Ethereum continues to point out resilience in early 2026, regardless of an more and more tense macro backdrop. Geopolitical uncertainty within the Center East, ongoing provide chain disruptions, and US–China tensions have shaken international threat urge for food, but crypto markets stay surprisingly secure.

Ethereum Value Evaluation: The Day by day Chart

On the every day chart, ETH has damaged above the broad descending channel. After bouncing strongly from the inexperienced demand zone close to $2,600 in mid-December, the value managed to reclaim the $3,000 psychological mark. Nonetheless, the rally stalled slightly below the $3,500 resistance band, which aligns with each the 200-day and 100-day transferring averages. This zone has acted as a powerful provide wall in current months.

Whereas the RSI confirmed robust momentum through the bounce, it has began turning decrease, suggesting the rally could also be dropping steam. If bulls fail to push above the channel resistance and transferring averages, we may see one other revisit of the $2,600 help zone. However, a clear breakout above $3,500 would flip the mid-term construction bullish and goal the subsequent provide zone round $4,000.

ETH/USDT 4-Hour Chart

Zooming into the 4H chart, the value motion has developed a symmetrical triangle, with clear larger lows and decrease highs converging across the $3,000 zone. This exhibits a stability of energy between patrons and sellers, but in addition alerts a possible breakout transfer within the coming days. The bottom of the triangle sits round $2,900, whereas the higher trendline caps the value slightly below $3,300.

The asset is at the moment retesting the triangle help after a small pullback. If patrons defend this stage, we’d see one other try on the higher vary. Nonetheless, a breakdown from the decrease trendline may set off a sell-off again into the $2,600–$2,500 help band. The RSI on this timeframe can be cooling off from overbought ranges and has dropped under 50 as soon as extra, which can give sellers short-term momentum if help breaks.

Sentiment Evaluation

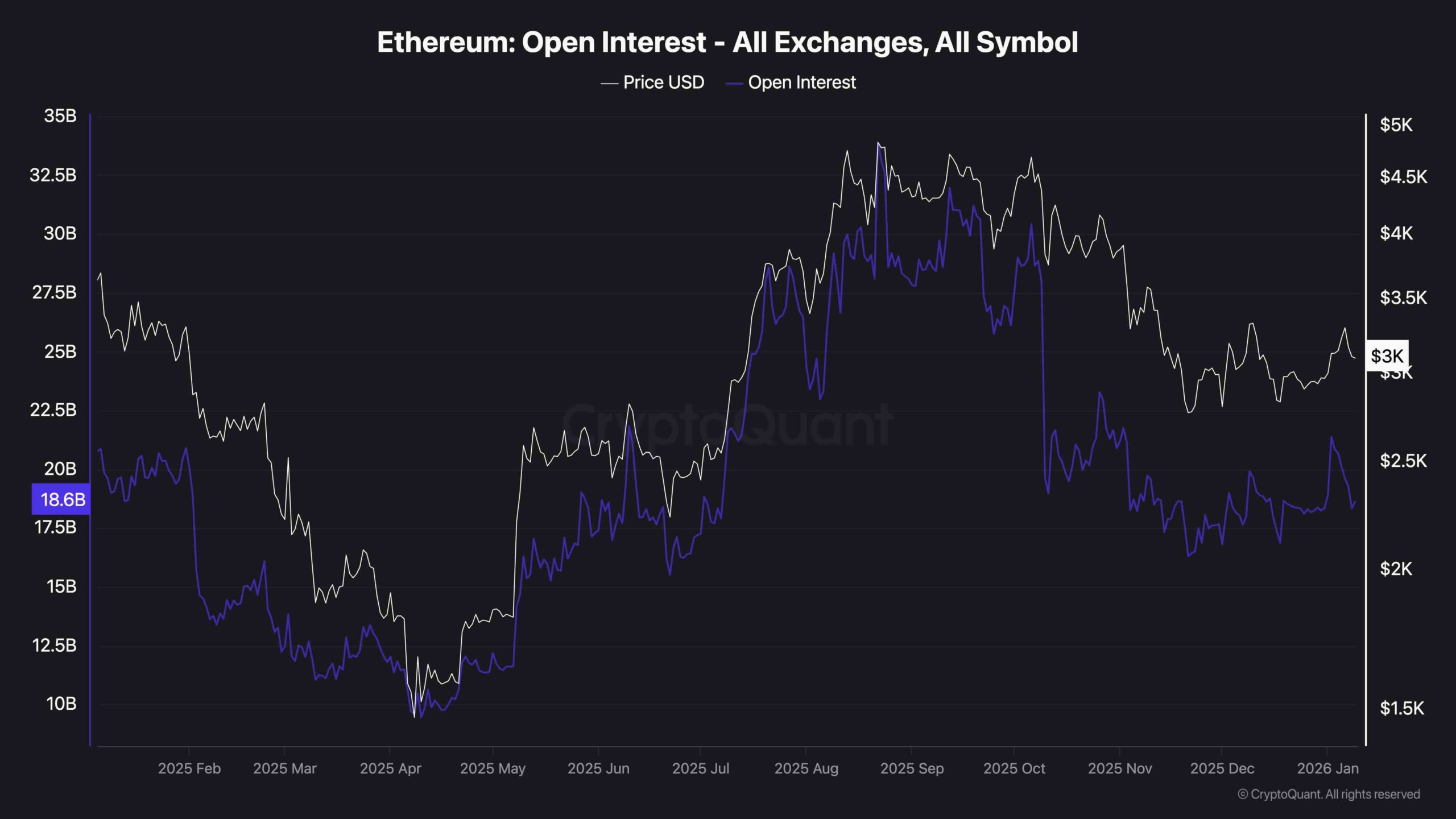

Trying on the Ethereum open curiosity chart throughout all exchanges, we are able to see that OI stays round $18B, though down from its Q3 2025 peak. This implies that merchants are nonetheless actively taking part available in the market, however with out indicators of overwhelming leverage. The current value rebound from December lows didn’t set off a surge in OI, which might be seen as wholesome, as there can be much less probability of compelled liquidations if volatility returns.

The general market sentiment stays cautiously optimistic. ETH has managed to keep away from the form of lengthy squeeze seen in another altcoins. That mentioned, with BTC dominance on the rise and a spotlight shifting again to ETF narratives, Ethereum would possibly lag within the quick time period except it could possibly break key resistance ranges on robust quantity.

The publish Ethereum Value Evaluation: ETH Dangers Falling to $2.6K if This Key Stage Cracks appeared first on CryptoPotato.