The launch of the spot XRP ETFs (exchange-traded funds) in the USA was one of many uncommon success tales of 2025’s last quarter. The crypto-linked merchandise have helped guarantee vital capital inflow into the altcoin in current months.

Whereas the XRP ETFs recorded their first unfavorable outflow day up to now week, the exchange-traded funds additionally reached a brand new report when it comes to the full worth traded in a single week. This milestone displays the rising maturity of the XRP ETF market within the US.

XRP Funds Put up $219M Buying and selling Quantity In Previous Week

In keeping with the most recent market information, the spot XRP ETFs posted their highest weekly buying and selling quantity since debut at $219 million. This determine is nearly double the worth traded within the XRP ETF market within the earlier week ($117.4 million).

In the meantime, this new report merely surpasses the earlier report of $213.9 million reached within the third week of December 2025. This feat indicators the rising investor demand for the XRP exchange-traded funds regardless of the waning curiosity within the broader crypto ETF market.

As talked about earlier, the US-based XRP ETFs registered their first unfavorable efficiency up to now week, with a web outflow of $40.8 million on Wednesday, January 7. Nevertheless, this single-day efficiency didn’t cease the exchange-traded merchandise from ending the week within the inexperienced.

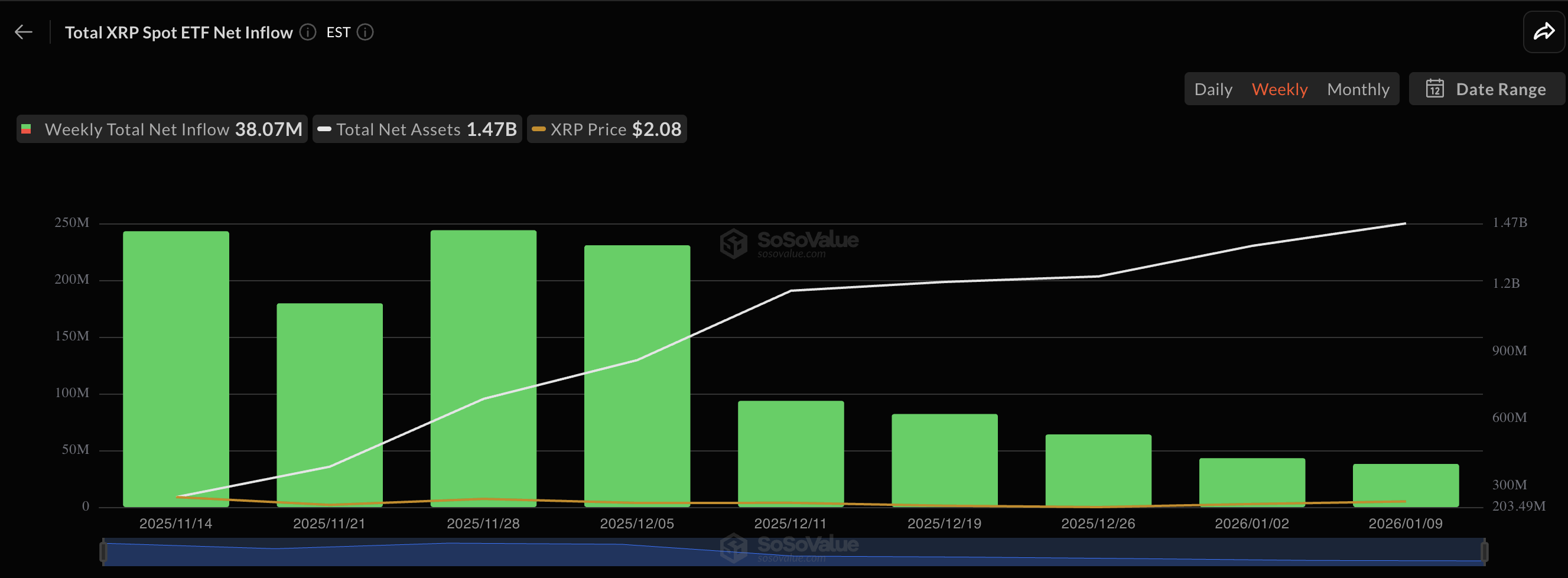

Information from SoSoValue reveals that the XRP ETF market noticed a further $38.07 million in worth for the week ending January 9. Nevertheless, a have a look at the chart reveals that the capital influx for the crypto-linked merchandise is steadily declining.

As of this writing, the spot XRP ETFs have amassed $1.47 billion in complete web property since launching in mid-November 2025. Canary Capital’s XRPC tops the record with $375.1 million in web property below administration (AUM), adopted by Bitwise’s XRP fund at $300.3 million, and Franklin Templeton’s XRPZ at $279.6 million.

XRP ETFs Shine Whereas Crypto ETF Market Flounders

Whereas the XRP ETFs appear to be enduring the market storm, the more-established Bitcoin and Ether ETFs have seen higher days. In keeping with current market information, the crypto funds noticed a mixed withdrawal of $749.6 million throughout their first full buying and selling week of the yr.

Most notably, the spot Bitcoin ETFs noticed their largest single-day web outflows of $486.1 million on Wednesday, January 7. The BTC exchange-traded funds closed the week with a web outflow of over $681 million.

In the meantime, the Ethereum ETF market, which began on a constructive observe with inflows of $168.1 million on January 5 and $114.7 million on January 6, finally ended the week with web withdrawals of $68.6 million.