- Solana continued to draw ETF inflows and whale accumulation, reinforcing longer-term confidence

- Community exercise stayed sturdy, with day by day transactions far outpacing rival blockchains

- Technical and liquidity knowledge urged key draw back ranges may come into play if assist breaks

2026 rapidly emerged as a defining 12 months for Solana, with whale habits and institutional capital enjoying an outsized position in shaping worth course. On-chain knowledge painted a robust image too, displaying Solana dealing with almost eight occasions extra day by day transactions than competing networks, a niche that’s onerous to disregard.

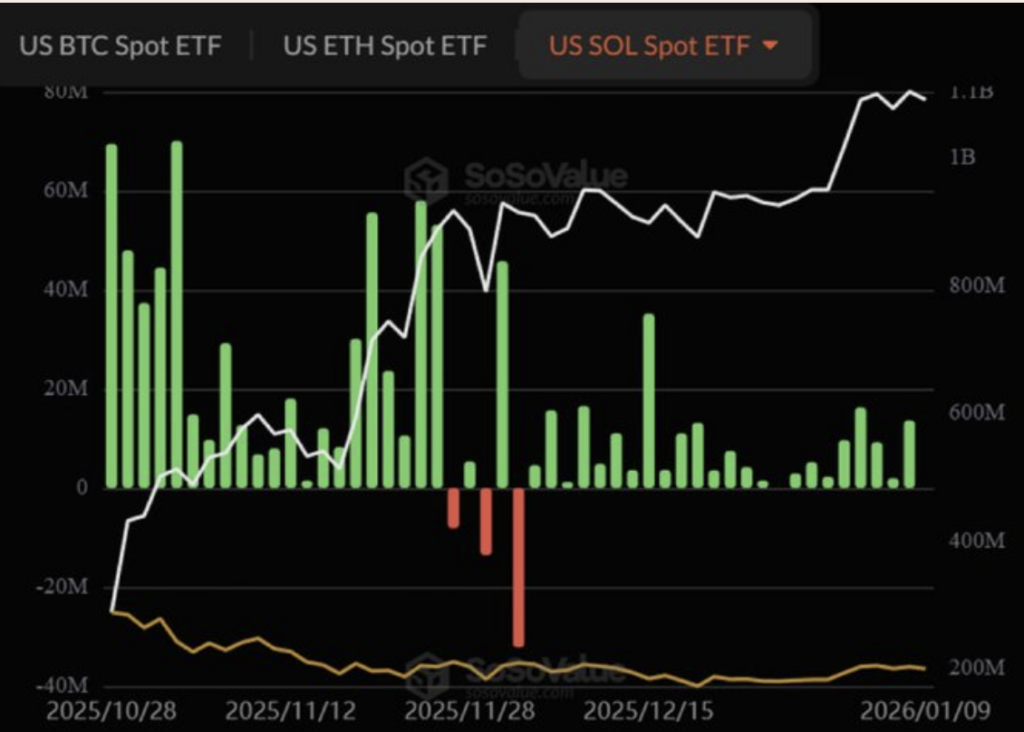

ETF flows added one other layer of confidence, as US Solana Spot ETFs continued to submit constant inexperienced inflows by way of December 2025 and into the brand new 12 months. With that backdrop, merchants have been left asking a easy however vital query, was Solana nonetheless constructing momentum, or have been early cracks beginning to seem.

Whales Previous and New Step In

Recent whale exercise tied to ETF merchandise continued to funnel bullish capital into the Solana ecosystem beginning December 4. These regular inflows helped reinforce upward worth stress, whilst broader crypto markets remained uneven at occasions.

On the similar time, an older, long-dormant whale all of the sudden resurfaced, buying roughly 80,000 SOL value about $10.87 million from Binance. Strikes like that are likely to seize consideration, not as a result of they assure increased costs, however as a result of they typically mirror sturdy conviction reasonably than short-term hypothesis.

Collectively, ETF demand and large-holder accumulation urged Solana was nonetheless in a comparatively sturdy place, though sustaining key assist zones remained crucial for any sustained upside.

Community Exercise Remained a Clear Power

Solana continued to dominate day by day transaction counts, processing roughly eight occasions extra transactions than its closest rivals. That degree of throughput highlighted its position as one of the actively used blockchains, not simply in idea however in actual, measurable exercise.

Excessive transaction quantity bolstered Solana’s sensible utility, displaying that demand wasn’t restricted to merchants alone. Builders, customers, and functions have been nonetheless partaking with the community at scale, which issues greater than hype throughout unsure market phases.

Technical Indicators Pointed to Potential Weak spot

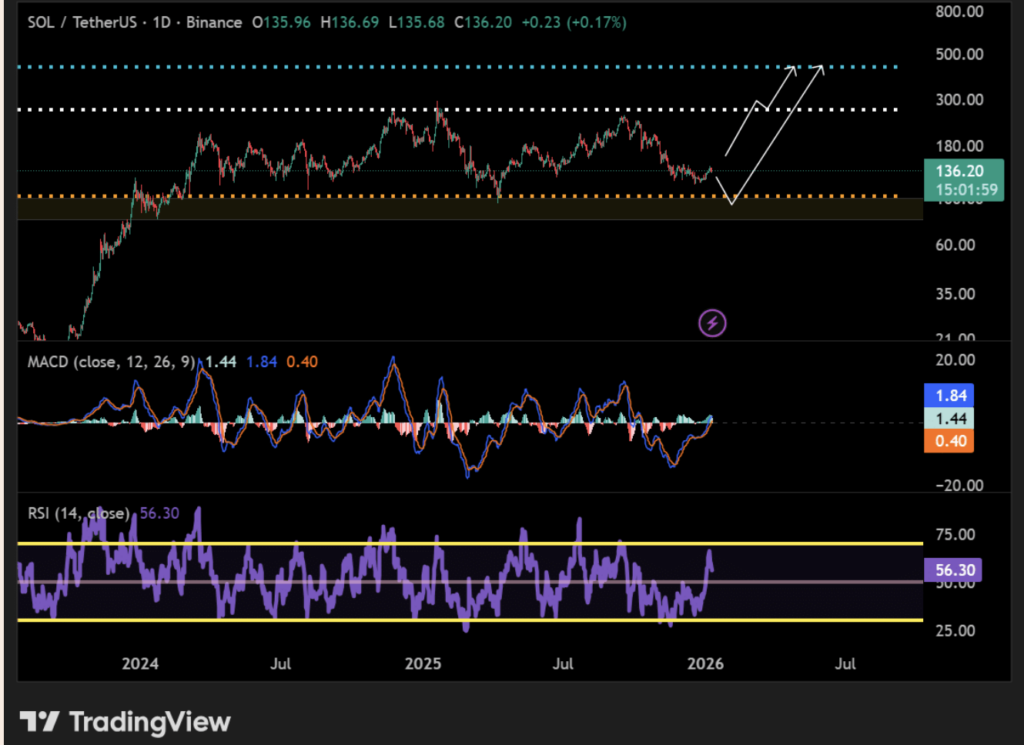

On the day by day chart, Solana traded close to $136 on January 10, however draw back dangers started to floor if worth moved towards equal lows round $102. In a bearish setting, that degree stood out as a possible magnet reasonably than a distant state of affairs.

Zooming out to the weekly timeframe, Solana confronted stress if it failed to carry the $122 to $145 vary on decrease timeframes. A clear lack of $122 may open the door to a transfer towards $102, the place equal highs, damaged ascending assist, and the 61% Fibonacci retracement all converge, not precisely a cushty setup.

If that zone failed, deeper draw back into the $50 vary couldn’t be dominated out. RSI and MACD indicators hinted at weakening momentum, suggesting worth may proceed looking for a backside if key helps gave manner.

Liquidity Lurking Beneath Value

Solana’s two-week liquidity heatmap revealed heavy clustering of positions under the $120 degree. In easy phrases, that space may act like a gravity properly if bearish sentiment picked up velocity.

A pointy transfer into that liquidity zone risked triggering accelerated liquidations, particularly if broader market circumstances turned risk-off. For now, worth remained above it, however merchants have been clearly conserving that area on their radar.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.