- PEPE stays up strongly throughout weekly and month-to-month timeframes regardless of a every day pullback.

- Latest features had been fueled by early-year risk-on sentiment and bullish neighborhood narratives.

- Ongoing market volatility makes memecoins susceptible to sharp swings in both route.

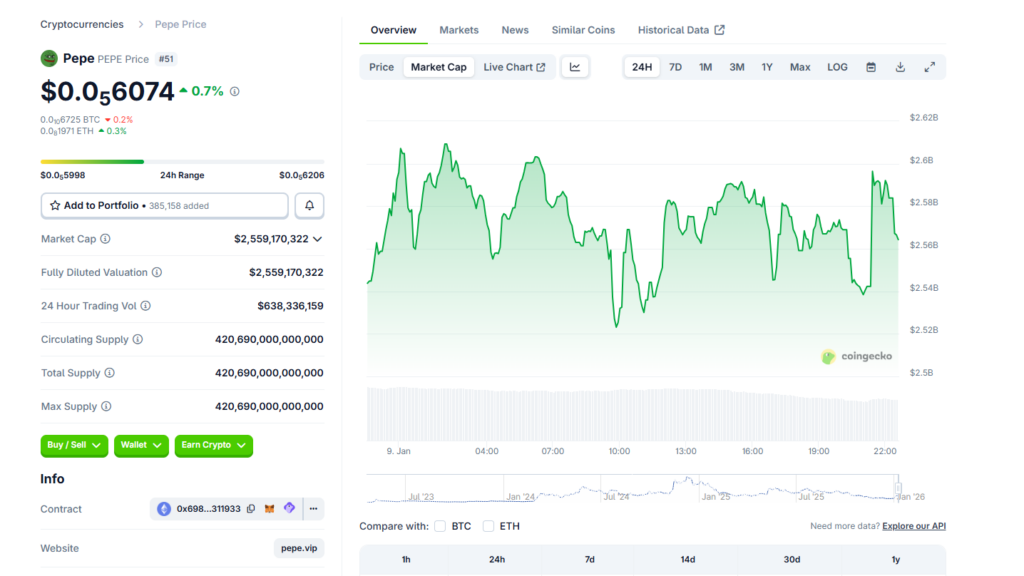

Pepe has taken a breather on the every day chart, slipping about 4.3% over the previous 24 hours, however zooming out tells a really completely different story. In line with CoinGecko knowledge, PEPE continues to be up greater than 57% during the last week, practically 60% throughout the 14-day window, and over 40% on the month-to-month timeframe. In a market that has began to wobble once more, that sort of relative power stands out, even when short-term stress is creeping again in.

Momentum Was Constructed Earlier than the Broader Market Turned

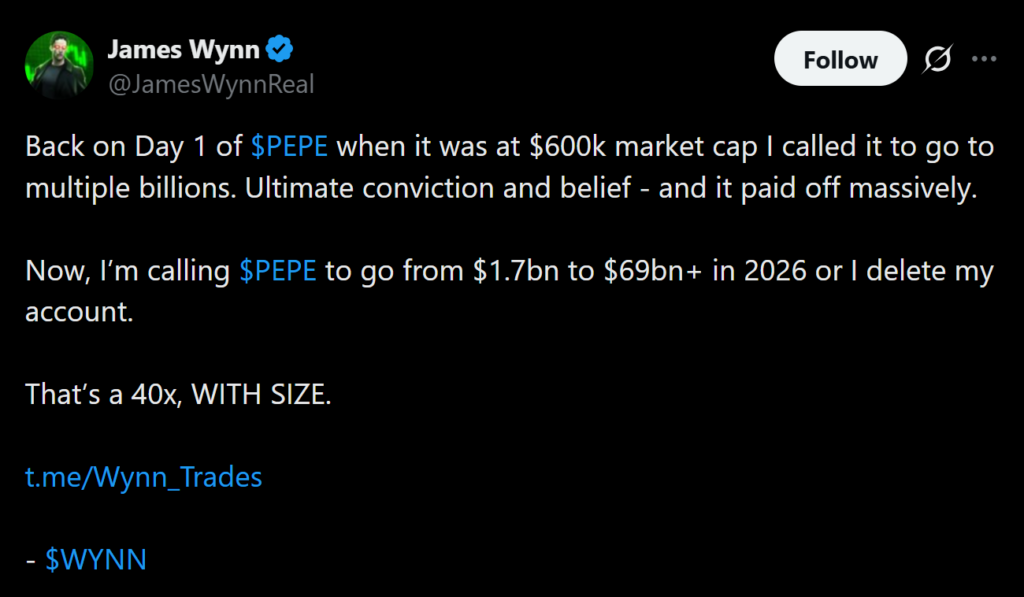

The latest PEPE surge got here throughout a broader risk-on section to begin the yr. ETF inflows picked up, Bitcoin briefly reclaimed the $94,000 stage, and speculative urge for food returned quick. That atmosphere helped memecoins run arduous, and PEPE was on the entrance of the pack. A part of the momentum was additionally narrative-driven. Early PEPE investor James Wynn reignited consideration after forecasting a $69 billion market cap for the token in 2026, a name that resonated with a neighborhood already primed to chase upside.

Why Warning Is Creeping Again In

The tone has shifted over the previous day. Bitcoin has slipped again towards $90,000, and the broader market has began to appropriate after failing to carry early January features. PEPE’s 4.3% dip displays that change in sentiment greater than any project-specific concern. Memecoins are inclined to amplify each side of the transfer, and when danger urge for food fades, they’re often the primary to really feel it.

Volatility Stays the Actual Danger

The crypto market nonetheless feels fragile. Volatility is elevated, and plenty of buyers are taking a extra defensive stance. In that atmosphere, memecoins sit on the far finish of the chance curve. PEPE might proceed to outperform if momentum returns, however it might simply as simply see sharper pullbacks if market circumstances worsen. This isn’t about fundamentals breaking down, it’s about how shortly sentiment can flip.

What May Reignite the Rally

There may be nonetheless a path for PEPE and the broader market to recuperate. Attainable U.S. crypto laws later this month might enhance sentiment if it factors towards clearer regulatory frameworks. A renewed push larger in Bitcoin would additionally seemingly pull speculative property again into favor. Till then, PEPE’s power needs to be considered in context. It’s main on larger timeframes, however the market beneath it stays unstable.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.