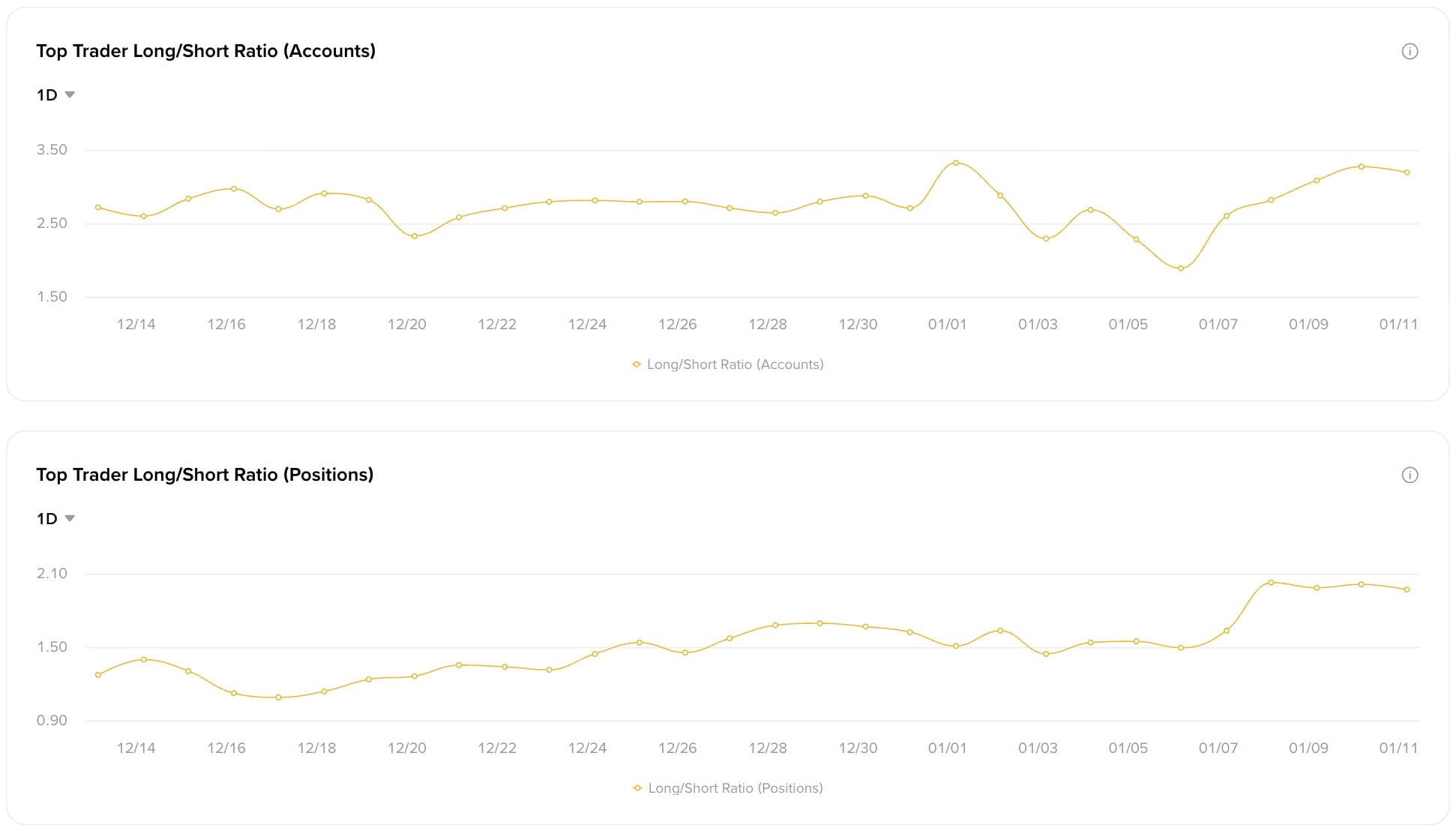

XRP is sizzling once more after Binance’s prime dealer metrics revealed a heavy bias: 76.16% of one of the best accounts are holding lengthy, with solely 23.84% nonetheless betting towards it. The lengthy/brief account ratio has shot as much as 3.19, which is without doubt one of the most bullish positions in months.

Much more importantly, the position-based ratio additionally climbed to 1.97, exhibiting that this isn’t only a crowd of sidelined bulls — these accounts are literally sizing up on XRP.

Only a few days in the past, XRP bounced off the $1.80 zone and received again as much as the $2.10 stage, however the worth continues to be fairly low in comparison with the early January time when it nearly broke by way of to $2.40.

Whereas the chart nonetheless reveals some promoting stress, derivatives sentiment has flipped decisively, and that not often occurs with out cause. This isn’t a impartial crowd hoping for route — it’s a packed bus heading north.

Why lengthy XRP?

Partly as a consequence of short-side exhaustion. Funding charges are cooling, and the market has digested a month-long altcoin cycle. Whereas Bitcoin consolidates, high-beta belongings like XRP are engaging candidates for catch-up performs, particularly if the ETF narrative sustains.

However a ratio of just about 3.2 lengthy/brief typically suggests native overconfidence or front-running. Up to now, there have been comparable imbalances earlier than XRP’s large strikes in March 2021 and November 2023.

If issues preserve going the way in which they’re, we would see an increase to someplace between $2.80 and $3 earlier than the top of the month, so long as the present tempo doesn’t decelerate across the $2.40 mark.

For now, it’s plain to see that whales are loading up, and they’re doing it rapidly. If $2.40 cracks, January has an opportunity of a last run.