Be a part of Our Telegram channel to remain updated on breaking information protection

Bitcoin value has traded tightly between $90,200 and $90,700 during the last 24 hours, at present at $90,659 as of 12:34 a.m. EST. BTC has been holding regular above $90,000, with indecisive buying and selling between $89,000 and $94,000.

As President Donald Trump continues jarring markets with bulletins aimed toward making properties extra reasonably priced, the president has swiveled one more client burden by demanding that credit-card lenders cap rates of interest at 10% for a 12 months beginning January 20.

TRUMP: WILL NO LONGER LET CREDIT CARD COMPANIES TO CHARGE 20-30% INTEREST RATES

TRUMP: JAN 20 WILL CALL FOR ONE YEAR CAP OF CC INTEREST RATES TO 10%

— *Walter Bloomberg (@DeItaone) January 10, 2026

“Efficient January 20, 2026, I, as President of the US, am calling for a one-year cap on Credit score Card Curiosity Charges of 10%,” Trump wrote on Fact Social, with out offering extra particulars.

Trump had earlier made this pledge throughout the 2024 marketing campaign, which he received.

“Please learn that we are going to not let the American Public be ’ripped off’ by Credit score Card Firms,” Trump added.

The cap would primarily have an effect on banks that subject playing cards, similar to JPMorgan Chase, Citigroup, and Capital One Monetary, by limiting their curiosity income. This may increasingly result in a problem in court docket, because it harms credit score entry and violates market ideas.

Alternatively, BTC’s value beforehand peaked at $126,000 in early October however later confronted downward stress amid world monetary uncertainty. Can the Bitcoin value nonetheless get better to beat the $94,000 barrier?

Bitcoin Worth Evaluation: Technicals Help A Rally In The Quick Time period

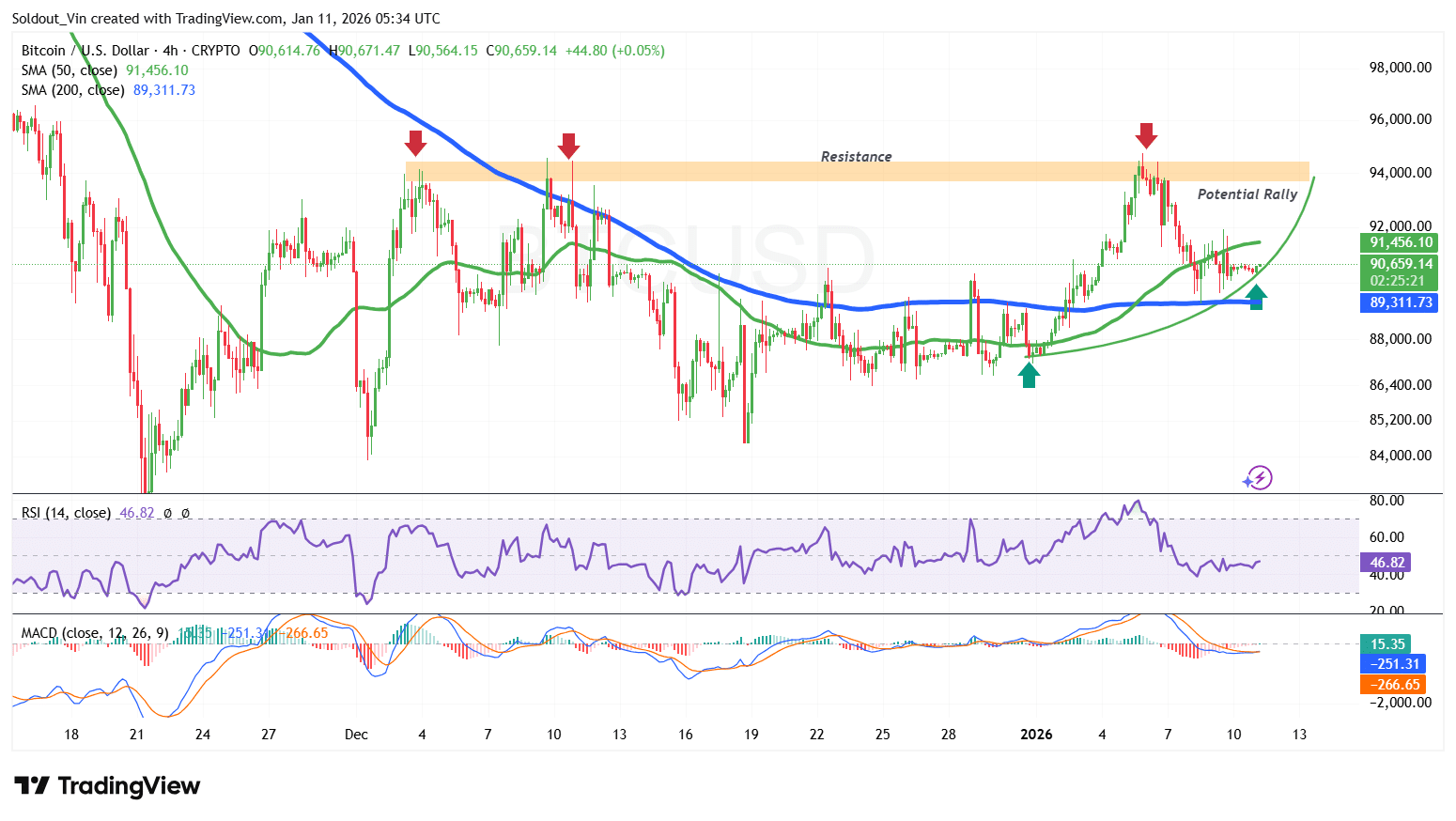

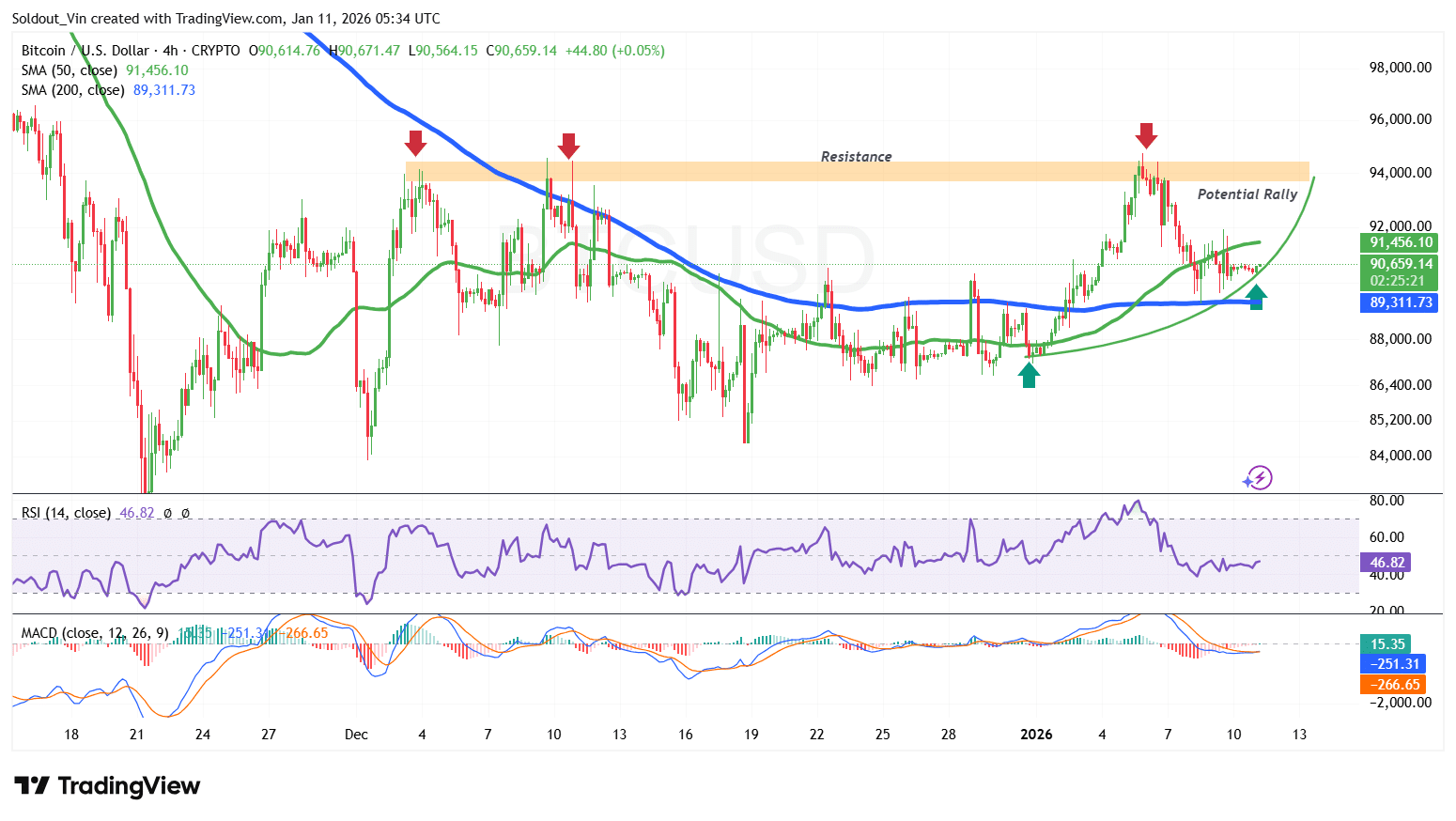

Based on the BTC/USD chart evaluation on the 4-hour chart, the BTC value is at present going through extended resistance on the $94,000 degree, with historic pattern actions suggesting an incoming rally.

Technicals are additionally supporting a surge, with Bitcoin buying and selling nicely above the 200-day Easy Shifting Common (SMA) ($89,311) and the shifting averages forming a golden cross round $89,271. The 50-day SMA at $91,456 serves as the subsequent overhead resistance, placing BTC underneath short-term stress.

In the meantime, the Bitcoin Relative Energy Index reveals a second of indecision, buying and selling across the impartial 46 degree, as the value continues to commerce throughout the $90,000 vary from January 7.

Nevertheless, the Shifting Common Convergence Divergence (MACD) has turned optimistic, with the blue MACD line crossing above the orange sign line.

Because the technicals flip optimistic, Bitcoin might surge above the 50-day SMA, with the value heading towards the $94,000 resistance space.

On the draw back, a drop under $89,000 might set off a downtrend, doubtlessly pushing Bitcoin to the $87,200 help.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection