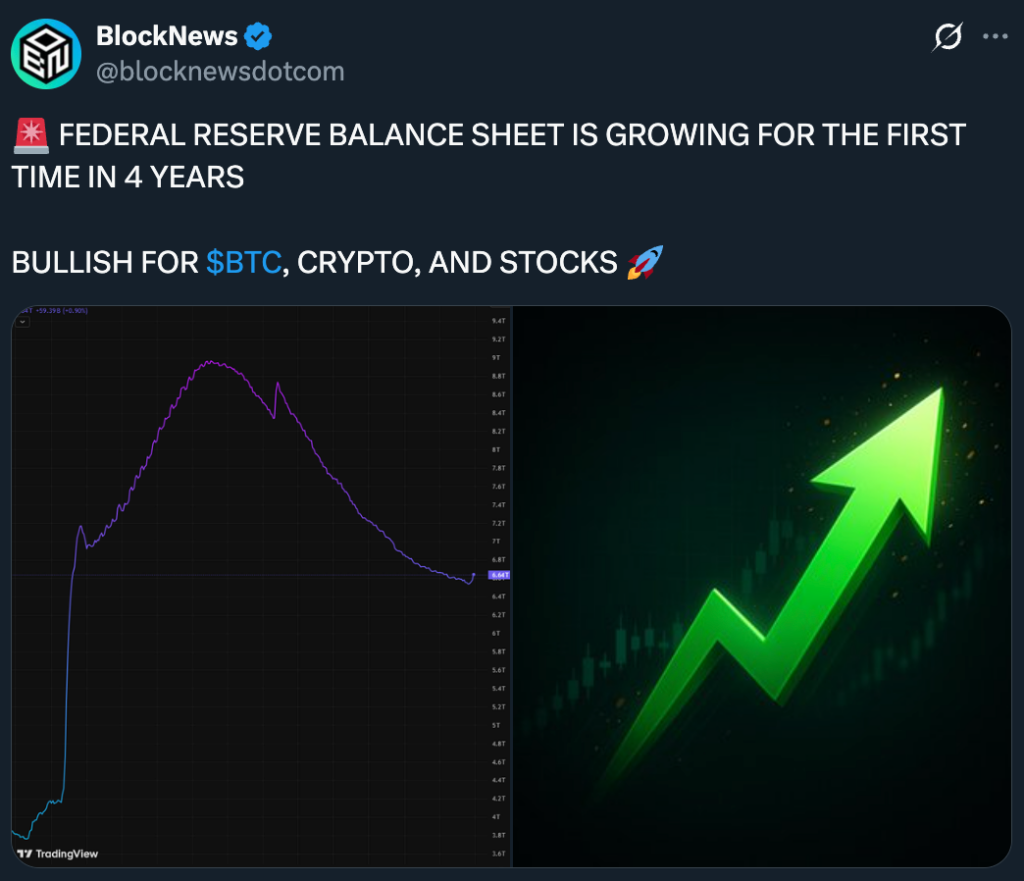

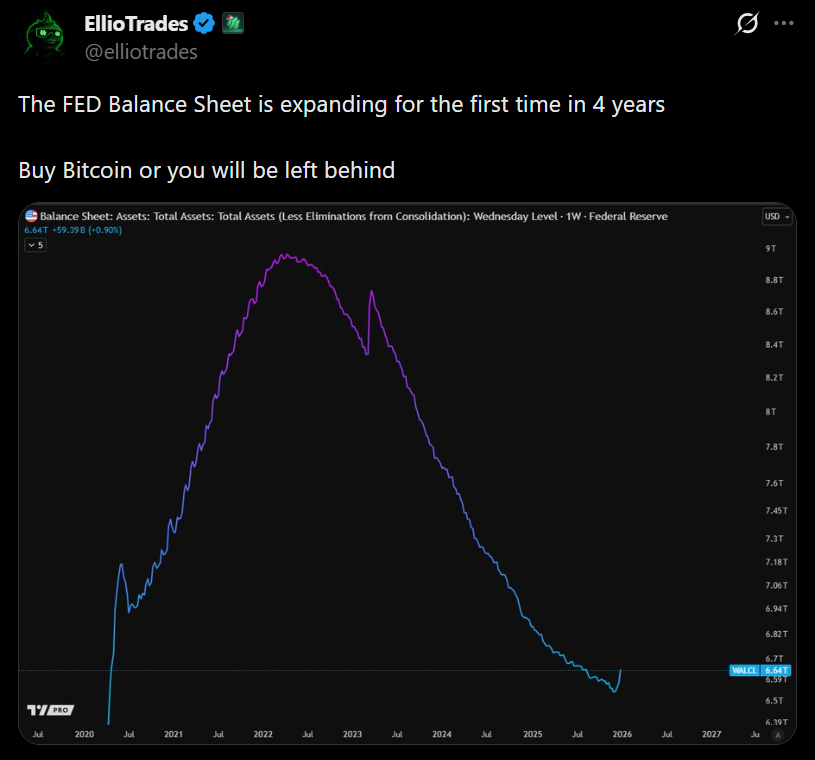

- The Fed’s steadiness sheet has began rising once more after years of contraction.

- Liquidity growth tends to assist threat property and future-oriented valuations.

- Bitcoin and crypto are particularly delicate to shifts in liquidity cycles.

After years of regular contraction, the Federal Reserve’s steadiness sheet has quietly began shifting greater once more. This marks a significant shift away from quantitative tightening and towards renewed liquidity coming into the system. A current uptick late in December was the primary clear improve in roughly 4 years, and whereas it didn’t include a press convention or daring announcement, markets have a tendency to note these items shortly.

Why Liquidity Adjustments Market Habits

When the Fed expands its steadiness sheet, reserves stream again into the banking system. That doesn’t simply sit idle. It lowers friction, improves funding situations, and offers traders extra room to take threat. Property that depend on future money flows or long-term utility have a tendency to profit most on this atmosphere. Progress shares, speculative tech, and crypto typically reply first, as a result of their valuations are extremely delicate to liquidity moderately than near-term earnings.

Bitcoin and Crypto React to Liquidity First

Bitcoin and broader crypto markets have proven a powerful relationship with liquidity cycles. When the Fed was shrinking its steadiness sheet aggressively, crypto struggled and inside stress confirmed up in value construction. If steadiness sheet growth turns into sustained moderately than short-term, that dynamic can flip. Bitcoin’s sensitivity to liquidity means its beta typically turns constructive when reserves develop, even earlier than fee cuts enter the dialog.

This Isn’t About Charges, It’s About Circulation

What makes this shift notable is that it places liquidity again on the desk as a driver, unbiased of rate of interest coverage. Markets don’t simply commerce on the worth of cash, they commerce on its availability. A rising steadiness sheet indicators that the period of relentless drain could also be ending, even when cautiously. That alone can raise sentiment throughout equities and threat property.

Why This Issues Going Ahead

No single macro sign ensures a breakout, and this doesn’t imply markets go straight up. However turning factors within the Fed’s steadiness sheet have traditionally mattered. For traders watching Bitcoin, crypto, and shares, this alteration suggests the macro backdrop could also be turning into much less hostile. Low-cost cash doesn’t must be loud to be efficient. Generally it simply must cease leaving.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.