Bitcoin is buying and selling at a important inflection level as markets brace for a uncommon convergence of authorized and macroeconomic catalysts. At present, the US Supreme Court docket is about to rule on the legality of Trump-era tariffs, a call that might ripple throughout international markets simply hours after the discharge of US unemployment information.

Collectively, the 2 occasions have created a compressed, high-risk window for threat belongings, together with cryptocurrencies.

Bitcoin Bears and Bulls Maintain Breath Forward of a Supreme Court docket Determination

On the time of writing, Bitcoin is buying and selling for $90,383, confined inside a slender buying and selling vary that displays rising uncertainty slightly than conviction.

Sponsored

Sponsored

Value motion has stalled between clearly outlined help held by bulls and overhead resistance defended by bears. Nonetheless, technical and on-chain information point out that each side are entrenched, ready for readability.

“This isn’t a routine authorized replace…Whether or not broad tariffs imposed beneath emergency powers have been lawful, ~$130B+ in annual tariff income doubtlessly challenged…a ruling on authority and construction, not a technical tweak…Even when some tariffs fall, others stay beneath totally different statutes. Any rollback would probably be partial, gradual, and messy…at present doesn’t finish tariffs. It defines how a lot of the present commerce regime holds and the way unsure income, inflation, and international commerce coverage change into from right here,” stated analyst Kyle Doops.

Markets Brace for a Binary Macro Shock

The Supreme Court docket ruling, anticipated at 10:00 a.m. ET, will decide whether or not tariffs imposed throughout the Trump administration are legally legitimate.

The result may act as a macro change for sentiment. Many market individuals have been working beneath the idea that tariffs stay in place, an surroundings that has formed inflation expectations, earnings outlooks, and trade-sensitive progress forecasts.

Some merchants argue that putting down the tariffs may in the end be constructive for threat belongings.

“If the Supreme Court docket strikes down Trump’s tariffs at present, the native backside is most certainly in for Bitcoin and crypto. Tariffs might be invalidated, markets get readability, value stress eases, company earnings outlook improves, and risk-on flows return,” stated analyst Fefe Demeny.

Sponsored

Sponsored

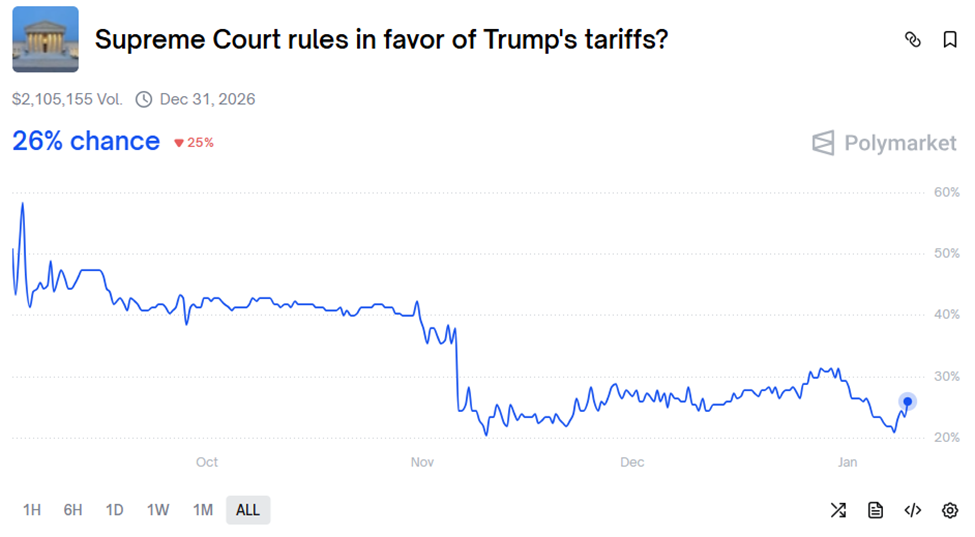

Nonetheless, sentiment is way from uniform. Polymarket information reveals a 26% probability of the Court docket ruling in favor of the tariffs. This highlights how skewed expectations have change into, and the way violent any repricing might be if markets are caught off guard.

The authorized resolution follows intently on the heels of the US unemployment report, due at 8:30 a.m. ET. In keeping with Crypto Rover, the sequencing alone is sufficient to elevate threat.

“Bitcoin drops again under $90,000 as markets brace for at present’s US unemployment report and the Supreme Court docket ruling on tariffs,” he wrote, warning that the subsequent 24 hours might be extraordinarily unstable.

Bulls Defend Beneath, Bears Cap Above: Right here’s The place Patrons and Sellers Might Act

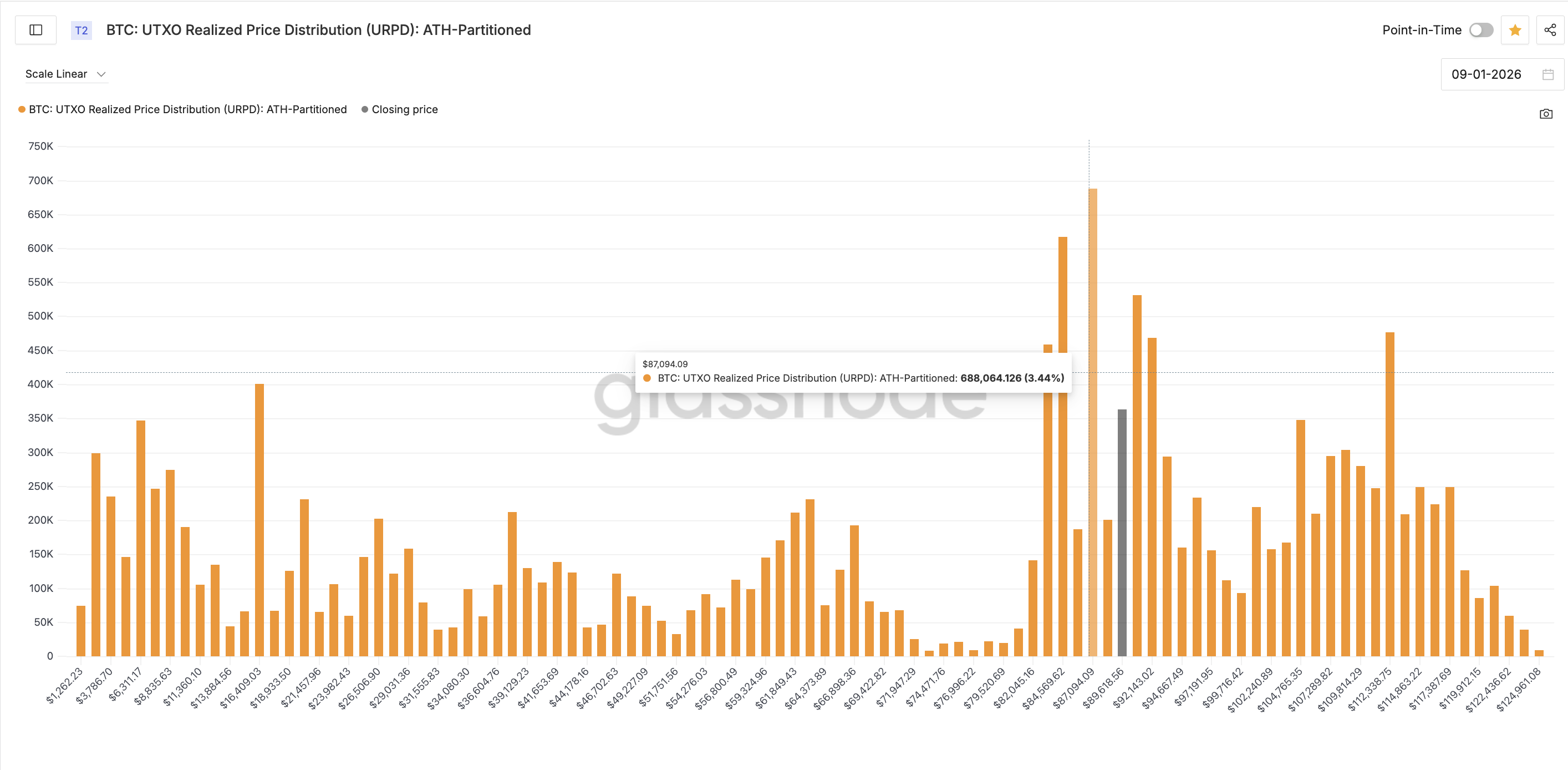

On-chain information from Glassnode reveals that bulls are firmly positioned at $87,094, the place a big quantity of Bitcoin final modified fingers. Holders at this stage are sitting comfortably in revenue, lowering their incentive to promote and making the zone a pure help space slightly than an aggressive shopping for stage.

Sponsored

Sponsored

If value pulls again, that is the primary area anticipated to soak up promoting stress.

Beneath that, $84,459 represents a secondary bull fallback, the place deeper cost-basis help exists if the upper stage fails.

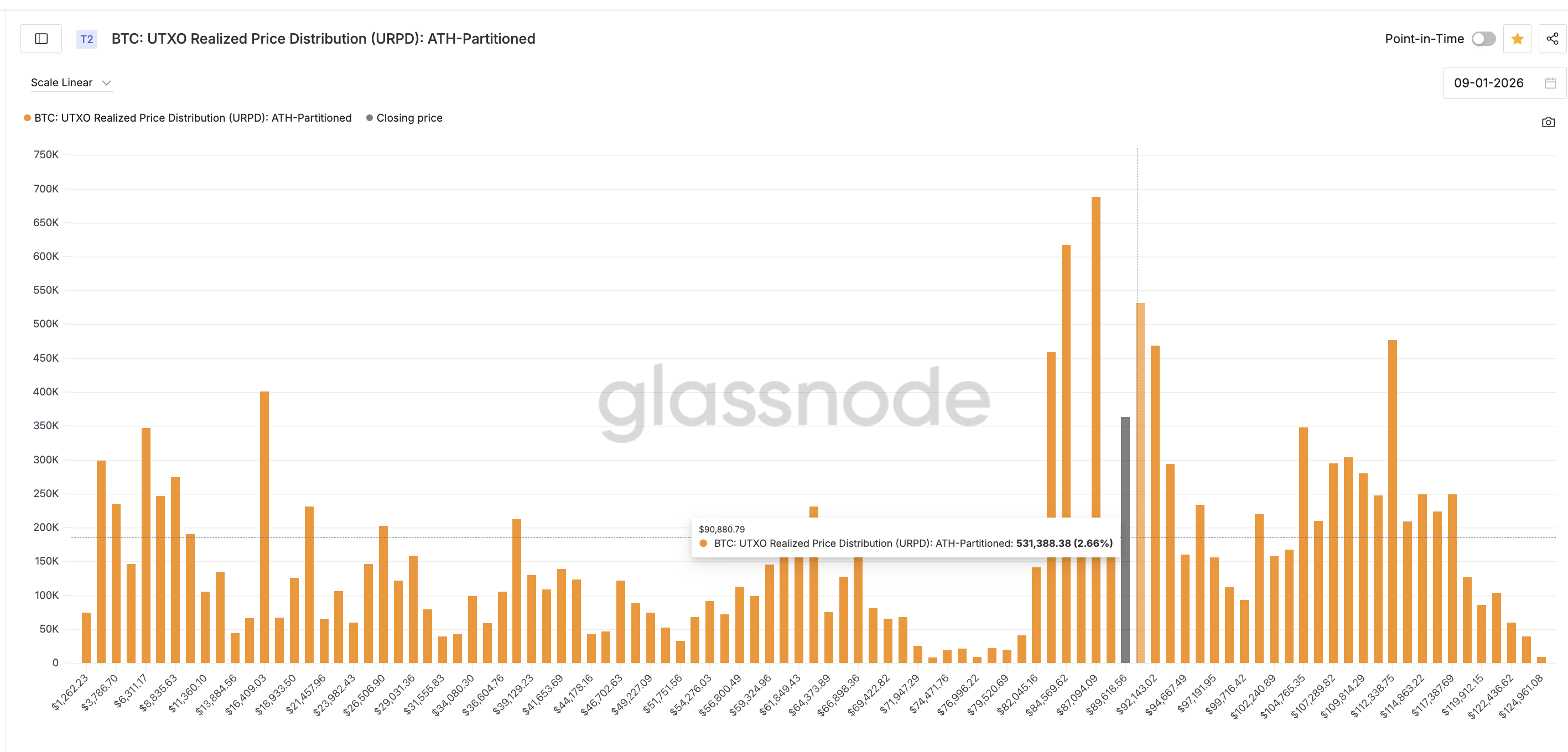

On the upside, resistance begins at $90,880. Right here, many holders are sitting close to breakeven, creating circumstances for distribution as value rallies into the zone.

Glassnode information reveals even heavier resistance clustered round $92,143, backed by a big focus of underwater provide that might intensify promoting stress.

Till bulls can reclaim $90,880 decisively, bears retain tactical management of the upside.

Sponsored

Sponsored

Quantity Profile Confirms the Standoff

TradingView’s Quantity Profile mirrors the identical image. Aggressive shopping for is concentrated between roughly $89,800 and $90,300, marking bulls’ short-term line of protection (proven with inexperienced horizontal bars).

In distinction, repeated promoting stress emerges between $91,200 and $92,000, the place bears have constantly capped upside makes an attempt (crimson horizontal bars).

The result’s a textbook compression construction, the place value is squeezed between demand under and provide above, with volatility suppressed not by calm, however by steadiness.

With Bitcoin wedged between bull-held help and bear-controlled resistance, the market is successfully ready for permission to maneuver.

A clear break above $92,000 may pressure bears to cowl and set off momentum enlargement. A lack of the $89,500–$90,000 area, nevertheless, would expose the market to a deeper retracement towards the high-$80,000s.

The Supreme Court docket ruling stands as essentially the most instant catalyst able to breaking the impasse, with bulls and bears remaining locked in place, ready to see which aspect the macro winds will favor.