Crypto presales are inclined to get plenty of consideration throughout bull markets, however historical past retains repeating the identical lesson. The strongest long-term tasks typically emerge quietly throughout slower phases, when the main focus shifts from hype to fundamentals. Because the market seems to be forward to the following cycle, infrastructure, safety, and actual utility are beginning to matter greater than quick narratives.

For this reason BMIC ($BMIC) is likely one of the greatest crypto presale alternatives in 2026. As an alternative of launching one other pockets or single-purpose product, BMIC positions itself as core safety infrastructure for a future the place crypto utilization is broader, extra advanced, and extra uncovered to long-term threats.

Beneath are the 5 essential the reason why many see $BMIC as the most effective crypto to purchase at this stage of the market.

Quantum-Native Safety Constructed From Day One

The largest threat most crypto customers usually are not ready for is just not market volatility, however cryptographic obsolescence. Many wallets and platforms depend on encryption that works in the present day however turns into weak as soon as quantum computing reaches sensible scale. BMIC is constructed to handle that downside immediately.

Relatively than patching outdated programs later, BMIC is quantum-native from the bottom up. Its structure is designed to defend in opposition to “harvest now, decrypt later” assaults, the place information is collected in the present day and damaged sooner or later.

This removes the necessity for disruptive migrations and emergency upgrades in a while, which is a significant purpose BMIC is being seen as long-term infrastructure reasonably than a short lived answer.

Zero Public-Key Publicity Via Signature-Hiding Structure

Most wallets, together with {hardware} wallets, expose public keys on-chain. That publicity is strictly what future quantum assaults are anticipated to focus on. BMIC takes a distinct route by eradicating public-key publicity altogether.

Utilizing sensible account constructions and signature-hiding logic, BMIC retains delicate information off-chain and out of attain. This shifts safety from device-level safety to protocol-level design. It isn’t about making keys tougher to steal, however about eliminating the assault floor completely.

This structural benefit is likely one of the clearest causes BMIC stands aside from present custody options.

Full Stack Safety: Storage, Staking, and Funds

Most crypto instruments safe just one a part of the person journey. Wallets shield storage, however staking and funds typically introduce new dangers. BMIC treats all three as a part of the identical safety downside.

The platform secures long-term storage, permits quantum-secure staking with out exposing classical keys, and helps protected funds designed to forestall cloning or future fraud. This unified method issues most to long-term holders, who usually tend to stake belongings and use them over prolonged intervals.

It additionally explains why BMIC is more and more mentioned amongst severe altcoins to purchase reasonably than short-lived utility tokens.

Enterprise-Grade Infrastructure With AI-Pushed Safety

BMIC is just not restricted to retail customers. It’s designed to scale into enterprise and institutional environments via its Quantum Safety-as-a-Service mannequin. Banks, fintech corporations, healthcare suppliers, and governments can combine custody, key administration, and safe communications with out rebuilding their complete infrastructure.

On high of that, BMIC makes use of AI-driven risk detection and optimization. The system repeatedly analyzes exercise, adapts to rising dangers, and improves efficiency as cryptographic requirements evolve.

This mixture of quantum safety and AI-driven safety positions BMIC as infrastructure that may develop alongside the broader digital economic system.

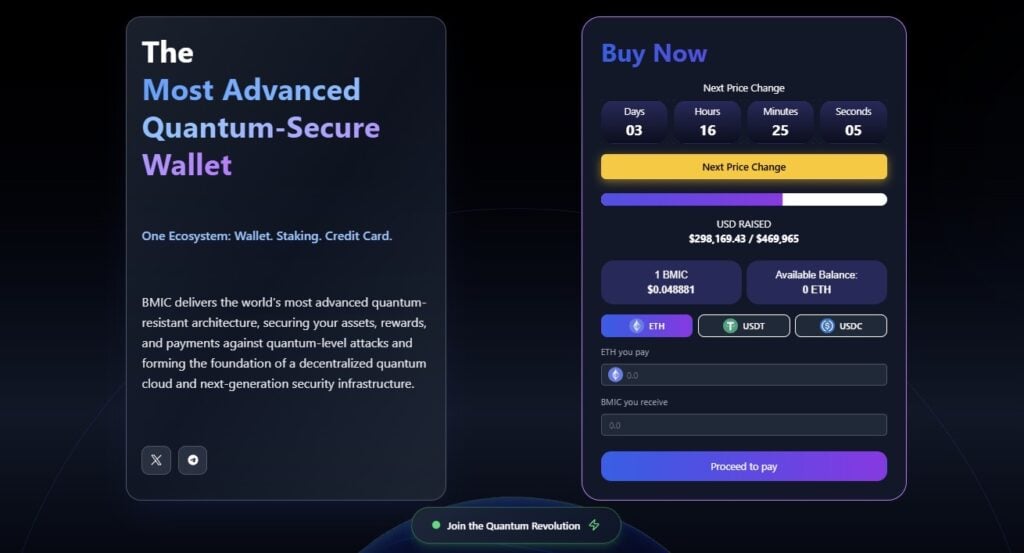

Presale Construction and Tokenomics Designed for Lengthy-Time period Worth

BMIC’s crypto presale is extraordinarily well-structured. The entire provide is capped at 1,500,000,000 tokens, with 50% allotted to the presale to make sure broad distribution. A further 12% is reserved for rewards and staking (aiming for long-term participation within the community).

Liquidity and trade listings account for 10%, whereas the staff allocation is restricted to only 3%, a comparatively low determine in comparison with many tasks. The ecosystem reserve stands at 9%, and 6% is devoted to advertising and marketing.

The presale itself is structured throughout a number of phases, with costs growing step by step and a deliberate launch worth above the ultimate presale tier.

That design creates a transparent incentive for early supporters and is one purpose BMIC is being talked about extra typically when discussions flip to the most effective crypto presale setups forward of 2026.

$BMIC: The Finest Crypto to Purchase Now?

BMIC doesn’t depend on hype-driven narratives or short-term traits. Its worth proposition is rooted in safety, infrastructure, and long-term relevance. By addressing quantum threats, eradicating public-key publicity, securing staking and funds, and providing enterprise-grade options, BMIC positions itself as extra than simply one other token launch.

As traders search for the most effective crypto to purchase and reassess which altcoins to purchase earlier than the following cycle, tasks constructed throughout quieter markets typically stand out in hindsight.

With a clearly (and really strongly) outlined use case, disciplined tokenomics, and a presale construction that rewards early conviction, BMIC is beginning to get troublesome to disregard for these targeted on the place crypto safety is headed subsequent.

Uncover the way forward for quantum-secure Web3 with BMIC:

Presale: https://bmic.ai

X (Twitter): https://x.com/BMIC_ai

Telegram: https://t.me/+6d1dX_uwKKdhZDFk

This text has been offered by one among our industrial companions and doesn’t mirror Cryptonomist’s opinion. Please remember our industrial companions might use affiliate packages to generate revenues via the hyperlinks on this text.