- Hedera’s utility and transaction quantity proceed to develop whereas value stays muted

- Institutional constructions, ETFs, and governance are reshaping HBAR provide and demand

- Lengthy-term valuation depends upon infrastructure adoption, not speculative hype

The crypto market has a behavior of rewarding noise over substance. Loud tales dominate timelines, whereas quieter infrastructure work typically goes unnoticed. That distinction sits on the coronary heart of a current breakdown from Cheeky Crypto Information, the place analyst Nick takes a better take a look at Hedera and why the long-term math behind HBAR retains pulling severe consideration, even with out hype.

Hedera doesn’t behave like most crypto initiatives. There are not any meme cycles or fixed promotional pushes. As a substitute, the community strikes intentionally, constructing within the background whereas a lot of the market chases short-term momentum. That’s precisely why speak of a $5 HBAR value sounds unrealistic at first, till the numbers begin to add up.

Hashgraph and Why Hedera Scales In another way

Hedera runs on Hashgraph relatively than a conventional blockchain, and that design selection shapes all the things else. Hashgraph permits hundreds of transactions per second with out congestion or unpredictable charges. These aren’t lab outcomes both. As 2026 unfolds, the community is already processing thousands and thousands, and at occasions billions, of real-world transactions.

For big organizations, reliability and predictability matter greater than hype. Hedera provides each, which explains why international firms are prepared to affiliate their reputations with the community. It could not generate retail pleasure, but it surely builds infrastructure establishments can belief.

HBAR Value Appears to be like Quiet As a result of Utility Leads Hypothesis

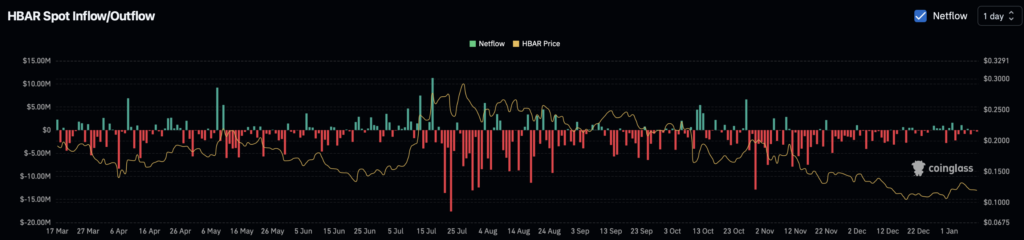

HBAR buying and selling round $0.13 has annoyed many merchants. With a market cap close to $5.6 billion, the valuation appears small in comparison with the dimensions of exercise occurring on the community. Nick frames this as utility outpacing hypothesis.

Excessive transaction quantity with out explosive value motion typically indicators accumulation relatively than disinterest. Establishments have a tendency to maneuver quietly, particularly when infrastructure is concerned. One instance highlighted by Cheeky Crypto Information is Hedera’s integration into Bitget’s international markets, which opened deep liquidity channels into Asia and Southeast Asia.

HBAR USDT pairs regularly noticed day by day quantity above $250 million, with sharp spikes throughout energetic market durations. That depth issues. Giant patrons want markets that may take up dimension with out distorting value.

Governance Constructed for Establishments, Not Hype Cycles

Governance is the place Hedera actually separates itself. The Hedera Governing Council is made up of main international organizations spanning finance, know-how, power, regulation, and academia. Firms like Google, IBM, Boeing, and Repsol take part as equal members, with nodes distributed throughout continents.

This construction reduces regulatory uncertainty, which is essential for establishments deploying massive quantities of capital. Stability typically issues greater than velocity when trillions are concerned, and Hedera seems designed for that actuality.

Breaking Down the Math Behind a $5 HBAR Value

The maths turns into clearer when damaged down. Circulating provide sits close to 43 billion HBAR, roughly 86% of the utmost provide. At round $0.13, that locations market cap close to $5.6 billion. A $5 HBAR value implies a valuation of roughly $215 billion, about 40% of Ethereum’s present market cap.

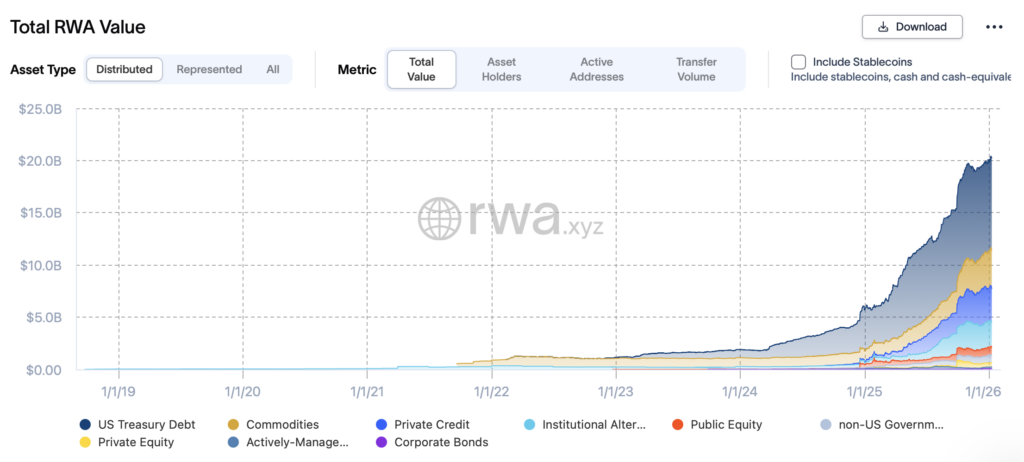

In line with Nick, this doesn’t require Hedera to switch Ethereum or Solana. Capturing a significant slice of enterprise settlement and tokenization flows could possibly be sufficient. Tokenizing simply 1% of worldwide equities, estimated close to $100 trillion, already helps that scale.

How the HBAR ETF Modified Provide and Demand

A serious structural shift arrived with the Canary Capital spot HBAR ETF, buying and selling beneath the ticker HBR. Filed in late 2025, the ETF opened entry for pension funds, household places of work, and wealth managers. Inside its first week, internet inflows exceeded $70 million, and by early 2026 it absorbed greater than 1% of circulating HBAR provide.

Every greenback getting into the ETF removes tokens from open markets and locks them into custody. Cheeky Crypto Information describes this as a Bitcoin-style institutionalization second, the place value discovery regularly shifts away from retail hypothesis.

Actual-World Tokenization and AI Create Non-Speculative Demand

Actual-world asset tokenization stays one in every of Hedera’s strongest narratives. RedSwan has already tokenized greater than $5 billion in institutional-grade actual property on the community, together with landmark properties in New York. Tokenization compresses months of authorized and settlement work into near-instant digital transactions, and each transaction consumes HBAR.

Regulatory alignment provides one other layer. Hedera was constructed with ISO 20022 compliance in thoughts, serving to clarify its position in CBDC pilots and banking integrations worldwide. Collaboration with Nvidia and Accenture introduces AI auditability, the place machine actions are recorded on Hedera for verification at scale. Every verification step creates extra useful demand.

A Quiet Community With Loud Math

Critics typically level to provide dimension or company governance, however most provide is already circulating and inflation strain has eased. Governance could transfer slower than developer-driven chains, but establishments prioritize predictability over fast experimentation.

A $5 HBAR value sounds excessive till infrastructure adoption, ETF flows, real-world tokenization, regulatory alignment, and AI verification demand are considered collectively. None of those depend on hype cycles. Hedera continues to construct quietly, and the arithmetic behind it’s turning into more durable to disregard.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.