- The Supreme Courtroom could rule Wednesday, January 14, on the legality of Trump’s tariffs.

- The case facilities on govt authority and potential tariff refunds.

- The choice might materially impression prices, inflation, and market sentiment.

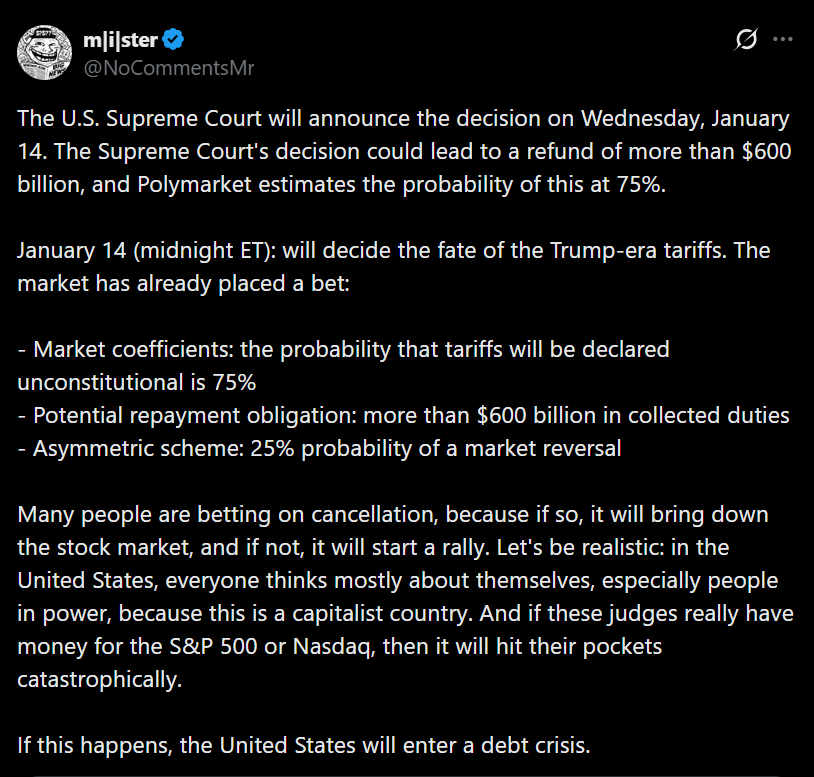

The destiny of President Donald Trump’s sweeping tariff regime could also be determined Wednesday, January 14, because the U.S. Supreme Courtroom prepares to concern rulings on a number of high-profile circumstances. Amongst them sits the problem to tariffs imposed on almost all main U.S. buying and selling companions final 12 months, a coverage Trump has repeatedly referred to as his favourite financial weapon. If the court docket guidelines, the result received’t simply make clear commerce legislation. It might quietly reshape prices throughout the worldwide economic system.

Tariffs as Coverage, Strain, and Punishment

Since starting his second time period, Trump has leaned closely on tariffs as a negotiating device. They’ve been used to extract concessions, sign dominance, and punish international locations that defy U.S. preferences. Final August’s extra 25 p.c tariff on Indian imports over Russian oil purchases is a transparent instance. This wasn’t commerce concept. It was leverage, utilized bluntly and publicly.

What the Supreme Courtroom Is Deciding

The authorized problem hinges on two core questions. First, whether or not the administration had the authority to impose such broad tariffs underneath the Worldwide Emergency Financial Powers Act. Second, if that authority is discovered missing, whether or not the U.S. authorities should reimburse importers who already paid billions underneath the tariff regime. That second level is the place markets begin paying nearer consideration, as a result of refunds would act like an surprising launch of capital again into the system.

Why This Isn’t Only a Authorized Story

Tariffs have functioned as a hidden tax on provide chains, margins, and customers. Companies tailored, however adaptation isn’t the identical as aid. A ruling in opposition to the tariffs would immediately change expectations round pricing, stock prices, and inflation strain. A ruling in favor retains the established order intact, reinforcing the concept commerce friction is now a everlasting characteristic of coverage.

Conclusion

Wednesday’s determination isn’t about whether or not tariffs are good or unhealthy politics. It’s about whether or not an enormous layer of price stays embedded within the economic system or will get peeled again. Both end result sends a transparent sign, and markets are unlikely to disregard it. That is a kind of moments the place authorized readability interprets instantly into monetary penalties.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.