- Ethereum’s efficiency is more and more seen as crucial for the survival of the broader altcoin market

- Technical analysts level to RSI buildings that beforehand led to main ETH rallies

- Brief-term forecasts stay modest, at the same time as long-term targets stretch a lot greater

Ethereum and Bitcoin have each been caught in a uneven stretch recently, shifting up, pulling again, then repeating the cycle as recent macro headlines hold shaking sentiment. Neither asset has been capable of maintain momentum for lengthy, and that’s made merchants cautious, if not outright impatient. The query hanging over the market now could be whether or not Ethereum can discover its footing earlier than January 2025 wraps up, or if this drift continues a bit longer.

On the time of writing, ETH is buying and selling round $3,116, down about 1% over the previous 24 hours. It retains trying to climb, however every push greater appears to run into resistance tied to shifting financial expectations. That uncertainty is bleeding into the broader altcoin market too, whether or not folks prefer it or not.

Why Ethereum’s Efficiency Issues for Alts

Based on Ash Crypto, Ethereum’s long-term efficiency often is the deciding issue for the remainder of the altcoin area. His view is blunt. If ETH fails to print a brand new all-time excessive in 2026, the case for holding most altcoins weakens considerably. In that situation, endurance stops being rewarded.

He factors out the uncomfortable comparability with Bitcoin. BTC managed a clear 2x from its 2021 peak, whereas Ethereum lagged behind, even from cycle lows. That’s regardless of Ethereum having deep institutional adoption, strong tokenomics, dominance in DeFi and real-world property, and now spot ETFs. If ETH underperforms with all of that going for it, he argues, smaller and newer altcoins received’t stand an opportunity.

Technical Alerts Trace at a Shift

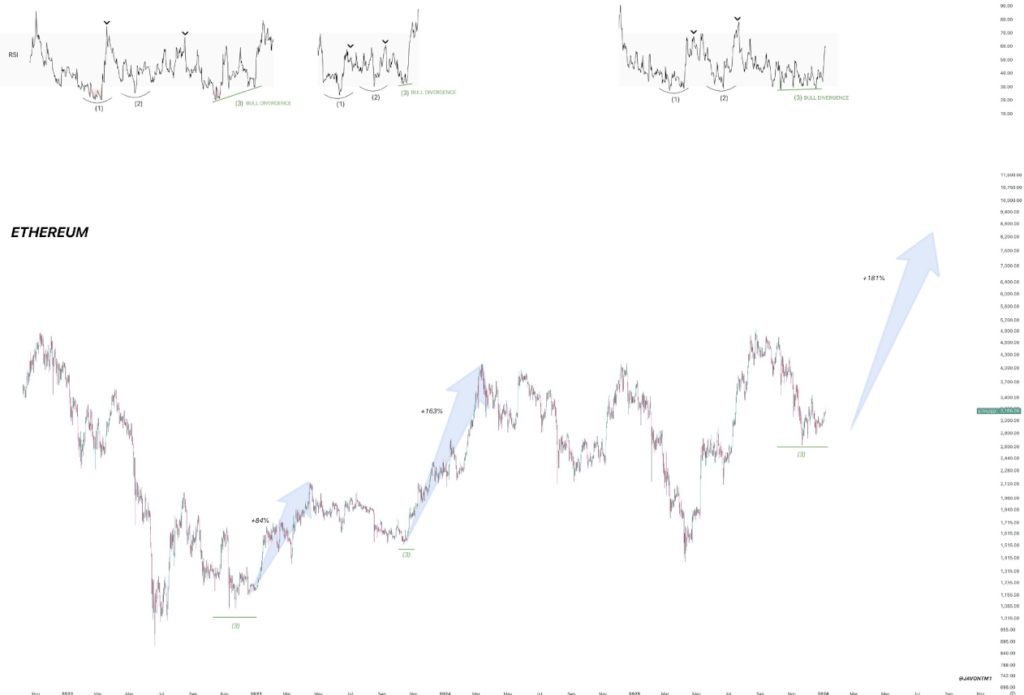

Not everybody shares that pessimism. Analyst Javon Marks believes Ethereum could also be organising for one thing a lot bigger. He’s centered on a particular RSI construction that, traditionally, has preceded robust ETH rallies. In previous situations, related setups led to common positive factors north of 120%, and generally extra.

Marks means that the current energy in Ethereum may simply be the opening act. If this RSI sample continues to unfold the way in which it has earlier than, ETH might reclaim misplaced floor quicker than many count on, with altcoins tagging alongside for the trip. It’s not a assure, however it’s sufficient to maintain bulls engaged.

How Excessive May ETH Go From Right here

Trying additional out, Marks believes Ethereum may ultimately push towards the $8,500 area if the sample totally performs out. He notes that the final time this RSI construction appeared, ETH rallied greater than 160%. An analogous transfer from present ranges would put that $8,500 goal firmly in view, although not with out loads of volatility alongside the way in which.

Extra conservative projections paint a distinct image. CoinCodex information suggests Ethereum may attain round $3,487 by early February 2026. Shorter time period, by the top of January, ETH is projected to commerce close to $3,264. These forecasts come alongside a still-bearish technical sentiment and a Concern & Greed Index studying of 27, firmly in concern territory.

Ethereum has logged 16 inexperienced days out of the final 30, with value volatility sitting close to 3.9%. It’s not explosive, however it’s not useless both. For now, ETH stays caught between daring long-term hopes and cautious near-term actuality.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.