The crypto markets might look calm on the floor, however this weekend noticed three main shocks: XRP had simply 1.16% of its whole market cap locked inside ETFs, a SHIB mega-whale pulled practically 2 trillion tokens straight off Coinbase Prime, and Vitalik Buterin casually posted what might be the blueprint for the subsequent stablecoin revolution.

TL;DR

- XRP ETF web property hit $1.47 billion and now make up 1.16% of the entire market cap.

- One Shiba Inu (SHIB) tackle is value 1.92 trillion tokens on Coinbase.

- Vitalik Buterin shares his three-step plan to repair stablecoins.

XRP ETFs now management over 1.16% of market

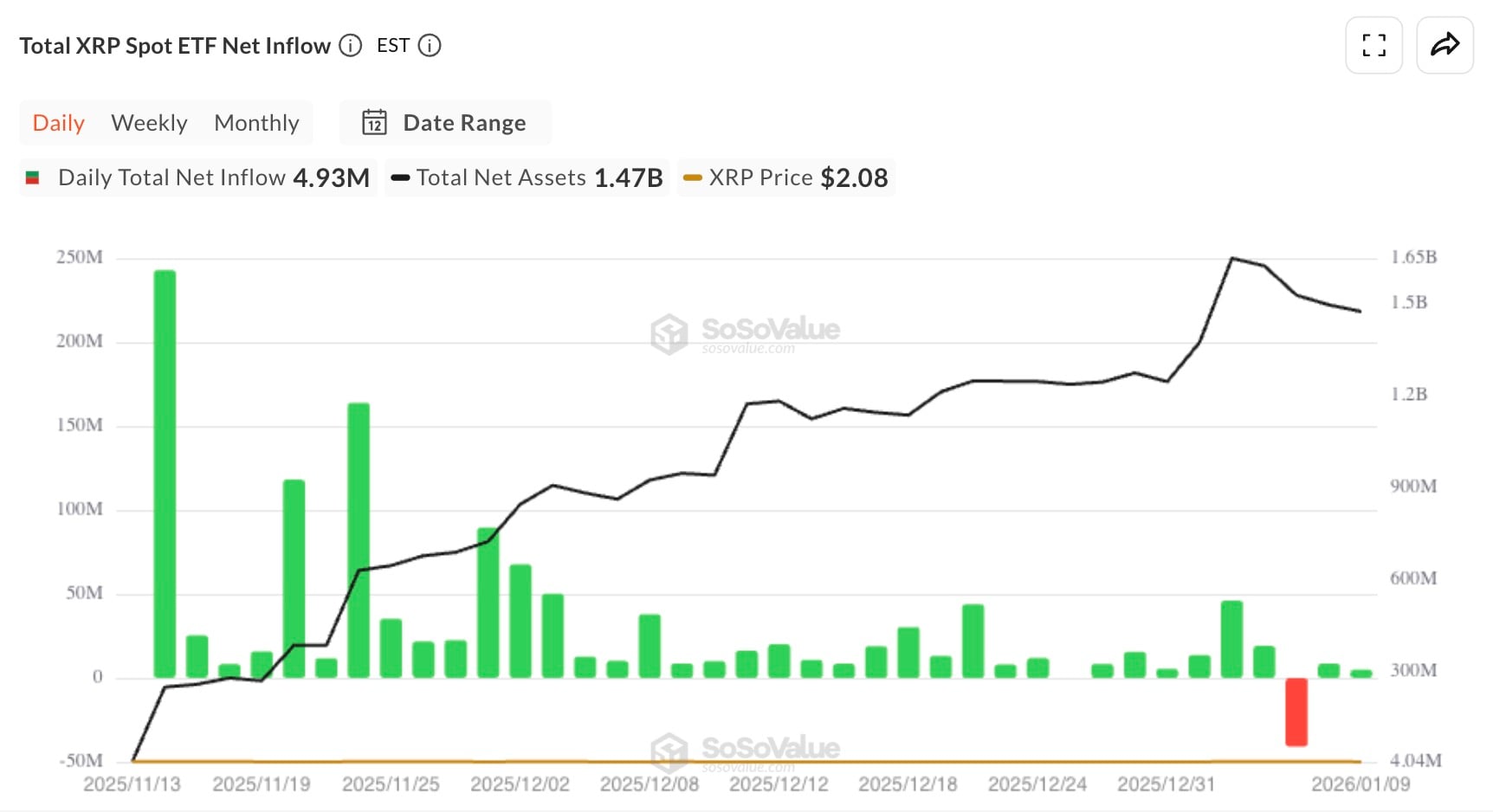

XRP simply hit a reasonably shocking milestone, with $1.47 billion now sitting locked inside U.S.-based spot ETFs, as per SoSoValue. That isn’t only a good spherical quantity — it’s 1.16% of XRP’s full market cap, wrapped up in regulated wrappers and brought off the taking part in area.

That doesn’t imply the tokens are gone or burned. These XRP are parked, passive and — at the very least for now — off-limits to day by day worth motion.

ETF flows like this have a tendency to fly underneath the radar — till they do not. That $1.47 billion is cash that has been slowly however absolutely altering the market’s dynamics for XRP. If folks preserve shopping for into the ETF, it is going to create a “worth magnet” across the web asset zone, which proper now’s concerning the $2.00-$2.10 XRP vary.

If inflows go previous $1.6 billion in Q1, anticipate XRP to start out performing extra like an ETF-backed commodity and fewer like a retail-driven altcoin. This implies extra muted reactions to information, extra compression across the $2.30 zone and probably fewer shakeouts.

Weekly flows present that the momentum has slowed down because the flood of late 2025. After a $243 million week in mid-November, this previous week solely added $38 million. However the route has not modified, it has simply slowed down. That’s a very powerful factor.

This type of profile may clarify why XRP volatility has been dampened these days. The identical patrons who have been as soon as fueling wicks at the moment are holding wrapped publicity by means of XRPC (Canary), XRPZ (Franklin) and others. And they aren’t promoting the dip — they aren’t even touching the chart.

Unknown Shiba Inu whale pulls 1.9 trillion tokens from Coinbase

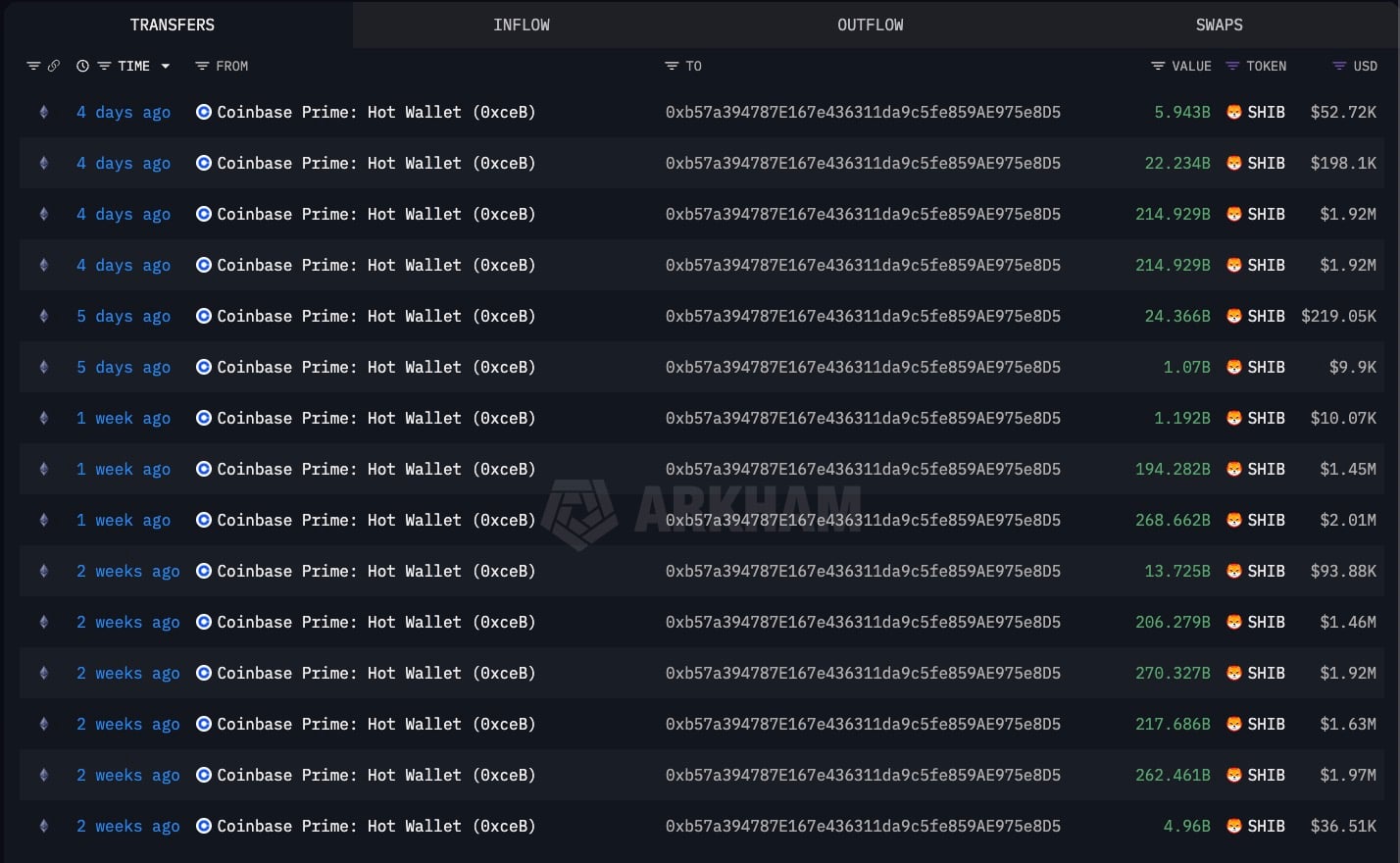

One pockets is consuming Shiba Inu cash like it’s on a reduction. Handle 0xb57a394 pulled in 1,923,043,775,311 SHIB over the previous two weeks — sure, that is trillion with a T. All of it got here straight from Coinbase Prime.

Arkham has had at the very least 15 transfers since late December. Some have been huge — 214 billion at a time. Others have been small scoops, like 5.9 billion SHIB. What is the whole worth? It’s simply over $16 million up to now, and it’s all nonetheless sitting at that tackle.

Only a guess: This isn’t some meme dealer making an attempt to drag a quick transfer. It appears like treasury positioning. It might be for a challenge utilizing Shibarium or for some ecosystem play that has not been revealed but.

Within the meantime, the worth of the Shiba Inu coin is caught proper underneath $0.000009, making an attempt to carry the road. It briefly spiked as much as $0.00000950 final week, however then misplaced steam. It’s at the moment at round $0.00000867 on Binance.

If that $0.000009 flips into help, bulls will in all probability go for $0.00001102 subsequent. If it fails once more, then $0.00000699 is the road within the sand. For now, this whale’s regular shopping for is probably the most optimistic factor SHIB has going for it.

What’s fascinating is that this pockets isn’t just reacting to the worth — it’s main the cost. The buildup began earlier than the breakout try. That means it was not chasing momentum. It was loading forward of one thing.

That is the form of habits you’d anticipate earlier than a staking launch, L2 incentive unlock or liquidity pool announcement. If SHIB will get any utility catalyst this month, this pockets would be the canary that known as it early.

Vitalik Buterin thinks most stablecoins are constructed unsuitable, however he has resolution

Vitalik Buterin dropped an informal put up this weekend, but it surely reads like a big-picture manifesto. To sum it up, decentralized stablecoins are usually not fairly as much as par. And it’s not simply concerning the tech — it’s about design flaws that nobody is fixing.

Here’s what the Ethereum creator laid out:

- Cease pegging every thing to the greenback. Use an index that makes extra sense for crypto.

- Make oracles really decentralized and onerous to control — no backdoors for whales.

- Repair the yield drawback. If staking rewards compete along with your stablecoin’s stability, your system is already damaged.

That third level hits hardest proper now. In most stablecoin programs, capital will get cut up — some will get locked into the stablecoin’s mechanism, however a rising portion chases larger yield elsewhere. This makes the peg’s collateral base weaker and forces tasks to supply larger rewards simply to remain aggressive.

Buterin’s take: Competitors for yield is killing decentralization. You can not provide 20% APY and anticipate secure habits. He didn’t point out any names, however it’s fairly clear he’s speaking about protocols like Frax, Liquity and possibly even MakerDAO with their DAI.

Principally, Buterin is pushing for a extra impartial means of measuring issues that can be utilized within the ecosystem. One thing that isn’t tied to Fed rates of interest or USD credibility.

Don’t anticipate a brand new coin from Vitalik Buterin, however do anticipate a wave of dialogue. If one of many main Ethereum builders takes this thread significantly, it might set off a brand new design cycle — probably on L2s the place experimentation is quicker.

If any new “index-stable” reveals up in Q1, particularly with Oracle innovation, it is going to in all probability be linked to this put up.

What to observe in crypto heading into the week

The crypto market shouldn’t be too thrilling proper now, however issues are altering behind the scenes. Wrapped XRP shouldn’t be going again into circulation anytime quickly. There’s a trillion SHIB sitting in a single place. Ethereum is perhaps the quiet drive behind a brand new wave of stablecoins — this time constructed with extra brains than branding.

Key ranges to keep watch over:

Shiba Inu (SHIB): $0.000009 is the extent to flip. Control $0.00001102 above and $0.00000699 under.

XRP: The ETF zone help is holding secure at round $2-$2.1. The mid-band is at the moment at $1.89.

Ethereum: No adjustments but at above $3,000, however any dev crew teasing an “index-stable” might be taking notes from Vitalik Buterin’s thread.