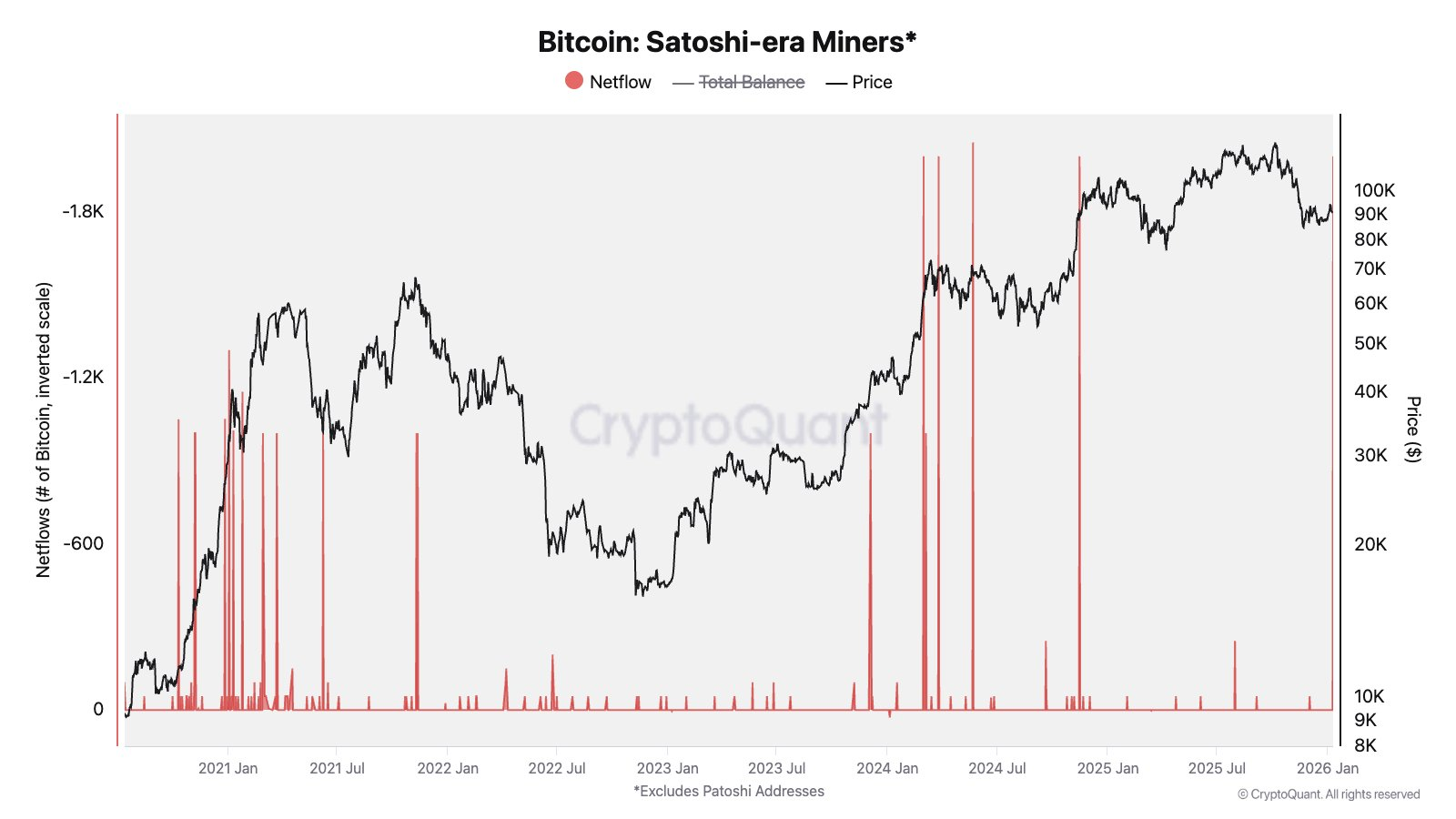

A Bitcoin miner from the community’s earliest days has emerged from dormancy to shift 2,000 BTC, a strategic profit-taking transfer valued at roughly $181 million.

CryptoQuant’s Julio Moreno famous that this represents essentially the most vital exercise by a “Satoshi-era” whale since late 2024.

Sponsored

Sponsored

Bitcoin Absorbs $181 Million Satoshi-Period Promote Sign

Moreno highlighted the timing of the transaction and noticed that “Satoshi-era miners [tend to] transfer their Bitcoin at key inflection factors.”

Including technical context, Sani, the founding father of TimechainIndex, confirmed that the funds originated from block rewards mined in 2010. Notably, the blockchain community had rewarded early miners of that period with 50 BTC in block subsidies.

The cash had remained untouched for greater than 15 years throughout 40 legacy Pay-to-Public-Key (P2PK) addresses. They have been later consolidated and transferred to Coinbase.

Usually, market analysts interpret transfers to centralized exchanges as a prelude to an open-market sale.

Sponsored

Sponsored

In the meantime, this transaction isn’t an remoted anomaly however underscores a creating development of “classic” provide hitting the market.

Over the previous yr, wallets from the 2009–2011 period have been more and more reactivated throughout the Bitcoin community. The exercise displays early holders shifting to lock-in features or replace long-standing custody preparations.

For context, Galaxy Digital had executed one of many largest crypto gross sales in historical past by serving to a Satoshi-era investor to promote greater than $9 billion in July 2025.

Crucially, the market has demonstrated exceptional resilience amid this promoting strain. Bitcoin efficiently absorbed these large-scale “OG” provide shocks with out struggling a breakdown in market construction.

This alerts that whereas Bitcoin’s early adopters are shifting to lock in generational wealth, the market’s liquidity stays deep sufficient to deal with their exits.

Nevertheless, regardless of the instant sell-side strain from legacy holders, long-term institutional forecasts stay bullish.

In a report launched final week, asset supervisor VanEck projected that Bitcoin might attain a theoretical valuation of $2.9 million per coin by 2050. The agency’s thesis depends on the asset’s potential adoption as a worldwide settlement forex.