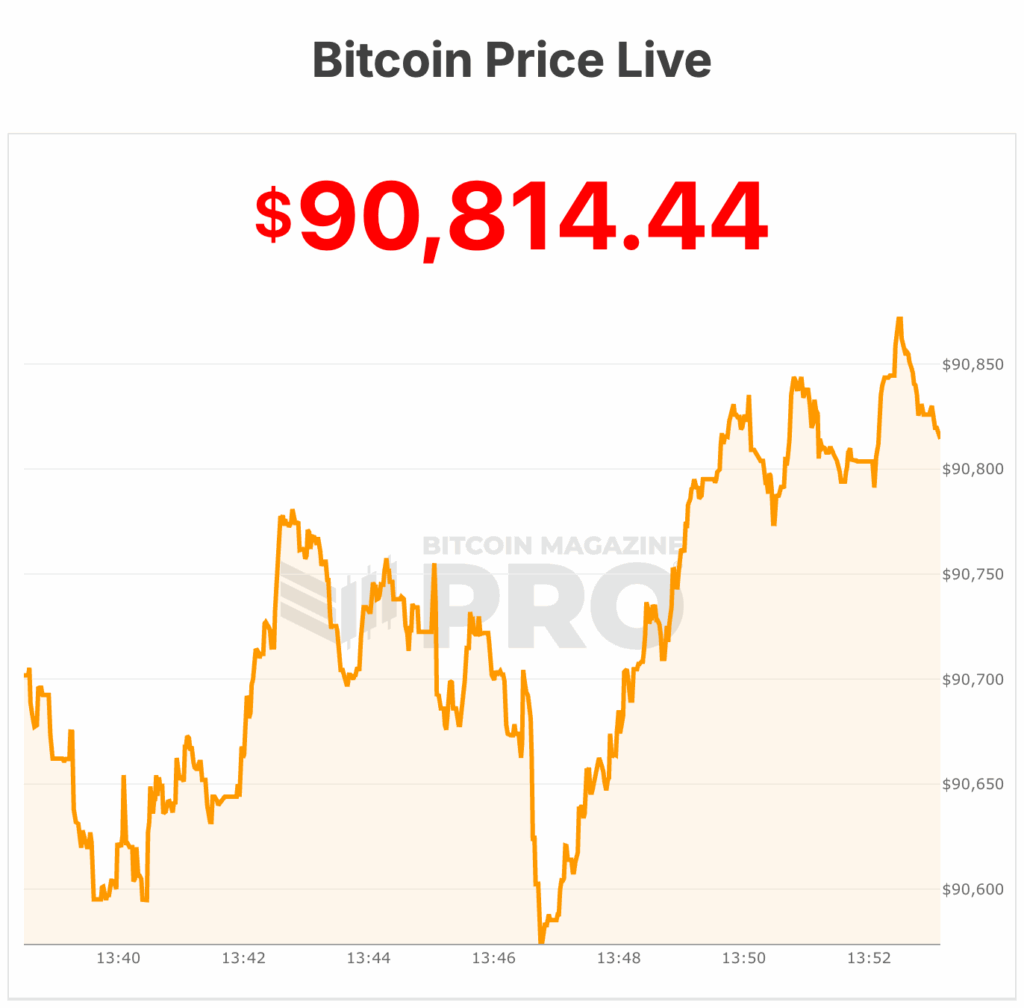

On the time of writing, the bitcoin value is $90,814.