- LINK is retracing right into a traditionally vital $13 imbalance zone

- On-chain and momentum information counsel positioning, not panic promoting

- Liquidity close to $15 may act as a short-term magnet if momentum builds

Nasdaq and CME Group’s newest announcement didn’t go unnoticed. The 2 giants revealed the launch of the Nasdaq CME Crypto Index, an index constructed round main digital belongings like Bitcoin, Ethereum, and Chainlink. For LINK, that timing is fascinating, perhaps even slightly uncomfortable, because the token sits at a technically delicate level on the chart.

This sort of institutional validation can shift narratives shortly, however value nonetheless has to do the work. And proper now, LINK is approaching an space the place choices are likely to get made.

A Return to a Acquainted Market Hole

On the time of writing, LINK was pulling again right into a key imbalance zone round $13. This degree has acted as a launchpad throughout a number of of LINK’s earlier rallies, making it a well-known battleground for each patrons and sellers. As value slipped again into that zone, promoting stress began to point out indicators of fatigue relatively than acceleration.

As a substitute of aggressive dip shopping for, the tape recommended one thing quieter. Patrons appeared cautious, testing liquidity relatively than speeding in unexpectedly, which frequently occurs close to significant inflection factors.

Momentum indicators helped reinforce that concept. On the charts, the Stochastic RSI drifted towards oversold territory, a area that often aligns with vendor exhaustion. When this indicator reaches these ranges during times of broader market stability, reversals are likely to change into extra possible, although by no means assured.

On-Chain Exercise Hints at Positioning, Not Panic

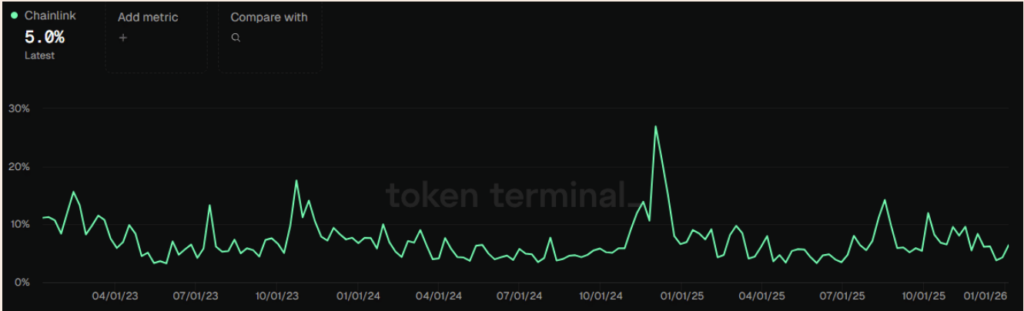

On-chain metrics added one other piece to the puzzle. LINK’s circulating token turnover climbed by roughly 5% over the previous 24 hours, a transfer that stood out given the continued retracement. Sometimes, rising turnover throughout a pullback displays tactical repositioning relatively than widespread capitulation.

On this case, the rise recommended market members is likely to be gearing up for a directional transfer, not abandoning ship. That distinction issues, particularly when value is sitting on traditionally reactive ranges.

Liquidity Factors to a $15 Goal Zone

Liquidity information sharpened the near-term image. Heatmap evaluation confirmed a notable liquidity cluster value round $1.32 million sitting close to the $15 degree. These clusters typically behave like magnets, pulling value towards them as soon as momentum begins to construct.

If LINK manages to stabilize and push greater from the $13 zone, that $15 pocket turns into a logical short-term goal. It’s the type of transfer that tends to unfold shortly as soon as situations align.

The Institutional Backdrop Provides Weight, however Value Decides

The institutional angle is difficult to disregard. Nasdaq partnering with CME Group locations Chainlink immediately inside a regulated monetary framework, and inclusion alongside Bitcoin and Ethereum subtly shifts how LINK is perceived. It now not sits on the perimeter of the altcoin universe, however nearer to crypto’s core infrastructure layer.

Nonetheless, narratives don’t transfer markets on their very own. The chart has the ultimate phrase. For the bullish reversal case to remain intact, LINK wants to carry above that each day imbalance zone. Lose it, and the dialog adjustments, quick.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.