- A single court docket ruling will determine the destiny of roughly $150B in U.S. tariffs.

- Putting them down would act like quiet stimulus via value reduction.

- Upholding them locks in larger prices and ongoing coverage friction.

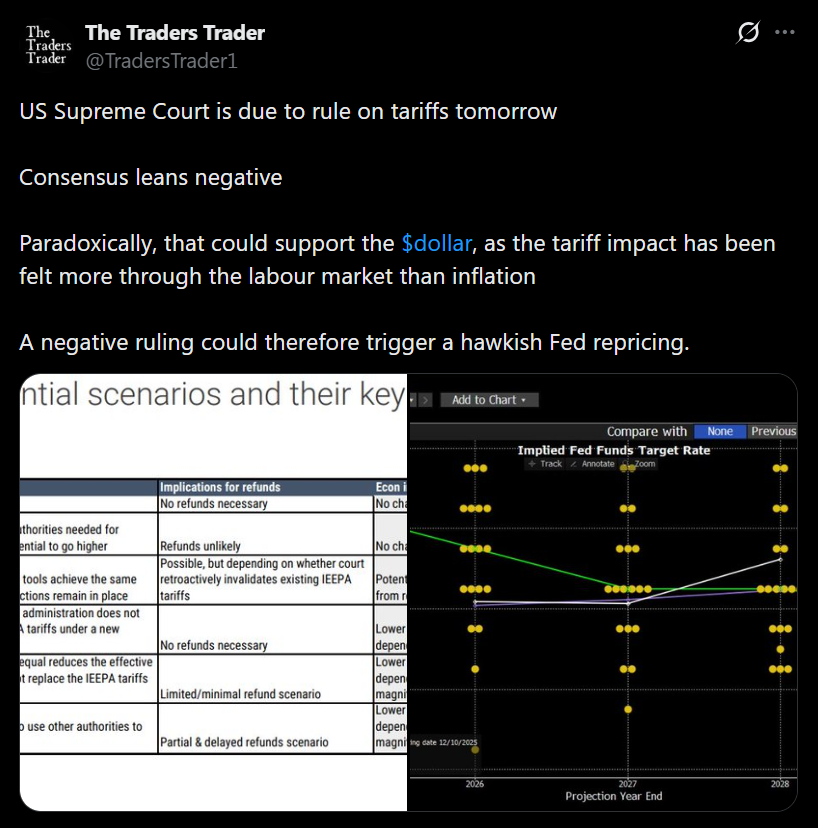

Tomorrow’s court docket ruling on U.S. tariffs isn’t only a procedural headline or a debate about presidential authority. It’s an actual financial swap. Roughly $150 billion in tariffs are tied to this choice, and whether or not they keep embedded within the system or get unwound will ripple straight via margins, costs, and capital flows. Markets have discovered to reside with these prices, however they haven’t actually priced in what occurs in the event that they disappear in a single day.

If the Tariffs Are Struck Down

A strike-down would act like a strain launch valve. Importers would see speedy reduction, and expectations round refunds would transfer rapidly into focus. Enter prices fall with out Congress passing a stimulus invoice and with out the Fed touching charges. That’s why markets might deal with this as quiet, uncoordinated stimulus. Not flashy, not introduced, however tangible. Threat property would probably react first, with equities and cyclicals catching a bid as margins reset larger.

If the Tariffs Stand

If the court docket upholds the tariffs, the message is much less dramatic however nonetheless significant. The fee construction stays intact. Provide chains stay distorted. Inflation strain doesn’t ease. That end result most likely wouldn’t shock markets, however it might reinforce the concept that coverage friction just isn’t short-term. Companies can adapt, however adaptation is defensive. It preserves margins, it doesn’t broaden them.

Why Markets Care Extra Than Politics

Markets don’t care about ideology. They care about outcomes. This ruling redraws assumptions round pricing energy, value pass-through, and capital allocation in a single stroke. That’s why it issues greater than most authorized choices. One ruling quietly adjustments the maths throughout industries.

The Actual Stakes

This isn’t about who wins in court docket or how the ruling is framed politically. It’s about whether or not $150 billion stays trapped contained in the system or begins leaking again out into the financial system. Both end result will transfer markets. Pretending it’s simply authorized noise can be the actual mistake.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.